It sure has been awhile, but the market finally succumbed to some serious selling pressure for the first time since August. This is spite of better-than-expected earnings from Apple, IBM, Coca-Cola, UnitedHealth, Johnson & Johnson,

Goldman Sachs, and Capital One Financial.

I noticed early on that financials were not selling off with the broader market this morning, which led me to believe the selling pressure might be reversed intra-day, but even that sector eventually reversed to finish with a 1.4% loss.

Supposedly, this selling pressure was a response to a headline that PIMCO and the New York Fed want Bank of America to repurchase mortgages. I guess the market let everyone know what it thinks of that idea.

The I fund was especially vulnerable today as the dollar spiked with a 1.7% gain. I suspect China's decision to hike its interest rate by 25 basis points fed that dollar rally.

And the Sentinels? They are hanging by a thread after today. Still on a buy, but they've taken a big hit. The question now is one of follow-through to the downside. Here's the charts:

Both NAMO and NYMO are on a sell and look poised to continue a downward trajectory.

Same with NAHL and NYHL.

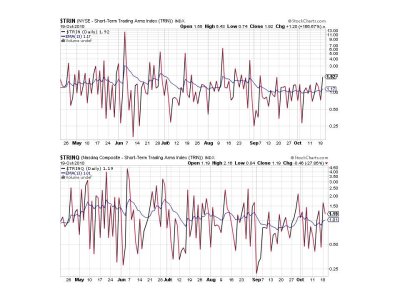

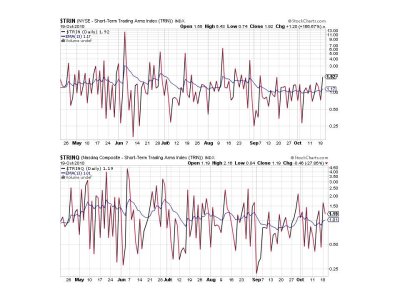

Two sells for TRIN and TRINQ

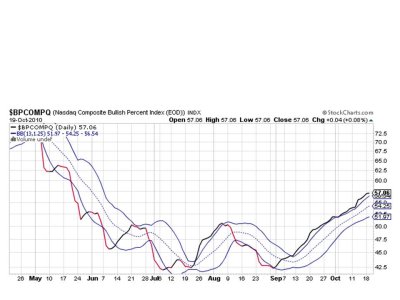

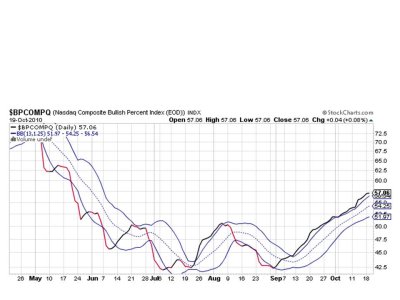

BPCOMPQ is not ready to throw in the towel yet as it did remain on a buy.

So we have 1 of 7 signals on a buy, which keeps the system on a buy.

I would ordinarily be very inclined to think we go lower from here, but sentiment is not over-the-top bullish. However, it may be bullish enough across multiple surveys to trigger further downside action. But aside from earnings, the news continues to broadcast economic catastrophe from any number of sources. China's interest rate hike spooked the market, but the mortgage debacle appears to be just heating up. And all of this against the current backdrop of joblessness in the US. So we could get bearish again in a hurry, which "may" contain damage to the downside, especially given we are moving towards election day.

It's a tough call for us given our inflexibility. I am currently in cash and bonds for about 35%, but I may raise those levels soon if today's action was a first warning. I do still have a buy signal from the sentinels, but that's small comfort knowing how quickly the big money can move.

Goldman Sachs, and Capital One Financial.

I noticed early on that financials were not selling off with the broader market this morning, which led me to believe the selling pressure might be reversed intra-day, but even that sector eventually reversed to finish with a 1.4% loss.

Supposedly, this selling pressure was a response to a headline that PIMCO and the New York Fed want Bank of America to repurchase mortgages. I guess the market let everyone know what it thinks of that idea.

The I fund was especially vulnerable today as the dollar spiked with a 1.7% gain. I suspect China's decision to hike its interest rate by 25 basis points fed that dollar rally.

And the Sentinels? They are hanging by a thread after today. Still on a buy, but they've taken a big hit. The question now is one of follow-through to the downside. Here's the charts:

Both NAMO and NYMO are on a sell and look poised to continue a downward trajectory.

Same with NAHL and NYHL.

Two sells for TRIN and TRINQ

BPCOMPQ is not ready to throw in the towel yet as it did remain on a buy.

So we have 1 of 7 signals on a buy, which keeps the system on a buy.

I would ordinarily be very inclined to think we go lower from here, but sentiment is not over-the-top bullish. However, it may be bullish enough across multiple surveys to trigger further downside action. But aside from earnings, the news continues to broadcast economic catastrophe from any number of sources. China's interest rate hike spooked the market, but the mortgage debacle appears to be just heating up. And all of this against the current backdrop of joblessness in the US. So we could get bearish again in a hurry, which "may" contain damage to the downside, especially given we are moving towards election day.

It's a tough call for us given our inflexibility. I am currently in cash and bonds for about 35%, but I may raise those levels soon if today's action was a first warning. I do still have a buy signal from the sentinels, but that's small comfort knowing how quickly the big money can move.