Risk on. In less than 24 hours the market turned from jubilant rally mode over Silvio Berlusconi's possible departure to a fear inspired sell-off as yields on Italian debt rose to levels considered unsustainable.

At this point it would seem that Italy is all but bankrupt as few market analysts see a bailout as a viable option anymore. Hence the spike in bond yields.

Selling was widespread, with financials taking the biggest hit with a 5% loss on the day.

As hard as the C and S funds were hit (down 3.67% and 4.32% respectively) the I fund took a bigger hit, as the dollar jumped 1.6%. By the close the I fund had a loss of 5.13%.

Not surprisingly, Treasuries rallied as the stock market swooned.

Here's tonight's charts:

NAMO and NYMO both spiked lower today and flipped back to sells.

As a reminder, last week Tuesday the Seven Sentinels issued an unconfirmed sell signal. At the time I had anticipated that it may take a number of days before the market might drop enough to see that sell signal confirmed via a fresh 28 day trading low from NYMO. We aren't quite there yet, but one more day of selling could do it. Currently, NYMO is now at a -10.66. Tomorrow it would need to drop below about -34 to achieve an official sell signal. If it doesn't do it tomorrow, the 28 day trading low moves more positive, making it even easier to get that sell signal. This is assuming the market remains weak over the coming days as it's also possible a sell signal could still be averted.

I'm not optimistic, however.

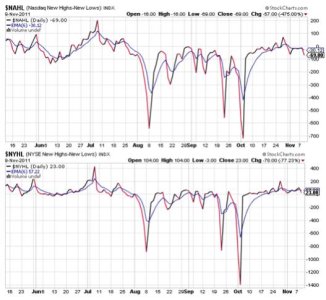

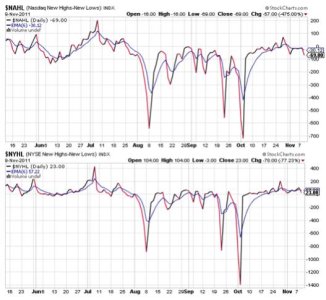

NAHL and NYHL also fell and flipped back to sell conditions.

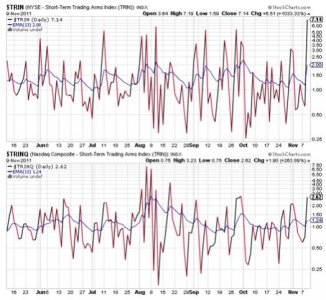

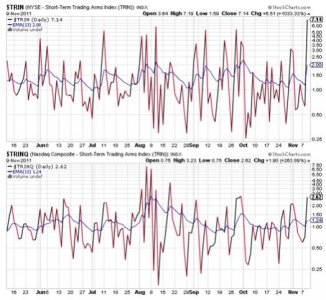

TRIN spiked to an extreme reading today, which is highly suggestive of an oversold market and that would normally mean a snap-back rally is imminent. TRINQ also spiked higher, but is not at quite at the extreme of TRIN. Still, it too is suggesting an oversold market. Both are now in sell conditions.

Any snap-back rally here may not last should dip buyers get too bullish at current support levels. I tend to think weakness will stick around for at least a few more days, short term or intraday rallies notwithstanding.

