As some of you already know, the Federal Reserve made an annoucement after the close today that they were hiking the discount rate from 0.5% to 0.75%. This is not the same as the Fed Funds Rate however, but is a preliminary step in that direction. Here's an article from the NY Times that provides a quick overview, http://www.nytimes.com/2010/02/19/business/19fed.html

So what happens tomorrow on Options Expiration Day? Volatility is usually associated with OPEX anyway, so you can bet we'll probably see some of that tomorrow, unless of course the big money decides to take the market in a specific direction. Futures are decidedly lower right now, but futures often fail to foretell the actual market action once the opening bell rings.

But the charts may be telling us something. Here they are:

NAMO and NYMO continue to stretch it out to the upside, but how much further can they go?

A higher move at this point would not be my call, but sentiment may drive the action tomorrow.

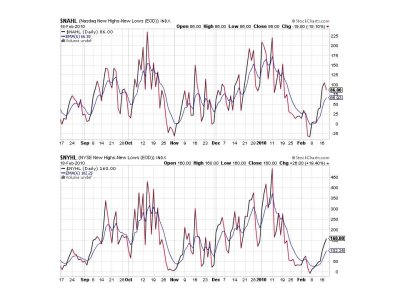

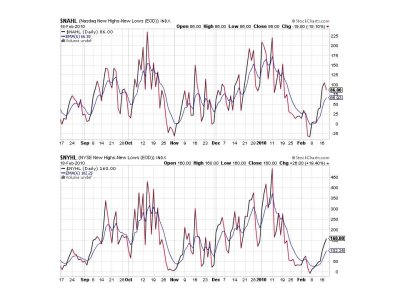

NAHL actually dipped, while NYHL inched higher.

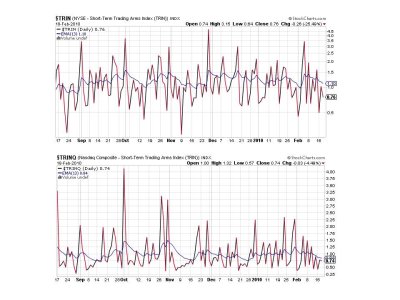

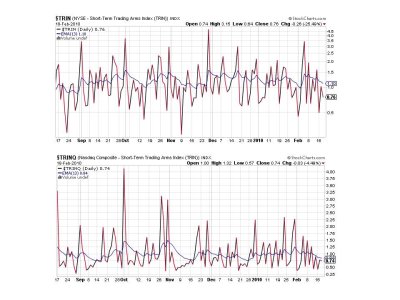

TRIN and TRINQ continue to stick close to their 6 day EMAs here and aren't foretelling much.

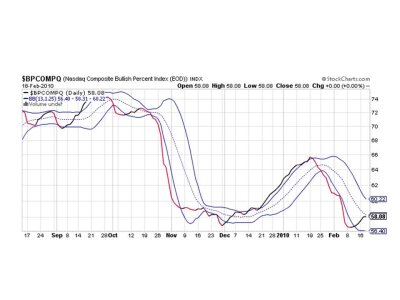

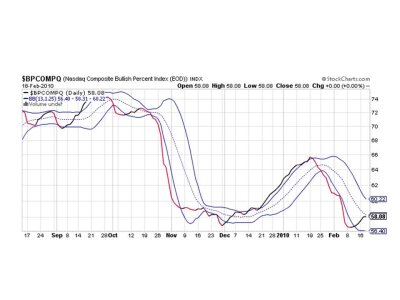

BPCOMPQ on the other hand, moved sideways today. Is this the first step towards a move lower? I don't know the answer to that, but we should find out soon enough.

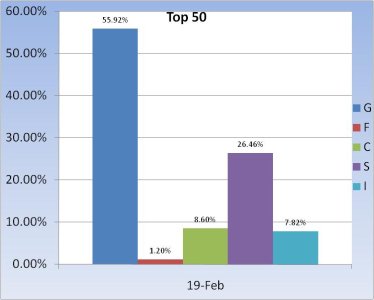

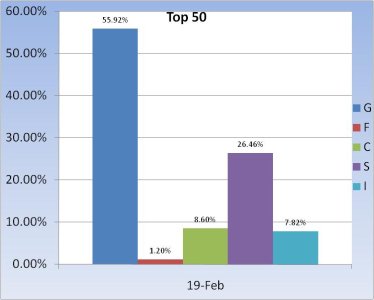

Not much change for the Top 15 today, but the Top 50 took just a bit off the table today, but remain moderately exposed to stocks. They did largely bail from bonds though and that may be a tell to expect something big.

So while the Seven Sentinels continue to flash buys for all seven signals we are overbought, it is OPEX tomorrow, and the Fed threw a curve ball this afternoon. It may end up not meaning much, but it could also serve as a catalyst to either launch the markets higher or give a reason to sell off. I am not sure what to expect, but a buy signal is a buy signal, so I wouldn't get too beared up just yet. OPEX is not the kind of day that a trader can read much into either, so we'll really need to wait until next week to see what the market's true nature is going to be.

That's it for this evening. Good luck on your trades.

So what happens tomorrow on Options Expiration Day? Volatility is usually associated with OPEX anyway, so you can bet we'll probably see some of that tomorrow, unless of course the big money decides to take the market in a specific direction. Futures are decidedly lower right now, but futures often fail to foretell the actual market action once the opening bell rings.

But the charts may be telling us something. Here they are:

NAMO and NYMO continue to stretch it out to the upside, but how much further can they go?

A higher move at this point would not be my call, but sentiment may drive the action tomorrow.

NAHL actually dipped, while NYHL inched higher.

TRIN and TRINQ continue to stick close to their 6 day EMAs here and aren't foretelling much.

BPCOMPQ on the other hand, moved sideways today. Is this the first step towards a move lower? I don't know the answer to that, but we should find out soon enough.

Not much change for the Top 15 today, but the Top 50 took just a bit off the table today, but remain moderately exposed to stocks. They did largely bail from bonds though and that may be a tell to expect something big.

So while the Seven Sentinels continue to flash buys for all seven signals we are overbought, it is OPEX tomorrow, and the Fed threw a curve ball this afternoon. It may end up not meaning much, but it could also serve as a catalyst to either launch the markets higher or give a reason to sell off. I am not sure what to expect, but a buy signal is a buy signal, so I wouldn't get too beared up just yet. OPEX is not the kind of day that a trader can read much into either, so we'll really need to wait until next week to see what the market's true nature is going to be.

That's it for this evening. Good luck on your trades.