DreamboatAnnie

TSP Legend

- Reaction score

- 851

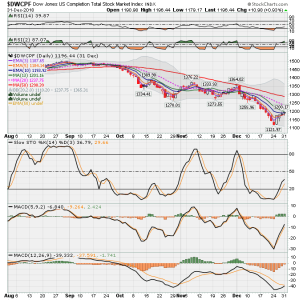

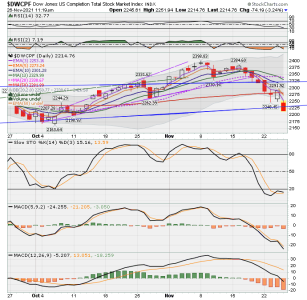

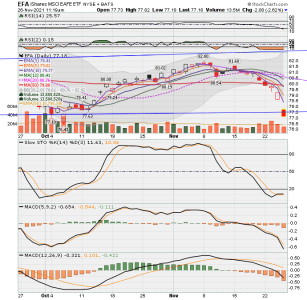

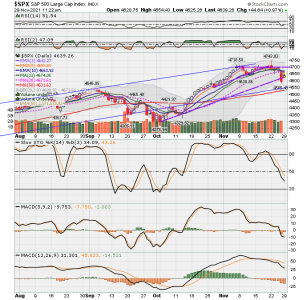

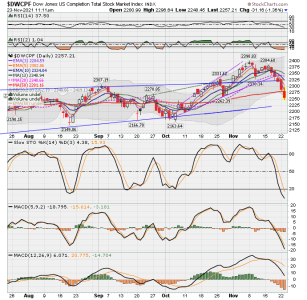

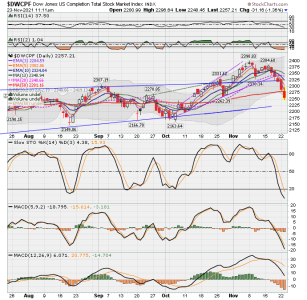

Hi here are today's charts as of a few mins ago. Yep, yesterday closed down and today's a stinker as well. The I fund is now riding the lower Bollinger band down and S fund looks like it might follow as it is now touching the lower band. C fund looks to be in the best position, and it's not looking that good.

Notice the 10 MA crossed below 20 MA yesterday, and price fell below 50 MA. But it can bounce...no telling. I probably will not enter until next week, but will see.

Notice the 10 MA crossed below 20 MA yesterday, and price fell below 50 MA. But it can bounce...no telling. I probably will not enter until next week, but will see.

Last edited: