-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DOOM Trading System

- Thread starter Minnow

- Start date

Cactus

TSP Pro

- Reaction score

- 38

Minnow, you are very systematic and have a plan. That's good! My problem is recently I'm all over the board and don't stick with anything very long. Why? Here's my story.

I don't like investing -- never have. I only do it now because I believe I have too. I am too conservative. I was 100% in the G Fund until 2000. People at work pointed out I needed exposure to the market, so I waited for the Y2K scare to die down (remember that) and entered the C Fund in May 2000. I didn't know what I was doing. Yeah, it dropped, but I knew enough to buy-and-hold and believe in dollar-cost-averaging. Thing is I bought high and it wasn't going anywhere even after it came back. The only thing this was getting me was trying to get back up to where I started. Not much of a goal. I gave up on that in Nov 2007 and decided to go into autopilot by giving the L Fund a try for a year. That was a disaster. I put my money into L30 and watched it lose more money than I thought possible in 2008 with it's daily rebalancing.

So I gave up on that and came here and tried my hand at trading. I've been all over the place on that. Last year I tried a bit of LMBF-1 and using the RSI and bollinger bands. Thing is last year was a buy-and-hold year and the RSI remained overbought for extended periods of time. This year I've been mainly looking at support/resistance at the 50 & 200 day SMA. My problems have been what to do when my expectations aren't realized and when. I refuse to chase the market because that has burned me in the past (whipsaw), but this year that was the right thing to do here recently and last summer and back in Feb. The thing is our IFT limit doesn't give one much option. That is why I'm looking at going back to buy-and-hold next year or looking into following a trend system like LMBF. I need something where I'm not looking at the market every day because that isn't working for me. I'm my own worst enemy. CRAP proves that.

So you see I'm still not sticking to one system and that is probably what's killing me.

I don't like investing -- never have. I only do it now because I believe I have too. I am too conservative. I was 100% in the G Fund until 2000. People at work pointed out I needed exposure to the market, so I waited for the Y2K scare to die down (remember that) and entered the C Fund in May 2000. I didn't know what I was doing. Yeah, it dropped, but I knew enough to buy-and-hold and believe in dollar-cost-averaging. Thing is I bought high and it wasn't going anywhere even after it came back. The only thing this was getting me was trying to get back up to where I started. Not much of a goal. I gave up on that in Nov 2007 and decided to go into autopilot by giving the L Fund a try for a year. That was a disaster. I put my money into L30 and watched it lose more money than I thought possible in 2008 with it's daily rebalancing.

So I gave up on that and came here and tried my hand at trading. I've been all over the place on that. Last year I tried a bit of LMBF-1 and using the RSI and bollinger bands. Thing is last year was a buy-and-hold year and the RSI remained overbought for extended periods of time. This year I've been mainly looking at support/resistance at the 50 & 200 day SMA. My problems have been what to do when my expectations aren't realized and when. I refuse to chase the market because that has burned me in the past (whipsaw), but this year that was the right thing to do here recently and last summer and back in Feb. The thing is our IFT limit doesn't give one much option. That is why I'm looking at going back to buy-and-hold next year or looking into following a trend system like LMBF. I need something where I'm not looking at the market every day because that isn't working for me. I'm my own worst enemy. CRAP proves that.

So you see I'm still not sticking to one system and that is probably what's killing me.

Minnow

TSP Pro

- Reaction score

- 80

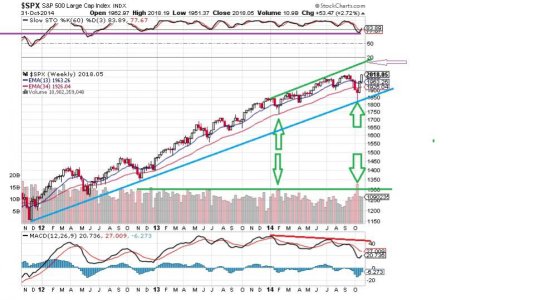

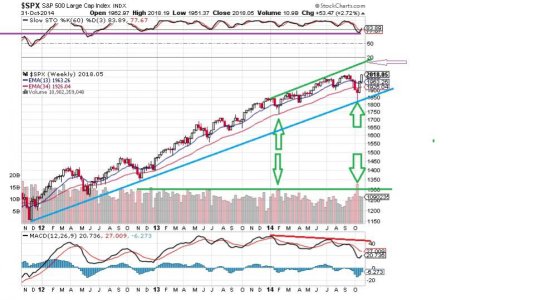

Ok...What do your red arrows mean? Green is usually Buy and Red is sell. But I think you are alternating colors in your drawing? Red/Red (BUY/SELL), Green/Green (BUY/SELL), etc. Am I reading it right?

