DreamboatAnnie

TSP Legend

- Reaction score

- 909

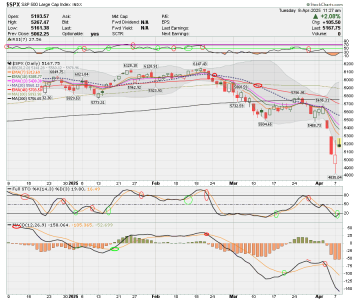

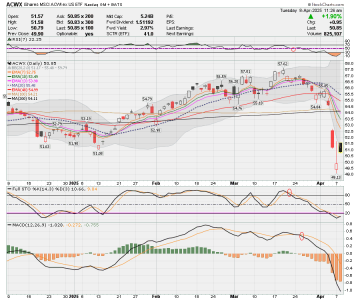

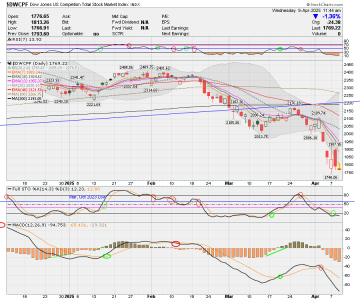

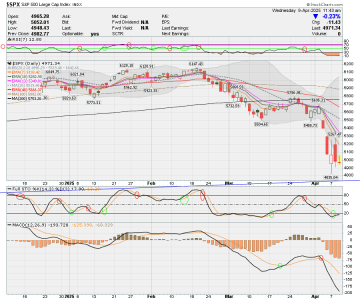

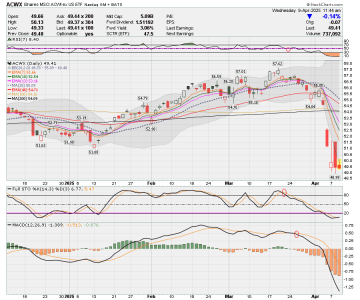

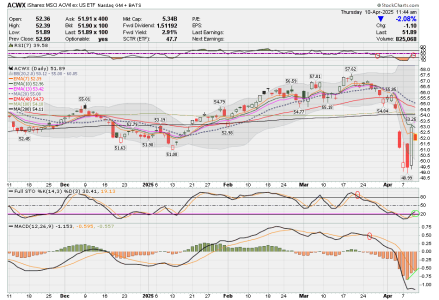

Here are charts before noon cut off. I was thinking about entering S and C fund a little today, but decided to stick with the indicators that I use.

While Stochastic has crossed above the 20 line and RSI is going back up, I typically do not like to enter until I see RSI hit 50 on the way up. So, with that, I am going to hold off. BEST WISHES TO YOU ALL!!

While Stochastic has crossed above the 20 line and RSI is going back up, I typically do not like to enter until I see RSI hit 50 on the way up. So, with that, I am going to hold off. BEST WISHES TO YOU ALL!!