Friday's action didn't change the short term picture very much. I suppose the good news is that the market closed well off its lows. I suspect the dip buyers may have been loading up in anticipation of another big Monday rally. Perhaps, but this coming week has the potential to move the market one way or another as the week ends on Black Friday. I'm expecting volatile action, and the following Monday could be a big trading day too, as the retail results of Black Friday won't be fully known until well after the market closes.

It should be an interesting week. Here's Friday's charts:

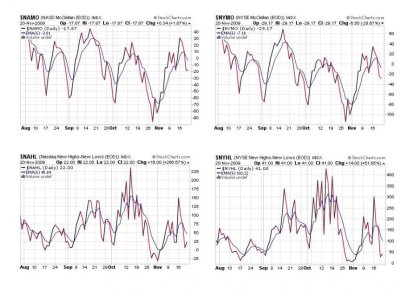

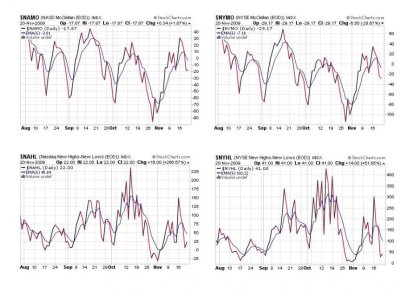

No major changes here. All four are on sells.

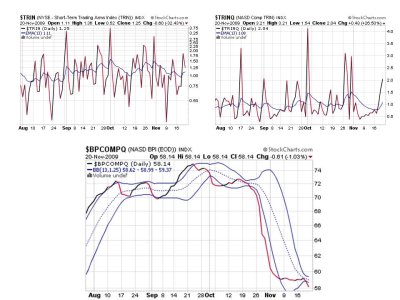

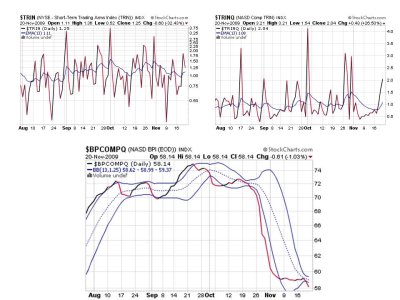

These three are still on a sell too, but BPCOMPQ continues to trend downward. That could be telling us something, but it hasn't dropped enough to get me overly concerned at this point.

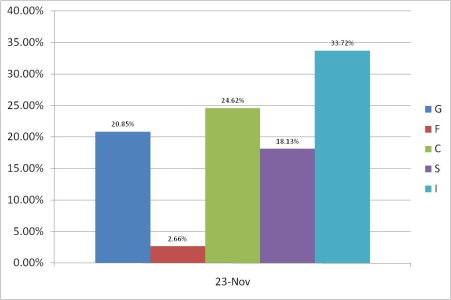

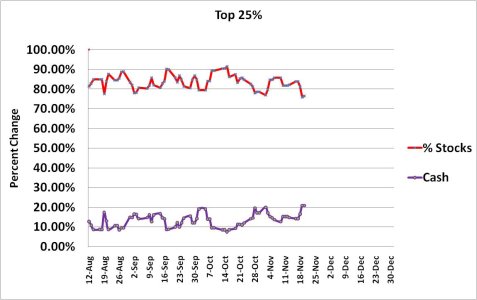

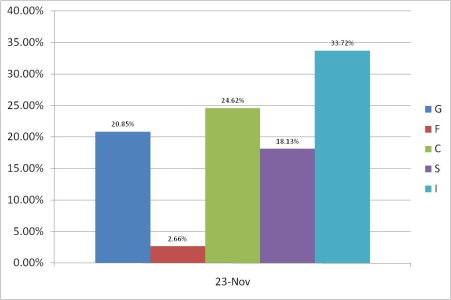

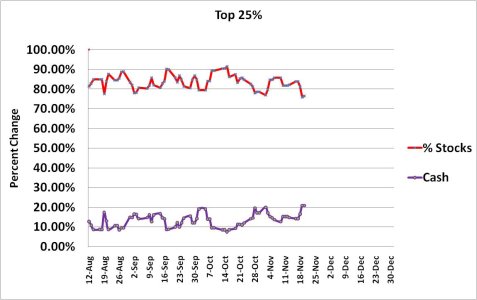

Not much change with our top 25%. The chart indicates how they are positioned for Monday's action.

So the Seven Sentinels system remains on a sell with none of the signals flashing a buy. I'm holding 100% cash right now until at least the

1st of December. See you Monday.

It should be an interesting week. Here's Friday's charts:

No major changes here. All four are on sells.

These three are still on a sell too, but BPCOMPQ continues to trend downward. That could be telling us something, but it hasn't dropped enough to get me overly concerned at this point.

Not much change with our top 25%. The chart indicates how they are positioned for Monday's action.

So the Seven Sentinels system remains on a sell with none of the signals flashing a buy. I'm holding 100% cash right now until at least the

1st of December. See you Monday.