When I started drawing, I forgot that I preferred to short so, my "buy" would actually have been a "sell" when the slow sto 14 crossed below the 3.

The arrows (colors don't mean anything other than my paint skills are BADDDDD) are just showing that now I (the frontrunner) buy when the slow sto 14 crosses the 3. If you want to play it safe, wait until the slow sto 14 crosses the 3 and the MACD and the 8sma crosses above the 21sma. But sell as soon as the slow sto 14 crosses below the 3.

I have not followed this system religiously this year because, hey, life gets in the way. It's just generally my way of "trading" (although I preferred to sell short and actually trade on 15 minute bars instead) since I was too stupid to follow the P&F C chart this year.

Minnow

TSP Pro

- Reaction score

- 80

Minnow, you are very systematic and have a plan. That's good! My problem is recently I'm all over the board and don't stick with anything very long. Why? Here's my story.

I don't like investing -- never have. I only do it now because I believe I have too. I am too conservative. I was 100% in the G Fund until 2000. People at work pointed out I needed exposure to the market, so I waited for the Y2K scare to die down (remember that) and entered the C Fund in May 2000. I didn't know what I was doing. Yeah, it dropped, but I knew enough to buy-and-hold and believe in dollar-cost-averaging. Thing is I bought high and it wasn't going anywhere even after it came back. The only thing this was getting me was trying to get back up to where I started. Not much of a goal. I gave up on that in Nov 2007 and decided to go into autopilot by giving the L Fund a try for a year. That was a disaster. I put my money into L30 and watched it lose more money than I thought possible in 2008 with it's daily rebalancing.

So I gave up on that and came here and tried my hand at trading. I've been all over the place on that. Last year I tried a bit of LMBF-1 and using the RSI and bollinger bands. Thing is last year was a buy-and-hold year and the RSI remained overbought for extended periods of time. This year I've been mainly looking at support/resistance at the 50 & 200 day SMA. My problems have been what to do when my expectations aren't realized and when. I refuse to chase the market because that has burned me in the past (whipsaw), but this year that was the right thing to do here recently and last summer and back in Feb. The thing is our IFT limit doesn't give one much option. That is why I'm looking at going back to buy-and-hold next year or looking into following a trend system like LMBF. I need something where I'm not looking at the market every day because that isn't working for me. I'm my own worst enemy. CRAP proves that.

So you see I'm still not sticking to one system and that is probably what's killing me.

Nope, I'm the same as you... I haven't been able to stick to the system because life gets in the way. I dont always have the time to study charts and do backtesting. Sucks. But, I do have time to watch my kids play sports, help with homework, take care of most of the honey "do" list and talk to you nice folks. I can live with that. I'm still young enough to make up all the investment wrongs I have committed over the past year or two -- plus I was following Ebb when he was on fire a few years ago -- thanks Ebb.

Glad to have you posting man.

jpcavin

TSP Legend

- Reaction score

- 97

When I started drawing, I forgot that I preferred to short so, my "buy" would actually have been a "sell" when the slow sto 14 crossed below the 3.

The arrows (colors don't mean anything other than my paint skills are BADDDDD) are just showing that now I (the frontrunner) buy when the slow sto 14 crosses the 3. If you want to play it safe, wait until the slow sto 14 crosses the 3 and the MACD and the 8sma crosses above the 21sma. But sell as soon as the slow sto 14 crosses below the 3.

I have not followed this system religiously this year because, hey, life gets in the way. It's just generally my way of "trading" (although I preferred to sell short and actually trade on 15 minute bars instead) since I was too stupid to follow the P&F C chart this year.

