-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DreamboatAnnie's Account Talk

- Thread starter DreamboatAnnie

- Start date

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Hummm... I guess I should talk about markets again....eeeekk :worried:

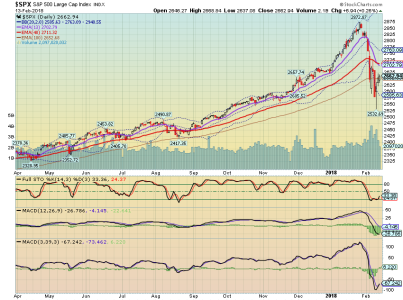

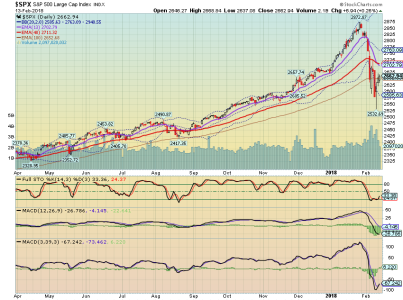

Maybe pictures would be better!! They say pictures are worth a thousand words...or something like that. Notice how 13EMA crossed below 48 Daily EMA on S Fund chart Thursday last week but that cross over just happened Monday for C Fund.

All I can say is I'm not entering until the MACD (default 12,26,9) crosses positive because I'm pretty sure that will be when the second hammer drops... I'm lucky like that!!! :blink: But all kidding aside, I think that would indicate the bottom....as I see it. Slow Stochastic and MACD (3,39,3) have already crossed positive BUT I want to see the slower MACD cross positive before reentry to e a little safer. Of course the best scenario would be to also see price move above Bollinger band mid-point and/or see 13day EMA cross back above 48 EMA before getting back in.... But then would lose out on lots of the upside...but earlier entry is riskier.

Best wishes to you all !!!!!!!!! :smile:

Maybe pictures would be better!! They say pictures are worth a thousand words...or something like that. Notice how 13EMA crossed below 48 Daily EMA on S Fund chart Thursday last week but that cross over just happened Monday for C Fund.

All I can say is I'm not entering until the MACD (default 12,26,9) crosses positive because I'm pretty sure that will be when the second hammer drops... I'm lucky like that!!! :blink: But all kidding aside, I think that would indicate the bottom....as I see it. Slow Stochastic and MACD (3,39,3) have already crossed positive BUT I want to see the slower MACD cross positive before reentry to e a little safer. Of course the best scenario would be to also see price move above Bollinger band mid-point and/or see 13day EMA cross back above 48 EMA before getting back in.... But then would lose out on lots of the upside...but earlier entry is riskier.

Best wishes to you all !!!!!!!!! :smile:

Last edited:

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Looking at chart I keep asking myself, why did I not exit when price moved away from upper Bollinger band and started nibbling on Bollinger mid-point? oh yeah... I was using a different (seasonal) strategy. Me thinks it's time to go back to old charting strategy. .... Well will see about that.

Best wishes to you all !!!!!!!!! :smile:

Best wishes to you all !!!!!!!!! :smile:

Whipsaw

Market Veteran

- Reaction score

- 257

Isn't the mid-point of the default BB just the 20 Day SMA?

This is what I am looking at, 20 day looks low at this point...

Dow Jones U.S. Completion Total Stock Market Index, XX

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Hi Cactus, That is correct. Bollinger default has mid-point set to 20 SMA. :smile: But on my charts, I typically like to use Exponential moving average (EMA) Lines because they are weighted to more current part of the period covered.

