We no longer have to wonder what the market will do on Wednesday when the Super Committee's deadline hits. They've already reported the process a failure.

Which makes one wonder if the past few day's trading action sufficiently priced in that outcome?

On the day, the DOW shed 2.11%, the S&P 500 dropped 1.86% and the Nasdaq fell 1.92%.

So it's no longer the EU that's unable to sufficiently address a dire debt situation, apparently we have the same problem here. Today, Moody's released some comments regarding France's debt rating that indicated they may be poised to lower their current triple AAA rating. Not be outdone, our Super Committee came up empty on their tasking, which will probably result in another downgrade of the US debt rating.

Earlier today, Atlanta Fed President Lockhart indicated that he does not see risk of an outright recession, and that the risk of stands at about 30% in his view. We'll see if his viewpoint carried any weight in tomorrow's release of the FOMC minutes. That gets released at 2PM tomorrow, but we also have the final GDP number for last quarter coming and that will be released prior to tomorrow's opening bell.

Here's today's charts:

NAMO and NYMO fell hard today and remain firmly in sell conditions. The signals are now at levels last seen around the September lows.

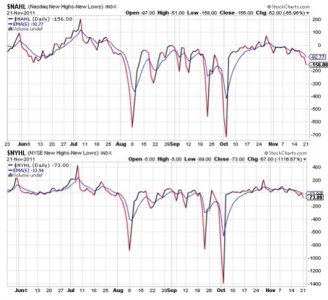

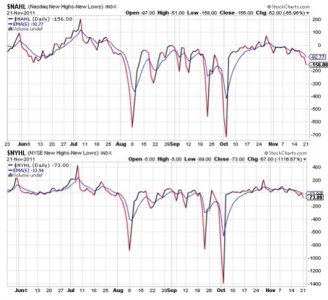

NAHL and NYHL also continue to ebb lower and remain on sells.

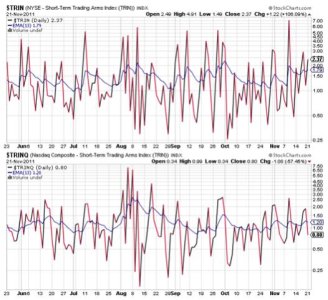

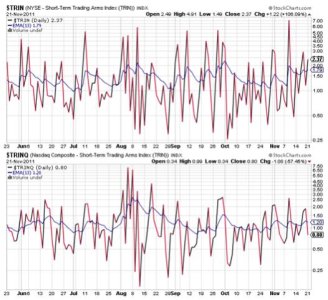

TRIN flipped to a sell, while TRINQ flipped to a buy. That's a bit odd given today's hard decline as I would have expected a somewhat oversold condition. The fact that we don't have one by these signals tells me we may be bottoming.

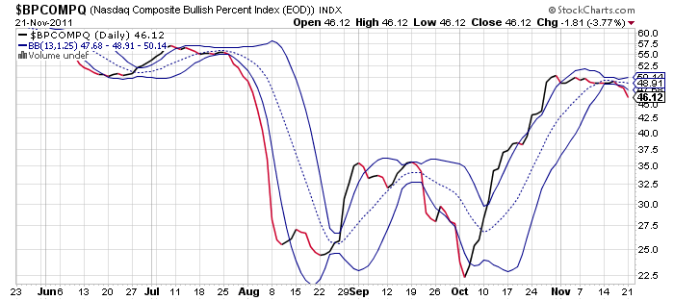

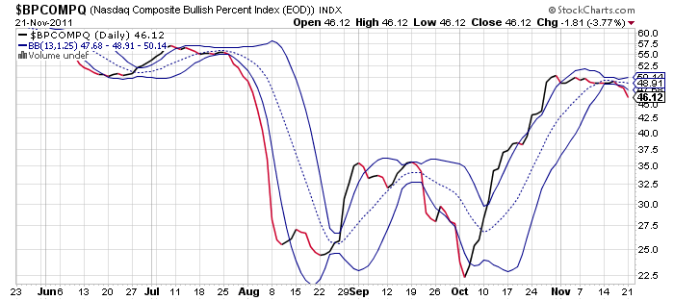

BPCOMPQ dropped further and remains in a sell condition.

So the signals are mixed, but the Seven Sentinels remains in a sell condition.

With the exception of TRIN and TRINQ these charts look decidedly bearish. But seasonality may help put a bottom in as we approach Thanksgiving. The biggest event for the week (Super Committee deadline) is now being officially cast as a failure, but what happens in the aftermath as automatic cuts loom?

I used my 2nd IFT today to increase my S fund position from 20% to 50%. It's not without risk as it's possible I could be trying to catch a falling knife, but leaving 50% in the G fund makes it an acceptable risk for me as we have one heck of a wall of worry and I'm counting on that to help put in a bottom soon.

Which makes one wonder if the past few day's trading action sufficiently priced in that outcome?

On the day, the DOW shed 2.11%, the S&P 500 dropped 1.86% and the Nasdaq fell 1.92%.

So it's no longer the EU that's unable to sufficiently address a dire debt situation, apparently we have the same problem here. Today, Moody's released some comments regarding France's debt rating that indicated they may be poised to lower their current triple AAA rating. Not be outdone, our Super Committee came up empty on their tasking, which will probably result in another downgrade of the US debt rating.

Earlier today, Atlanta Fed President Lockhart indicated that he does not see risk of an outright recession, and that the risk of stands at about 30% in his view. We'll see if his viewpoint carried any weight in tomorrow's release of the FOMC minutes. That gets released at 2PM tomorrow, but we also have the final GDP number for last quarter coming and that will be released prior to tomorrow's opening bell.

Here's today's charts:

NAMO and NYMO fell hard today and remain firmly in sell conditions. The signals are now at levels last seen around the September lows.

NAHL and NYHL also continue to ebb lower and remain on sells.

TRIN flipped to a sell, while TRINQ flipped to a buy. That's a bit odd given today's hard decline as I would have expected a somewhat oversold condition. The fact that we don't have one by these signals tells me we may be bottoming.

BPCOMPQ dropped further and remains in a sell condition.

So the signals are mixed, but the Seven Sentinels remains in a sell condition.

With the exception of TRIN and TRINQ these charts look decidedly bearish. But seasonality may help put a bottom in as we approach Thanksgiving. The biggest event for the week (Super Committee deadline) is now being officially cast as a failure, but what happens in the aftermath as automatic cuts loom?

I used my 2nd IFT today to increase my S fund position from 20% to 50%. It's not without risk as it's possible I could be trying to catch a falling knife, but leaving 50% in the G fund makes it an acceptable risk for me as we have one heck of a wall of worry and I'm counting on that to help put in a bottom soon.