No signals for this week from the auto-tracker. Last week, the Total Tracker came close to a sell signal with a jump of almost 8% in stock allocation and it may have been close enough as we had significant selling pressure earlier in the week, but the market came back by week's end to close positive across all TSP stock funds.

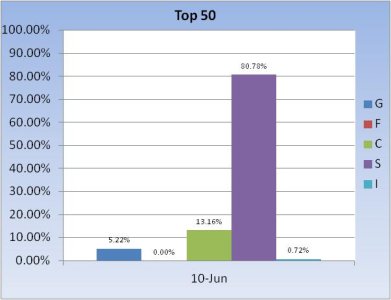

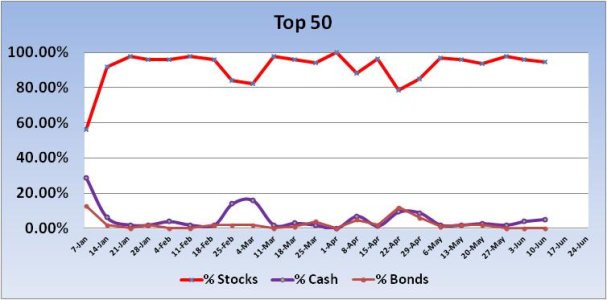

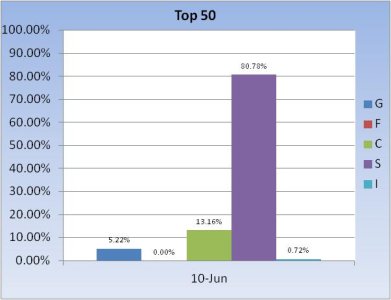

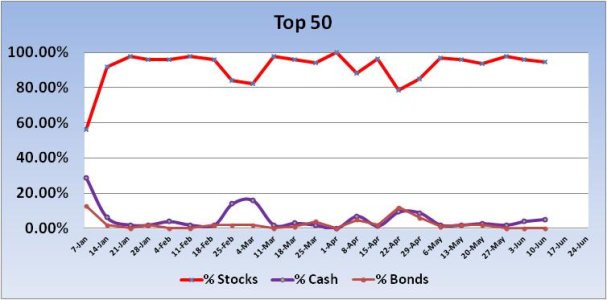

This week, the Top 50's stock exposure dipped by 1.34% to a total allocation of 94.66%.

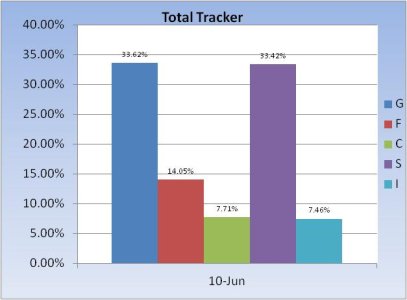

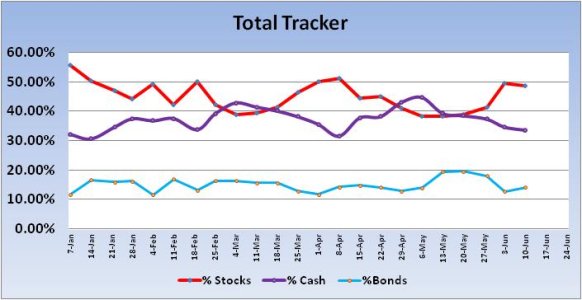

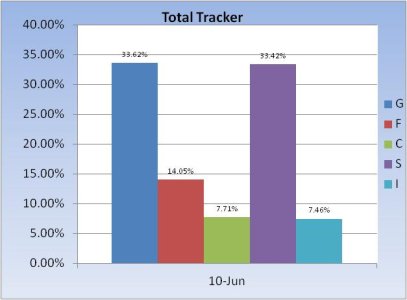

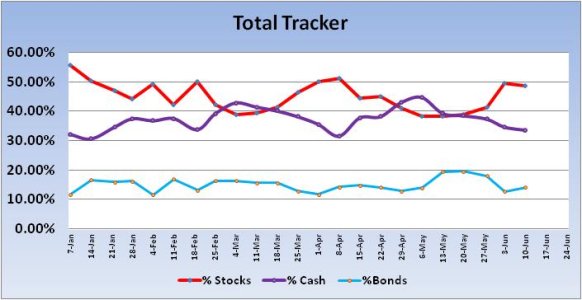

On Thursday, I noted that the Total Tracker showed stock allocations rising modestly again, but by Friday it actually dipped 0.79% for a total stock allocation of 48.58%. Last week it was 49.37%. Bond holdings increased modestly in spite of the decided downward trend in our bond fund.

Looking at the very short term, I am assuming the S&P 500's top made on May 22nd will hold for now given negative seasonality. So I'm looking for a lower high, which I suspect was achieved on Friday, as price retraced about 50% of the losses (using Fibonacci retracements) off the May 22nd high. Also, note the gap in price on Friday. I'm thinking the very short term favors the downside. I do note that RSI is positive again and MACD is rising. That's just the very short term. Longer term this is still a bull market.

Our sentiment survey came in 42% bulls vs 50% bears, which keeps it in a buy condition.

So I'm looking for weakness early on in the week, but I'm still not bearish longer term. However, should weakness take the S&P to a lower low and close below the 50 dma, I may need to think about getting more defensive. But for now, the bull gets the benefit of the doubt.

This week, the Top 50's stock exposure dipped by 1.34% to a total allocation of 94.66%.

On Thursday, I noted that the Total Tracker showed stock allocations rising modestly again, but by Friday it actually dipped 0.79% for a total stock allocation of 48.58%. Last week it was 49.37%. Bond holdings increased modestly in spite of the decided downward trend in our bond fund.

Looking at the very short term, I am assuming the S&P 500's top made on May 22nd will hold for now given negative seasonality. So I'm looking for a lower high, which I suspect was achieved on Friday, as price retraced about 50% of the losses (using Fibonacci retracements) off the May 22nd high. Also, note the gap in price on Friday. I'm thinking the very short term favors the downside. I do note that RSI is positive again and MACD is rising. That's just the very short term. Longer term this is still a bull market.

Our sentiment survey came in 42% bulls vs 50% bears, which keeps it in a buy condition.

So I'm looking for weakness early on in the week, but I'm still not bearish longer term. However, should weakness take the S&P to a lower low and close below the 50 dma, I may need to think about getting more defensive. But for now, the bull gets the benefit of the doubt.