My current daily charts use (at minimum) the 13 and 48.5 EMA settings because someone posted a very good article last year with Study that showed that these MAs was the best cross over indicators for best returns using limited transactions for longer term strategies. So, I've been trying to make sure I am out of market during those downward crossovers. Will likely post charts again tonight

Best wishes to you and everyone!!!!!!! :smile:

My current daily charts use (at minimum) the 13 and 48.5 EMA settings because someone posted a very good article last year with Study that showed that these MAs was the best cross over indicators for best returns using limited transactions for longer term strategies. So, I've been trying to make sure I am out of market during those downward crossovers. Will likely post charts again tonight

Best wishes to you and everyone!!!!!!! :smile:

Last edited:

So I jumped back in today with about 40% leaving 60% in G for now. Good luck everyone. Little drops here and there I can take...corrections hurt..Hi Cactus, That is correct. Bollinger default has mid-point set to 20 SMA.But on my charts, I typically like to use Exponential moving average (EMA) Lines because they are weighted to more current part of the period covered.

My current daily charts use (at minimum) the 13 and 48.5 EMA settings because someone posted a very good article last year with Study that showed that these MAs was the best cross over indicators for best returns using limited transactions for longer term strategies. So, I've been trying to make sure I am out of market during those downward crossovers. Will likely post charts again tonight

Best wishes to you and everyone!!!!!!!

Sent from my SAMSUNG-SM-N910A using Tapatalk

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Here are daily charts. I added a 7day EMA and RSI. Looks like we are close to breaking out or going back down to test support. I'd be surprised if we don't test that bottom.

If not, I'll jump back in next week....we'll see....

Looks like 50% of the drop was retraced over 5 days...dang good dead cat bounce if that's what it is. So if I were in, this would be a great time to exit or reduce exposure until we find out where market is going.... But I must say it looks good...maybe it continues up??? Slow Stochastic and both MACDs sloped up AND RSI rising above 50...hummm...

Best wishes and Good Evening!!!!!!! :smile:

S Fund

C Fund.

If not, I'll jump back in next week....we'll see....

Looks like 50% of the drop was retraced over 5 days...dang good dead cat bounce if that's what it is. So if I were in, this would be a great time to exit or reduce exposure until we find out where market is going.... But I must say it looks good...maybe it continues up??? Slow Stochastic and both MACDs sloped up AND RSI rising above 50...hummm...

Best wishes and Good Evening!!!!!!! :smile:

S Fund

C Fund.

Last edited:

DreamboatAnnie

TSP Legend

- Reaction score

- 909

DreamboatAnnie

TSP Legend

- Reaction score

- 909

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Taking a little leap back in...hope hammer doesn't strike twice. Probably should have waited a few more days, but its a partial entry. :worried:

Now at 40G / 30C / 30I ....

Best wishes to you all !!!!!!! :smile:

Now at 40G / 30C / 30I ....

Best wishes to you all !!!!!!! :smile:

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Dont know what the hell I was thinking yesterday.....obviously was in La La DBAnnie Land! :notrust:

Last night looked at a few years with lots of volatility and scared myself.... Nightmares all night. So I was hoping that maybe last two days M and Tu were testing 50 EMA as support, so I got in yesterday only to see the big drop at end of day with Lots of Volume...oh oh.... There's some conviction there. Big bottom ....Here I come because what I lost last month was not enough

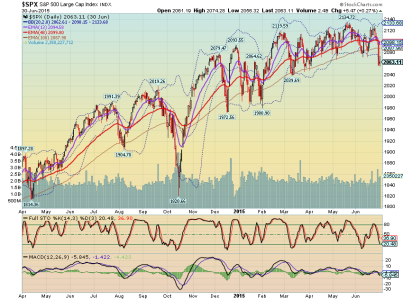

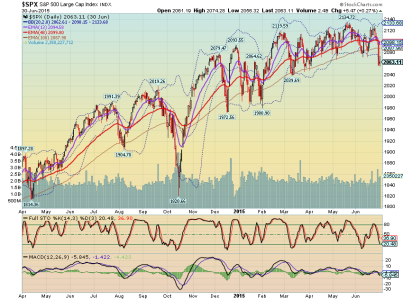

What i noticed is that usually when we have a drop, we have a second lower bottom before going up....and typically the true bottom is usually marked by the 10, 13, 20 SMA or EMA going above daily 50. Price obviously goes above 50 as well....but the daily average lines do not cross above 50 until the pain is over.

