DreamboatAnnie

TSP Legend

- Reaction score

- 909

Just Reposting Daily Charts I use. These permalinks are automatically updated with latest to the minute market pricing plus my most current trendlines.

Here are new Permalinks to provide latest chart indicators I am using. You can bookmark and they will update each time you open them. To change parameters you would need to use Stockcharts.com free charts or buy a subscription. FYI - The old permalinks at post #4264, page 356 and post #4816 pg 402 should continue working.

Best wishes to you all in your Investments! :smile:

S Fund =$DWCPF (Dow Jones US Completion Total Stock Market Index, i.e. Small-Mid cap, except the S&P 500)

https://schrts.co/hTPsWxDY

C Fund =$SPX (S&P 500 Large Cap Index)

https://schrts.co/smcvDsmn

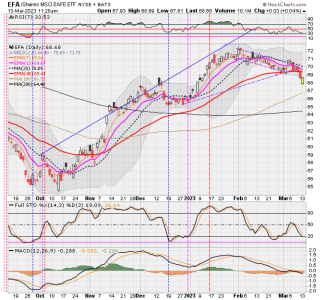

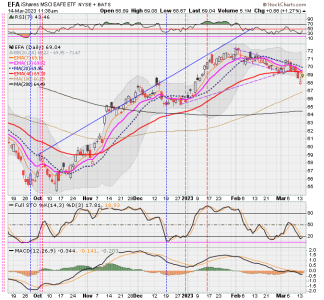

I Fund =EFA(iShares MSCI EAFE ETF)

https://schrts.co/bIEdfSGR

F Fund = AGG. (iShares Core US Aggregate Bond ETF)

https://schrts.co/gsjtDDwg