Make that 2 for 2 to begin the month of December as stocks gapped at the open once again and never looked back.

Of note on the economic front, initial jobless claims came in at 436,000, up from the previous week and a bit more than forecast. But what really seemed to spark the bulls was the October pending home sales numbers, which jumped by 10.4%.

The Dollar ran into more selling pressure as it shed another 0.7%.

And so the market makes another statement, putting what appears to be an exclamation point on yesterday's action, which suggests the trend has just changed again. And perhaps it has, but with one caveat as far as the Seven Sentinels are concerned. Let's take a look:

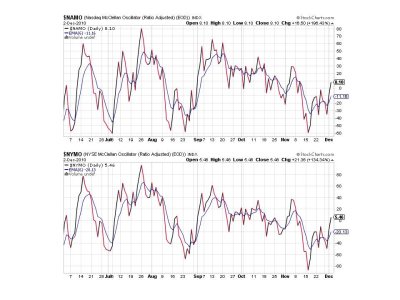

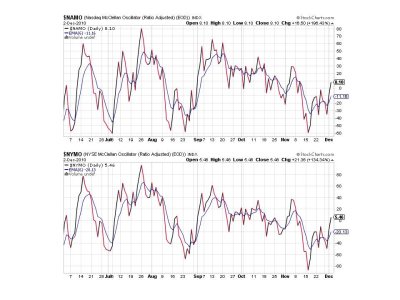

NAMO and NYMO have both pushed back up into positive territory and remain on buys.

NAHL and NYHL also remain on buys.

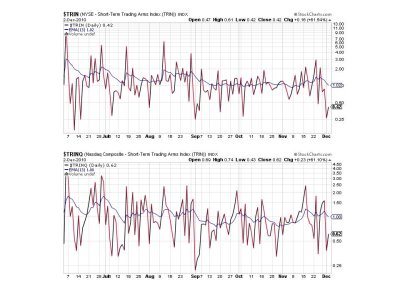

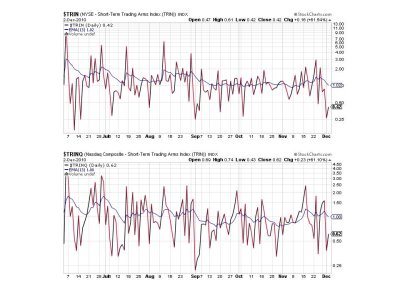

TRIN and TRINQ remain on buys and still suggest an overbought condition. But we saw this kind of action early in September as it bounced around for several trading sessions in this area.

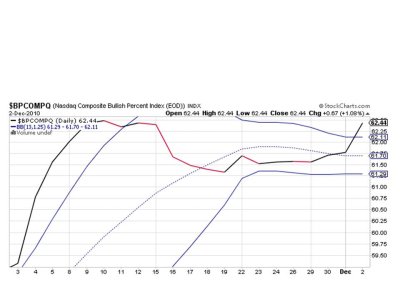

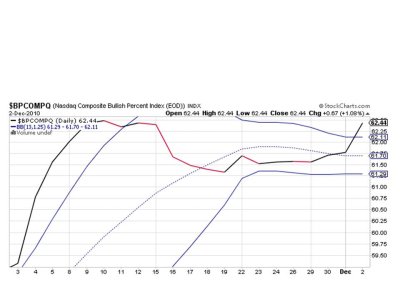

BINGO, BPCOMPQ flips to a buy.

So all 7 signals are flashing buys, which means the system flips to buy as long as NYMO has hit a new 28 day trading high. That's the caveat. Take a look:

While NYMO may be in positive territory it needs to go above 36.63 to hit a new 28 day trading high. Otherwise the risk of whipsaw is elevated. And that's a real risk in such a volatile market. In September it took the Sentinels extra time to "confirm" a buy signal the same way, and while it cost me some gains the market did continue upward for quite some time after anyway, so it's all relative.

As for myself, I plan to wait this market out a bit more as I am admittedly conservative in my approach. Remember to keep an eye on our sentiment survey as it continues to hit the ball out of the park. Next week's results should be out soon.

Of note on the economic front, initial jobless claims came in at 436,000, up from the previous week and a bit more than forecast. But what really seemed to spark the bulls was the October pending home sales numbers, which jumped by 10.4%.

The Dollar ran into more selling pressure as it shed another 0.7%.

And so the market makes another statement, putting what appears to be an exclamation point on yesterday's action, which suggests the trend has just changed again. And perhaps it has, but with one caveat as far as the Seven Sentinels are concerned. Let's take a look:

NAMO and NYMO have both pushed back up into positive territory and remain on buys.

NAHL and NYHL also remain on buys.

TRIN and TRINQ remain on buys and still suggest an overbought condition. But we saw this kind of action early in September as it bounced around for several trading sessions in this area.

BINGO, BPCOMPQ flips to a buy.

So all 7 signals are flashing buys, which means the system flips to buy as long as NYMO has hit a new 28 day trading high. That's the caveat. Take a look:

While NYMO may be in positive territory it needs to go above 36.63 to hit a new 28 day trading high. Otherwise the risk of whipsaw is elevated. And that's a real risk in such a volatile market. In September it took the Sentinels extra time to "confirm" a buy signal the same way, and while it cost me some gains the market did continue upward for quite some time after anyway, so it's all relative.

As for myself, I plan to wait this market out a bit more as I am admittedly conservative in my approach. Remember to keep an eye on our sentiment survey as it continues to hit the ball out of the park. Next week's results should be out soon.