In spite of last week's QE2 announcement, and contrary to what I think conventional wisdom would suggest, the dollar rallied for a second straight day, tacking on another 0.6% gain on top of the 0.9% rally this past Friday. And yet the stock market is continuing to show relative strength despite the recent headwind of the greenback.

Given the global currency policy debate I have to wonder how real this turn-about by the dollar is as last Friday's initial move higher came after the dollar bounced off an 11-month low. The "obvious" outcome of using more quantitative easing certainly suggests the dollar should be weakening. But if this rally continues, how much longer can equity prices continue to rise? Or is the dollar's pricing action some kind of signal prior to the next G20 meeting?

Of course I have no answer to that question, but it's an observation nonetheless.

Here's today's charts:

No real damage to NAMO and NYMO after today. They both remain on a buy.

NAHL and NYHL flipped to sells.

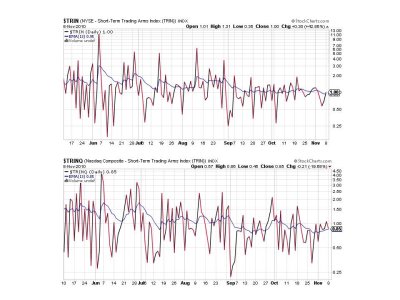

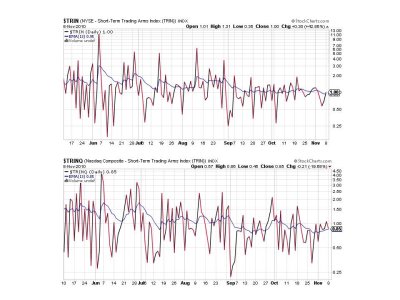

TRIN and TRINQ also flipped to sells.

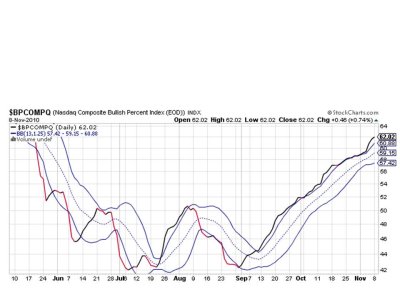

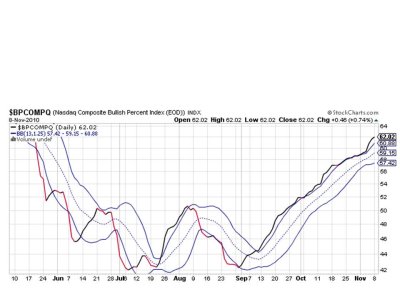

BPCOMPQ remains on a buy.

So 3 of 7 signals remain on buys, which keeps the system on a buy.

I am looking for short term weakness this week, and I don't know if today was it or not. Our sentiment survey is on a sell this week, but other surveys are not in synch with our own, so it's not likely we'll see any serious selling pressure. After last week's elections and FOMC announcement the market needs to find something else to focus on and I suspect it will be this week's G20 meeting and how they react to the Fed's new round of QE. From what I'm reading we aren't doing anyone else any favors as the expectation by all concerned is that we are deliberately debasing the dollar, which makes it more difficult for other countries to compete. The meeting is scheduled for the 11th and 12th so market action may be choppy until this meeting ends.

I am mostly in the G fund and looking for a buying opportunity to present itself, but I'm ignoring the Sentinels by taking this position. But I've got my eye on the dollar as it may give us a clue to short term market direction in the days ahead.

Given the global currency policy debate I have to wonder how real this turn-about by the dollar is as last Friday's initial move higher came after the dollar bounced off an 11-month low. The "obvious" outcome of using more quantitative easing certainly suggests the dollar should be weakening. But if this rally continues, how much longer can equity prices continue to rise? Or is the dollar's pricing action some kind of signal prior to the next G20 meeting?

Of course I have no answer to that question, but it's an observation nonetheless.

Here's today's charts:

No real damage to NAMO and NYMO after today. They both remain on a buy.

NAHL and NYHL flipped to sells.

TRIN and TRINQ also flipped to sells.

BPCOMPQ remains on a buy.

So 3 of 7 signals remain on buys, which keeps the system on a buy.

I am looking for short term weakness this week, and I don't know if today was it or not. Our sentiment survey is on a sell this week, but other surveys are not in synch with our own, so it's not likely we'll see any serious selling pressure. After last week's elections and FOMC announcement the market needs to find something else to focus on and I suspect it will be this week's G20 meeting and how they react to the Fed's new round of QE. From what I'm reading we aren't doing anyone else any favors as the expectation by all concerned is that we are deliberately debasing the dollar, which makes it more difficult for other countries to compete. The meeting is scheduled for the 11th and 12th so market action may be choppy until this meeting ends.

I am mostly in the G fund and looking for a buying opportunity to present itself, but I'm ignoring the Sentinels by taking this position. But I've got my eye on the dollar as it may give us a clue to short term market direction in the days ahead.