Based on your green arrows, it would appear that you would buy around the 15/16 or September and sell around the 19th?? If you compare prices for these days, it would have been a losing trade, would it not? If you look at ROC in my chart for this period, momentum is actually decreasing. That's what I see anyway. Anyone else see it differently? I'm learning with ya bro!

Minnow

TSP Pro

- Reaction score

- 80

Yep, green arrows would have been a losing trade. Should have colored them red, huh? Like: "Caution" this system isn't perfect. I don't believe I did anything then for some reason -- I think the 8sma was trying to cross back below the 21sma during that timeframe. There's more subtle things with the system that I didn't include. I will try to find a good description and then link it to you. Fair enough?

What I did do recently at the end of July was buy when the slow sto crossed mid-day (but not convincingly) anticipating a big move... well, at the close of business the slow sto 14 actually was still below the 3... and the markets fell around 2%. That's what I get for frontrunning.

I'm learning too.

What I did do recently at the end of July was buy when the slow sto crossed mid-day (but not convincingly) anticipating a big move... well, at the close of business the slow sto 14 actually was still below the 3... and the markets fell around 2%. That's what I get for frontrunning.

I'm learning too.

jpcavin

TSP Legend

- Reaction score

- 97

Yep, green arrows would have been a losing trade. Should have colored them red, huh? Like: "Caution" this system isn't perfect. I don't believe I did anything then for some reason -- I think the 8sma was trying to cross back below the 21sma during that timeframe. There's more subtle things with the system that I didn't include. I will try to find a good description and then link it to you. Fair enough?

What I did do recently at the end of July was buy when the slow sto crossed mid-day (but not convincingly) anticipating a big move... well, at the close of business the slow sto 14 actually was still below the 3... and the markets fell around 2%. That's what I get for frontrunning.

I'm learning too.

I guess what I was getting at is that you can't use slow stochastics by itself. I've been down that route before and it was not pretty.

Minnow

TSP Pro

- Reaction score

- 80

Link that's part of a powerpoint (8/21 crossover stuff starts around page 5):

http://freewebinars.s3.amazonaws.com/Bringing-It-All-Together-With-Anchors.pdf

Basically, you look for a market that is trending upward at least in the mid-term (week or two --means more than one would think) and then get that slow sto 14 breaking above the 3. if the 8 sma crosses above the 21 and the MACD falls in line, so be it. But you don't want to trade against the trend -- unless you're selling short. That's probably why I'm still learning on this one.

http://freewebinars.s3.amazonaws.com/Bringing-It-All-Together-With-Anchors.pdf

Basically, you look for a market that is trending upward at least in the mid-term (week or two --means more than one would think) and then get that slow sto 14 breaking above the 3. if the 8 sma crosses above the 21 and the MACD falls in line, so be it. But you don't want to trade against the trend -- unless you're selling short. That's probably why I'm still learning on this one.

Minnow

TSP Pro

- Reaction score

- 80

I guess what I was getting at is that you can't use slow stochastics by itself. I've been down that route before and it was not pretty.

Absolutely 100% correct. Have a happy halloween!!!

alevin

Market Veteran

- Reaction score

- 97

I do not have the ability to do so unless someone can tell me. I saved it from stockcharts.com to Paint and then drew my little arrows and changed the overlays. Then I saved it and tried to insert picture into my thread reply. Then I was sucked into the ceiling fan -- which is where I remain holding my laptop hoping someone will come by and show me how to escape the ceiling fan's clutches or make the picture bigger.

Sorry I can't be of more help.

Anyone? Anyone?

I'm not much help. My skills extend to the paint-import and insert arrows, beyond that, me and the ceiling fan just go round and round too. :laugh:

PessOptimist

Market Veteran

- Reaction score

- 67

11, you may have gotten the paint answer all ready. Open your chart in paint. Use the slider thingy on the right to go all the way to the bottom. Somewhere in the middle of the image is a place you can mouse over and get a two ended arrow. If this image is really big you may have to use the bottom slider thingy to find this little square. Once you find it, left click hold and move up to the bottom of the chart. You may have to do the same thing with the width using the bottom slider thingy. I am not explaining this well but I hope it helps.

PO

PO

alevin

Market Veteran

- Reaction score

- 97

Never did find the 2-ended arrow you spoke of, but I learned how to use the arrows tonight. easier than the hand-drawn ones I've always done before.

