The intraday volatility wasn't as severe today, but the action over the last two days in general is very volatile. The S&P finds itself not far from the 1100 mark and only a bit further away from its 200 dma. Will the resistance hold again, or will the bears come out in numbers to short, providing the potential for a short covering rally?

Of course the media has to have a reason for the rally so it must have been the pending home sales for April, which increased 6.0%, 1% above expectations.

A small bounce in the euro helped too.

In reality, the market probably bounced because of the short term oversold conditions.

Tomorrow we will get the retail sales reports, weekly jobless claims, monthly factory orders, and the latest ISM Service Index, as well as the latest monthly ADP Employment Report.

Not surprisingly, the Seven Sentinels improved with today's action, but do we have a buy signal. That would be a definite maybe. Let's take a look at the charts:

No problems here. Both NAMO and NYMO are flashing buys. NYMO is also well above its 28 dma, which is an element of the latest SS parameters and is considered a buy using that metric.

Here's one of the areas of minor concern. NAHL sitting right on its trigger point, the 6 day ema. Is it a buy? We aren't seeing a lot of movement with either NAHL or NYHL due to the volatile action. We're basically in a channel right now, and that's settling these two signals out. NYHL is a buy. My personal preference is to see both signals as buys, mainly because breadth was good today.

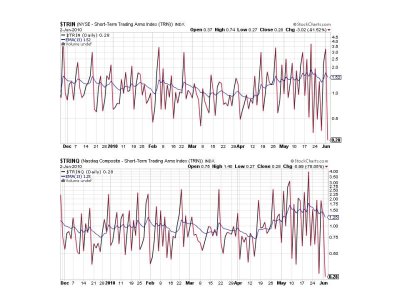

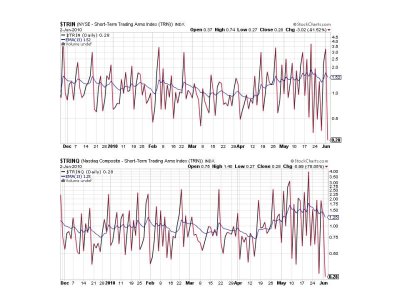

TRIN and TRINQ are flashing buys, but are very low, indicating an overbought condition. We could see some selling pressure tomorrow because of this.

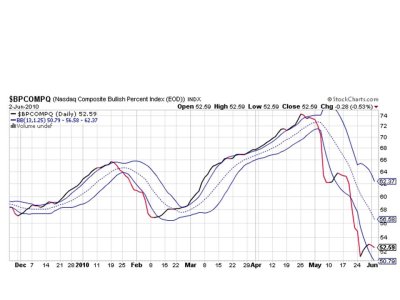

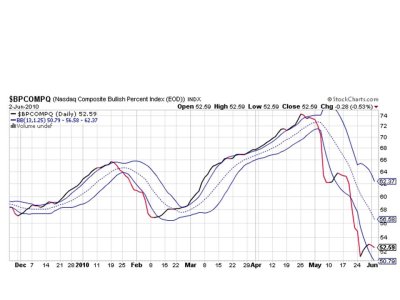

I'm not happy with BPCOMPQ at the moment. Yes, it's on a buy. But it's not moving in the right direction. Again, I think this is due to the volatile nature of this market.

Did you see a sell signal above? Unless you're looking at these signals using your own filter, you probably didn't. I'm seeing 7 of 7 buy signals as well as NYMO being over the 28 dma.

So yes, the Seven Sentinels are flashing a buy, but as I keep saying over and over again, the volatile nature of this market makes it difficult for me to be as comfortable with this buy signal as I might otherwise be. A little bit of selling pressure tomorrow should not be unexpected given TRIN and TRINQ overbought conditions.

But a another major sell off soon after this buy signal would make me very uncomfortable.

Sorry for sounding somewhat wishy-washy here, but with only two IFTs in this market environment some may want to see something more than a SS buy signal here. Perhaps a close above the S&P's 200 dma?

In any event, I'm still in the market from the last sell signal, so my decision is already made. Good luck on your trading decisions. See you tomorrow.

Of course the media has to have a reason for the rally so it must have been the pending home sales for April, which increased 6.0%, 1% above expectations.

A small bounce in the euro helped too.

In reality, the market probably bounced because of the short term oversold conditions.

Tomorrow we will get the retail sales reports, weekly jobless claims, monthly factory orders, and the latest ISM Service Index, as well as the latest monthly ADP Employment Report.

Not surprisingly, the Seven Sentinels improved with today's action, but do we have a buy signal. That would be a definite maybe. Let's take a look at the charts:

No problems here. Both NAMO and NYMO are flashing buys. NYMO is also well above its 28 dma, which is an element of the latest SS parameters and is considered a buy using that metric.

Here's one of the areas of minor concern. NAHL sitting right on its trigger point, the 6 day ema. Is it a buy? We aren't seeing a lot of movement with either NAHL or NYHL due to the volatile action. We're basically in a channel right now, and that's settling these two signals out. NYHL is a buy. My personal preference is to see both signals as buys, mainly because breadth was good today.

TRIN and TRINQ are flashing buys, but are very low, indicating an overbought condition. We could see some selling pressure tomorrow because of this.

I'm not happy with BPCOMPQ at the moment. Yes, it's on a buy. But it's not moving in the right direction. Again, I think this is due to the volatile nature of this market.

Did you see a sell signal above? Unless you're looking at these signals using your own filter, you probably didn't. I'm seeing 7 of 7 buy signals as well as NYMO being over the 28 dma.

So yes, the Seven Sentinels are flashing a buy, but as I keep saying over and over again, the volatile nature of this market makes it difficult for me to be as comfortable with this buy signal as I might otherwise be. A little bit of selling pressure tomorrow should not be unexpected given TRIN and TRINQ overbought conditions.

But a another major sell off soon after this buy signal would make me very uncomfortable.

Sorry for sounding somewhat wishy-washy here, but with only two IFTs in this market environment some may want to see something more than a SS buy signal here. Perhaps a close above the S&P's 200 dma?

In any event, I'm still in the market from the last sell signal, so my decision is already made. Good luck on your trading decisions. See you tomorrow.