There's a quite a bit going on in the global markets right now, but I'm not going to cover any of it in tonight's blog as I'm pressed for time. But if you haven't had a chance to check out my account talk thread, I posted a long line of links this morning that covered a lot of economic territory. Check it out if you haven't already.

Here's today's charts:

NAMO and NYMO continued lower today and remain on sells. Both are now in negative territory and given the momentum this market has to the downside right now, I believe they may be suggesting lower prices are coming in the days ahead. NYMO is well away from a 28 day trading low, so should the seven sentinels trigger an unconfirmed sell signal in the short term, the market would have to pretty much fall apart to confirm a potential sell. More on that in a bit.

NAHL and NYHL are also on sells.

TRIN and TRINQ both fell back into buy conditions and are now neutral overall.

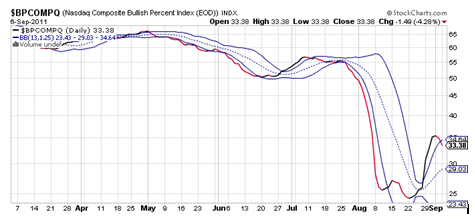

Here's where things get interesting again. BPCOMPQ dropped into a sell condition after passing through that upper bollinger band. That may be an early warning given the system remains in a buy condition overall.

This remains a dangerous market in my opinion. The volatility, while providing trading opportunities, makes it much more challenging for us to execute an IFT either into or out of this market with any given price objective (expectation). And it's a bear market, so trying to pick a bottom could be hazardous to one's account performance.

I mentioned earlier that NYMO was well away from a 28 day trading low. That particular low was at a very rare negative level. If this system gets an unconfirmed sell signal in the days ahead, I would treat it with respect and move to the sidelines as waiting for NYMO to exceed that previous low would mean this market would be at much lower prices before a signal could be confirmed. This is a more conservative approach, but with only 2 IFTs to work with a month, why take chances in such a difficult, bearish, trading environment. There are many unknowns about where this market is headed and the wall of worry may crumble if things get out of hand in the weeks and months ahead.

Just some thoughts relative to risk.

Here's today's charts:

NAMO and NYMO continued lower today and remain on sells. Both are now in negative territory and given the momentum this market has to the downside right now, I believe they may be suggesting lower prices are coming in the days ahead. NYMO is well away from a 28 day trading low, so should the seven sentinels trigger an unconfirmed sell signal in the short term, the market would have to pretty much fall apart to confirm a potential sell. More on that in a bit.

NAHL and NYHL are also on sells.

TRIN and TRINQ both fell back into buy conditions and are now neutral overall.

Here's where things get interesting again. BPCOMPQ dropped into a sell condition after passing through that upper bollinger band. That may be an early warning given the system remains in a buy condition overall.

This remains a dangerous market in my opinion. The volatility, while providing trading opportunities, makes it much more challenging for us to execute an IFT either into or out of this market with any given price objective (expectation). And it's a bear market, so trying to pick a bottom could be hazardous to one's account performance.

I mentioned earlier that NYMO was well away from a 28 day trading low. That particular low was at a very rare negative level. If this system gets an unconfirmed sell signal in the days ahead, I would treat it with respect and move to the sidelines as waiting for NYMO to exceed that previous low would mean this market would be at much lower prices before a signal could be confirmed. This is a more conservative approach, but with only 2 IFTs to work with a month, why take chances in such a difficult, bearish, trading environment. There are many unknowns about where this market is headed and the wall of worry may crumble if things get out of hand in the weeks and months ahead.

Just some thoughts relative to risk.