Somehow after watching this week's action unfold I can't say I'm surprised that the S&P 500 closed on its high of the day. I started expecting that outcome several hours before the trading day ended. I suppose the old adage "The market can stay irrational longer than we can stay solvent" applies for the time being.

Here's the charts:

Not surprisingly, both NAMO and NYMO turned positive today and are flashing buys.

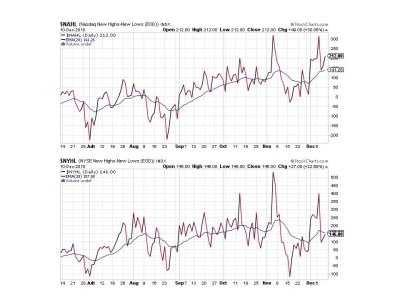

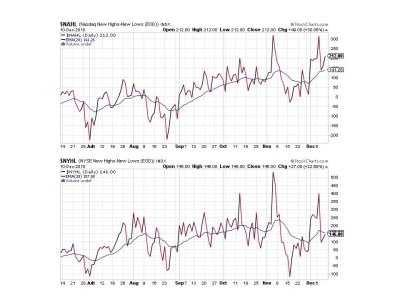

NAHL and NYHL also turned positive, but NYHL remains in a sell condition.

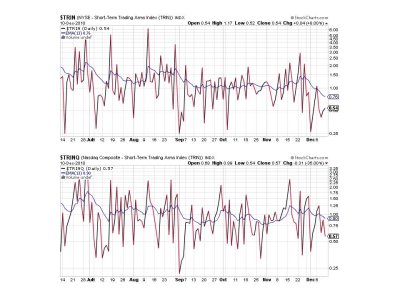

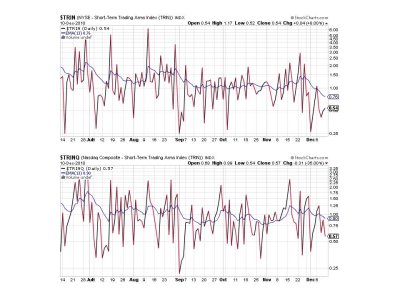

TRIN and TRINQ remain on buys.

BPCOMPQ is looking more bullish each trading day and looks to be lifting off. Of course it remains on a buy.

So 6 of 7 signals are flashing buys, but the system remains on a sell since NYMO never confirmed the previous buy signal. I had mentioned at that time that if one was more inclined towards risk you may have wanted to act on that buy signal, and so far that appears to have been the right more. There has been little in the way of whipsaw action, which is what the 28 day trading high for NYMO is suppose to guard against.

But a new week begins Monday and it's an OPEX week to boot. I still think there's a lot of risk in this market, but I can't deny the price action has been unstoppable to the up side.

See you this weekend when I post the updated tracker charts.

Here's the charts:

Not surprisingly, both NAMO and NYMO turned positive today and are flashing buys.

NAHL and NYHL also turned positive, but NYHL remains in a sell condition.

TRIN and TRINQ remain on buys.

BPCOMPQ is looking more bullish each trading day and looks to be lifting off. Of course it remains on a buy.

So 6 of 7 signals are flashing buys, but the system remains on a sell since NYMO never confirmed the previous buy signal. I had mentioned at that time that if one was more inclined towards risk you may have wanted to act on that buy signal, and so far that appears to have been the right more. There has been little in the way of whipsaw action, which is what the 28 day trading high for NYMO is suppose to guard against.

But a new week begins Monday and it's an OPEX week to boot. I still think there's a lot of risk in this market, but I can't deny the price action has been unstoppable to the up side.

See you this weekend when I post the updated tracker charts.