One of the difficulties of a trading range is that it smooths out the EMA, making signals dance up and down around it. We've been seeing this play out for the past week. I mention this because the Seven Sentinels are flashing 7 sells signals today. But there's a caveat. If NYMO has not hit its 28 day trading average low at the same time the signals all flash sells, then the system remains on a buy. The idea behind the 28 day trading average was to try and filter out whipsaws.

Well, the 28 day trading day average for NYMO is nowhere near its low, so the system remains on buy.

The other tricky part of today's sell signal is that it occured on a FOMC annoucement day. A day in which the Fed would keep constant its securities holdings by reinvesting principal payments from agency debt and agency mortgage-backed securities in Treasuries. This was a surprise. That message was responsible for driving the 10-year note's yield to 2.75%.

And trading around a FOMC announcement tends to be volatile, so a snap-back rally is not out of the question.

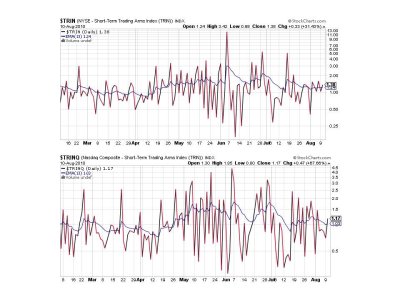

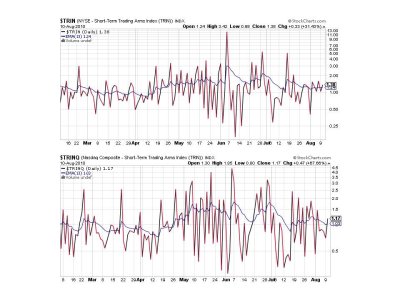

Here's the charts:

Both NAMO and NYMO are on sells.

NAHL and NYHL are also on sells, but remain very close to their trigger points.

TRIN and TRINQ, while on sells, didn't exactly spike higher.

BPCOMPQ dipped a bit today and remains on a sell.

So all signals are flashing sells, but NYMO has not hit its 28 day trading low. I believe the trend is still up, but risk is elevated here, so you can either play it safe and move at least partially to cash or stay the course if you're long.

I'm looking for an opportunity to spread out my allocation, but for now I'm going to hold 100% S fund.

Well, the 28 day trading day average for NYMO is nowhere near its low, so the system remains on buy.

The other tricky part of today's sell signal is that it occured on a FOMC annoucement day. A day in which the Fed would keep constant its securities holdings by reinvesting principal payments from agency debt and agency mortgage-backed securities in Treasuries. This was a surprise. That message was responsible for driving the 10-year note's yield to 2.75%.

And trading around a FOMC announcement tends to be volatile, so a snap-back rally is not out of the question.

Here's the charts:

Both NAMO and NYMO are on sells.

NAHL and NYHL are also on sells, but remain very close to their trigger points.

TRIN and TRINQ, while on sells, didn't exactly spike higher.

BPCOMPQ dipped a bit today and remains on a sell.

So all signals are flashing sells, but NYMO has not hit its 28 day trading low. I believe the trend is still up, but risk is elevated here, so you can either play it safe and move at least partially to cash or stay the course if you're long.

I'm looking for an opportunity to spread out my allocation, but for now I'm going to hold 100% S fund.