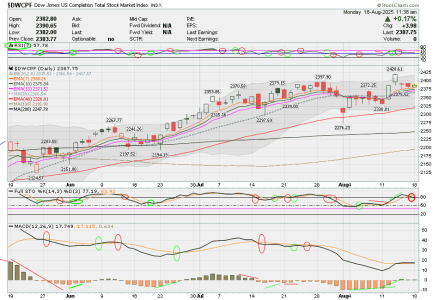

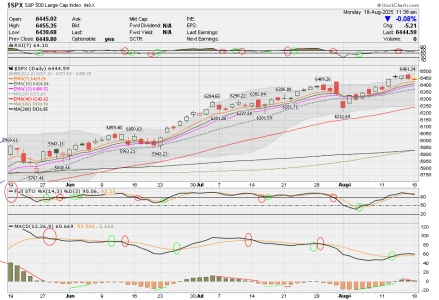

Hi, I just noticed that my TSP account shows a gain of 6.29% for the year. Looking at my investment entries and exits I see that I was invested in stocks 50% in mid-January, 25% in March, 35% in April, 25% at end of May, 45% at end of June, 30% on last day of July until now---BUT did get out between each of those trades to go into the G fund for safety or to lock in gains. So it looks like maybe I was invested about 1/2 of the year. Those entries generated this return.

While I was not risking a lot this year, I like the return. It tells me that if I had invested 100% instead of 25-50% during these short moves, I likely could have earned close to18%. So, I may have been too conservative in my investment percentages, but I am nearly at retirement and do not want to risk too much.

I am pleased that the strategy I am now using is working well. My strategy has "evolved" over the years and I am now happy with what I am doing and plan to continue with it as I go into retirement 12/31/25. Also, being invested very little helps me sleep at night.

When I retire, I plan to rollover a small portion out of TSP to a traditional IRA trading account that lets me make unlimited transactions that occur immediately. Looking for a trading vendor that will offer low fees. I would like to day-trade an hour or two each morning. Once I am confident of my method, I can then look to move more funds from TSP to the outside account. If anyone has any suggestions on a good account, please let me know.

Hope you all have a great weekend!!!