DreamboatAnnie

TSP Legend

- Reaction score

- 909

Hi Shitepoke, sorry for late response. If agreement does not result in some relief to reduce prospect of future debt increases, I believe this could cause bond rating for USA to be reduced (lack of confidence in US bonds) which I think would cause bond yield rates to go up for investors to accept a higher risk in buying the bonds and F fund would drop in value as those bond rates are already set ... And overall market would drop as well. Just my thoughts...not an expert on this.

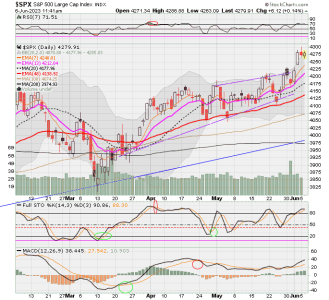

Yet, AGG looks like MACD wants to cross positive and its rising...hummmm..I've been thinking about entry on it...

Best wishes to you! :smile:

Yet, AGG looks like MACD wants to cross positive and its rising...hummmm..I've been thinking about entry on it...

Best wishes to you! :smile: