Don't be fooled, there's underlying strength in this market in spite of the red close.

First, the market came roaring back after being down significantly intraday, so today's losses need to be seen in that context. But there's another reason to believe the market is stronger than it may appear, and that's because internals were deceptively strong today as you'll see in the charts.

Good earnings continue to be largely ignored by the market.

Amid today's economic data we saw initial jobless claims posted at 457,000, which was below the expected 464,000. Continuing claims moved higher at 4.57 million, up from the 4.48 million the previous week.

So it was a battle between bulls and bears today, but my money is on the bulls to put an end to this consolidation and profit taking and take this market higher.

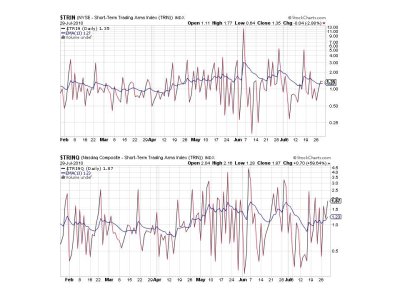

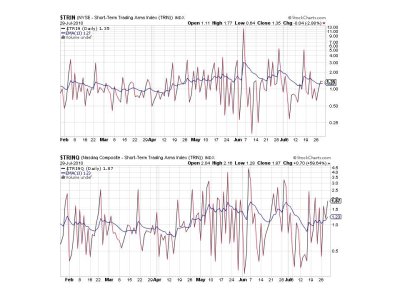

Here's the charts:

Still on sells here, but we're holding at a relatively high level in spite of the recent selling pressure.

Here's where underlying strength in this market is most notable. The A/D line, which advanced today, although both signals remain on sells.

TRIN and TRINQ remain on sells.

BPCOMPQ is hanging in there and remains on a buy.

So we have 6 of 7 signals on a sell, but the one buy signal keeps the system on a buy.

Overall, the sell signals are all close to their respective trigger points, so another big rally could see these charts reenergized very quickly. The A/D line advancing today tells me the up-leg is not over.

Still holding 100% S.

First, the market came roaring back after being down significantly intraday, so today's losses need to be seen in that context. But there's another reason to believe the market is stronger than it may appear, and that's because internals were deceptively strong today as you'll see in the charts.

Good earnings continue to be largely ignored by the market.

Amid today's economic data we saw initial jobless claims posted at 457,000, which was below the expected 464,000. Continuing claims moved higher at 4.57 million, up from the 4.48 million the previous week.

So it was a battle between bulls and bears today, but my money is on the bulls to put an end to this consolidation and profit taking and take this market higher.

Here's the charts:

Still on sells here, but we're holding at a relatively high level in spite of the recent selling pressure.

Here's where underlying strength in this market is most notable. The A/D line, which advanced today, although both signals remain on sells.

TRIN and TRINQ remain on sells.

BPCOMPQ is hanging in there and remains on a buy.

So we have 6 of 7 signals on a sell, but the one buy signal keeps the system on a buy.

Overall, the sell signals are all close to their respective trigger points, so another big rally could see these charts reenergized very quickly. The A/D line advancing today tells me the up-leg is not over.

Still holding 100% S.