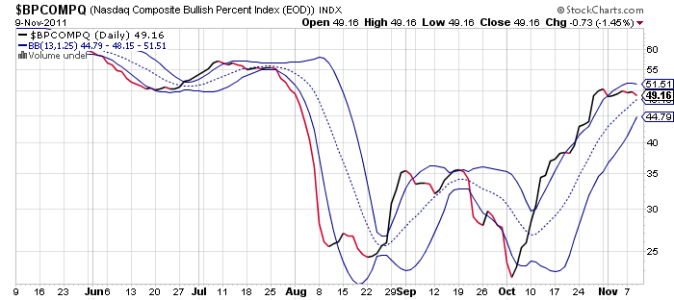

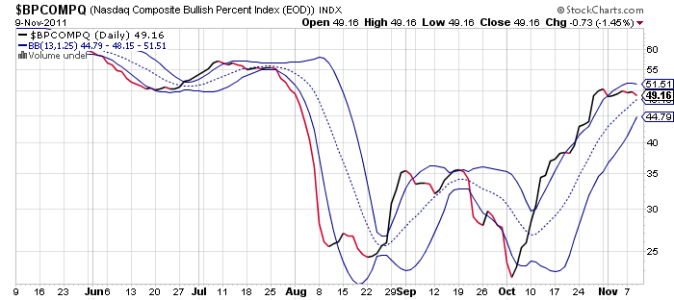

BPCOMPQ moved lower on today's weakness and remains in a sell condition. This signal has remained on a sell for a number of days now, which typically is a warning of an impending intermediate term change in direction. The problem was that the signal wasn't looking as robust as I'd like, so I played it down a bit as the other signals were not flashing warnings. That may have changed today.

So all signals are back to sell conditions for the second time in six trading days. That's a red flag, but officially the system remains on a buy until NYMO can tag another 28 day trading low. And as I mentioned above, it wouldn't take a lot more selling pressure to get it there.

I remain 100% G fund as risk is now rising once again. However, I'll be looking for an entry back into stocks should I see a set-up that I like. Having said though, I do not plan to take more than a 50% position in stocks in what is technically still a bear market. And I would probably scale it in using both of my IFTs to further mitigate risk. The 50 day moving average is my first target, but sentiment will also be part of the equation so we'll have to see how the market plays out over the coming days.

At this point it would seem that Italy is all but bankrupt as few market analysts see a bailout as a viable option anymore. Hence the spike in bond yields.

Selling was widespread, with financials taking the biggest hit with a 5% loss on the day.

As hard as the C and S funds were hit (down 3.67% and 4.32% respectively) the I fund took a bigger hit, as the dollar jumped 1.6%. By the close the I fund had a loss of 5.13%.

Not surprisingly, Treasuries rallied as the stock market swooned.

Here's tonight's charts:

NAMO and NYMO both spiked lower today and flipped back to sells.

As a reminder, last week Tuesday the Seven Sentinels issued an unconfirmed sell signal. At the time I had anticipated that it may take a number of days before the market might drop enough to see that sell signal confirmed via a fresh 28 day trading low from NYMO. We aren't quite there yet, but one more day of selling could do it. Currently, NYMO is now at a -10.66. Tomorrow it would need to drop below about -34 to achieve an official sell signal. If it doesn't do it tomorrow, the 28 day trading low moves more positive, making it even easier to get that sell signal. This is assuming the market remains weak over the coming days as it's also possible a sell signal could still be averted.

I'm not optimistic, however.

NAHL and NYHL also fell and flipped back to sell conditions.

TRIN spiked to an extreme reading today, which is highly suggestive of an oversold market and that would normally mean a snap-back rally is imminent. TRINQ also spiked higher, but is not at quite at the extreme of TRIN. Still, it too is suggesting an oversold market. Both are now in sell conditions.

Any snap-back rally here may not last should dip buyers get too bullish at current support levels. I tend to think weakness will stick around for at least a few more days, short term or intraday rallies notwithstanding.

BPCOMPQ moved lower on today's weakness and remains in a sell condition. This signal has remained on a sell for a number of days now, which typically is a warning of an impending intermediate term change in direction. The problem was that the signal wasn't looking as robust as I'd like, so I played it down a bit as the other signals were not flashing warnings. That may have changed today.

So all signals are back to sell conditions for the second time in six trading days. That's a red flag, but officially the system remains on a buy until NYMO can tag another 28 day trading low. And as I mentioned above, it wouldn't take a lot more selling pressure to get it there.

I remain 100% G fund as risk is now rising once again. However, I'll be looking for an entry back into stocks should I see a set-up that I like. Having said though, I do not plan to take more than a 50% position in stocks in what is technically still a bear market. And I would probably scale it in using both of my IFTs to further mitigate risk. The 50 day moving average is my first target, but sentiment will also be part of the equation so we'll have to see how the market plays out over the coming days.