But Other times (ala 2010, 2011, 2014, 2015) you can get faked out by having the 10 &20 Daily average go above the 50 only to drop below again. That is NOT that common...hoping this is not about to happen because if it does, it may very well drop hard and fast again! Since it did not do a double bottom, it should not be that unexpected. Ughhh...where's the damn door! Tye only saving grace for me now is that im only in 60% so if i must ride it down i might be able to sink the rest at the bottom...if im lucky enough to realize it in time.

Here are some old 15 month charts to review over your morning coffee.....best wishes....:smile: starting to think i need to pay closer attention to slope of midpoint on Bollinger band and when price drops to or below midpoint....just saying....

Last night looked at a few years with lots of volatility and scared myself.... Nightmares all night. So I was hoping that maybe last two days M and Tu were testing 50 EMA as support, so I got in yesterday only to see the big drop at end of day with Lots of Volume...oh oh.... There's some conviction there. Big bottom ....Here I come because what I lost last month was not enough

What i noticed is that usually when we have a drop, we have a second lower bottom before going up....and typically the true bottom is usually marked by the 10, 13, 20 SMA or EMA going above daily 50. Price obviously goes above 50 as well....but the daily average lines do not cross above 50 until the pain is over.

But Other times (ala 2010, 2011, 2014, 2015) you can get faked out by having the 10 &20 Daily average go above the 50 only to drop below again. That is NOT that common...hoping this is not about to happen because if it does, it may very well drop hard and fast again! Since it did not do a double bottom, it should not be that unexpected. Ughhh...where's the damn door! Tye only saving grace for me now is that im only in 60% so if i must ride it down i might be able to sink the rest at the bottom...if im lucky enough to realize it in time.

Here are some old 15 month charts to review over your morning coffee.....best wishes....:smile: starting to think i need to pay closer attention to slope of midpoint on Bollinger band and when price drops to or below midpoint....just saying....

Last edited:

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Here's an intra day...look at that end of day drop! Wow! Most of it happened in the last 10 minutes of the trading session.

Talk about not wanting to exit all on one day...on the wrong day....like i did last month...

Best wishes to everyone !!!!!!! :smile:

View attachment 42869

Talk about not wanting to exit all on one day...on the wrong day....like i did last month...

Best wishes to everyone !!!!!!! :smile:

View attachment 42869

DreamboatAnnie

TSP Legend

- Reaction score

- 909

No move today...gonna wait and see.... i fund down today. Gapped down.

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Tis a sad state Whipsaw...for both of us and others. Okay so this time it will likely drop lower than the first one. New pack of sticky pants must be deployed, and this time please pass the gorilla glue! The last time I bailed, and that really hurt me.....

I hope im wrong and this turns out to be a shallower dip. But for it to go down to the level the market was at 6-7 months ago would not be a surprise.....anything further would be ___________.[fill in the blank please]

Here are COB charts -12 months....geez...S&P going to 2450??? I am wanting to bail again.....but futures are now down -114 pts on DOW....gonna be a scary day...:suspicious:

I hope im wrong and this turns out to be a shallower dip. But for it to go down to the level the market was at 6-7 months ago would not be a surprise.....anything further would be ___________.[fill in the blank please]

Here are COB charts -12 months....geez...S&P going to 2450??? I am wanting to bail again.....but futures are now down -114 pts on DOW....gonna be a scary day...:suspicious:

Last edited:

DreamboatAnnie

TSP Legend

- Reaction score

- 909

Here is I fund

View attachment 42874

View attachment 42874

But on my charts, I typically like to use Exponential moving average (EMA) Lines because they are weighted to more current part of the period covered.

But on my charts, I typically like to use Exponential moving average (EMA) Lines because they are weighted to more current part of the period covered.