From the looks of things, there is still room for this move to continue for a little bit. See the purple arrow at the top. If wishes were fishes, I'd be in the swim of things. alas, I was out of town all week, didn't have time to watch or react. Same will transpire this coming week, different place, same project.

alas, I was out of town all week, didn't have time to watch or react. Same will transpire this coming week, different place, same project.

The macd divergence still concerns me. I always look at weekly charts before I look at daily or shorter for entry decisions.

From the looks of things, there is still room for this move to continue for a little bit. See the purple arrow at the top. If wishes were fishes, I'd be in the swim of things.

The macd divergence still concerns me. I always look at weekly charts before I look at daily or shorter for entry decisions.

PessOptimist

Market Veteran

- Reaction score

- 67

Chart looks good so you are on top of it.

Cactus

TSP Pro

- Reaction score

- 38

as of COB 11/19:

[TABLE="class: grid, width: 500"]

[TR]

[TD]Cactus

[/TD]

[TD]CRAP

[/TD]

[/TR]

[TR]

[TD]-7.5%

[/TD]

[TD]+21.83%

[/TD]

[/TR]

[TR]

[TD]still in the G Fund

[/TD]

[TD]still in the S Fund

[/TD]

[/TR]

[/TABLE]

CRAP is still #2 on the AT. Cactus is waiting for a pullback to jump into the market for a santa clause rally. CRAP will jump to the G Fund at that time.

[TABLE="class: grid, width: 500"]

[TR]

[TD]Cactus

[/TD]

[TD]CRAP

[/TD]

[/TR]

[TR]

[TD]-7.5%

[/TD]

[TD]+21.83%

[/TD]

[/TR]

[TR]

[TD]still in the G Fund

[/TD]

[TD]still in the S Fund

[/TD]

[/TR]

[/TABLE]

CRAP is still #2 on the AT. Cactus is waiting for a pullback to jump into the market for a santa clause rally. CRAP will jump to the G Fund at that time.

Cactus

TSP Pro

- Reaction score

- 38

Still waiting for that pullback.  Looks like Cactus will go into Dec. sitting on the lily pad (G Fund) which means CRAP stays the course in the S Fund.

Looks like Cactus will go into Dec. sitting on the lily pad (G Fund) which means CRAP stays the course in the S Fund.

CRAP is still @ #2 on the AT as of COB 11/25.

[TABLE="class: grid, width: 150"]

[TR]

[TD]Cactus

[/TD]

[TD]CRAP

[/TD]

[/TR]

[TR]

[TD]-7.47%

[/TD]

[TD]24.22%

[/TD]

[/TR]

[/TABLE]

Happy Thanksgiving everyone! Remember this year I'm the turkey. Don't poke yourself picking your teeth with my spines.

CRAP is still @ #2 on the AT as of COB 11/25.

[TABLE="class: grid, width: 150"]

[TR]

[TD]Cactus

[/TD]

[TD]CRAP

[/TD]

[/TR]

[TR]

[TD]-7.47%

[/TD]

[TD]24.22%

[/TD]

[/TR]

[/TABLE]

Happy Thanksgiving everyone! Remember this year I'm the turkey. Don't poke yourself picking your teeth with my spines.

Cactus

TSP Pro

- Reaction score

- 38

Cactus goes from G to S COB today which means CRAP goes from S to G.

CRAP is @ #3 on the AT as of COB 12/22.

[TABLE="class: grid, width: 150"]

[TR]

[TD]Cactus

[/TD]

[TD]CRAP

[/TD]

[/TR]

[TR]

[TD]-7.33%

[/TD]

[TD]24.48%

[/TD]

[/TR]

[/TABLE]

Make of this what you will.

CRAP is @ #3 on the AT as of COB 12/22.

[TABLE="class: grid, width: 150"]

[TR]

[TD]Cactus

[/TD]

[TD]CRAP

[/TD]

[/TR]

[TR]

[TD]-7.33%

[/TD]

[TD]24.48%

[/TD]

[/TR]

[/TABLE]

Make of this what you will.

Similar threads

- Replies

- 1

- Views

- 159

- Replies

- 0

- Views

- 181