The market began selling early again today, but this time dip buyers were unable to mount a reversal.

The selling appeared to begin in Europe, where news came that eurozone officials may suspend fund payouts to Greece unless the country agrees to additional austerity measures. This situation has seen so much back and forth political posturing that the market is now concerned further gridlock may ensure a Greek default.

Here at home, a preliminary reading on consumer sentiment showed a drop from 75.0 in January to 72.5 for February. Also reported was the January Treasury deficit, which fell hard to 27.4 billion; almost half the amount posted the previous month. The December trade deficit was up by $1.7 billion to $48.8 billion.

The charts took a hit today. Let's look at the damage:

NAMO and NYMO fell sharply on today's action and are now both in negative territory. Both remain on sells. I had mentioned yesterday that these two signals had me concerned even if the others were still relatively unchanged.

NAHL and NYHL also dipped and are in sell conditions.

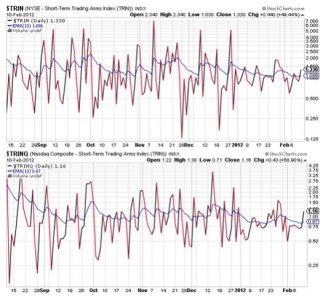

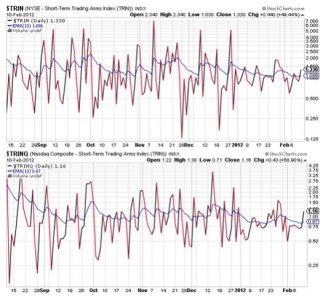

TRIN and TRINQ both flipped to sells. Neither is suggesting an oversold market by this measure, so follow through to the downside is a good possibility.

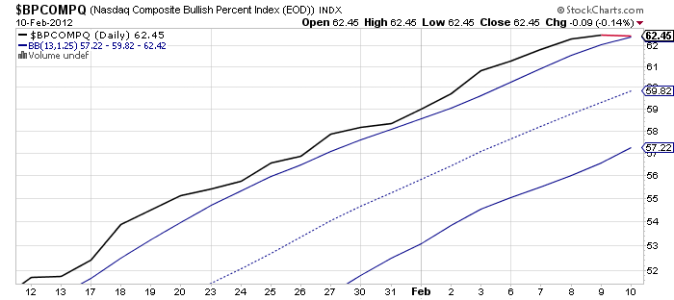

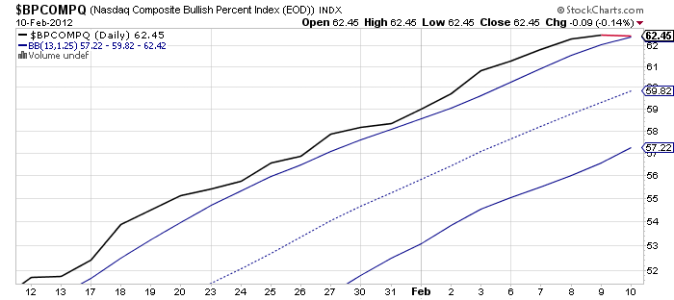

BPCOMPQ dipped for the first time in weeks, but it stopped just short of triggering a sell signal. It doesn't get much closer than that.

So "technically" the Seven Sentinels remain in a buy condition, but only because BPCOMPQ remained a hair's width away from flipping to a sell. That's not very reassuring if one is a bull.

Given that NAMO and NYMO were looking bearish to me yesterday and given the way our market opened after significant losses overseas, I decided to move the Seven Sentinels into a 50/50 G and S position at the close of trade today. I could not be sure the dip buyers would turn this market again and I also couldn't be sure a sell signal would indeed be triggered, but I felt risk was high enough to warrant a more defensive posture.

At the moment I am comfortable with that position and will decide Monday whether to move to 100% G fund or not. For several reasons. First, I'd like to see BPCOMPQ make a more decisive move lower and actually trigger a sell. Second, it was only one day of selling and I'm not so sure momentum to the upside will be extinguished so easily. Third, next week is OPEX and today's action could have been pre-OPEX positioning by the big boys. Fourth, the week of OPEX tends to be supportive of market prices even if volatility is present.

So it's not a slam dunk that the selling pressure we saw today will lead to significant losses in the short term. Or that we won't recover relatively quickly and resume the upward bias.

For now I'm just going to wait and see how Monday plays out before I commit to taking a more defensive posture.

Stop by Sunday evening when I'll have the Tracker charts posted. See you then.

The selling appeared to begin in Europe, where news came that eurozone officials may suspend fund payouts to Greece unless the country agrees to additional austerity measures. This situation has seen so much back and forth political posturing that the market is now concerned further gridlock may ensure a Greek default.

Here at home, a preliminary reading on consumer sentiment showed a drop from 75.0 in January to 72.5 for February. Also reported was the January Treasury deficit, which fell hard to 27.4 billion; almost half the amount posted the previous month. The December trade deficit was up by $1.7 billion to $48.8 billion.

The charts took a hit today. Let's look at the damage:

NAMO and NYMO fell sharply on today's action and are now both in negative territory. Both remain on sells. I had mentioned yesterday that these two signals had me concerned even if the others were still relatively unchanged.

NAHL and NYHL also dipped and are in sell conditions.

TRIN and TRINQ both flipped to sells. Neither is suggesting an oversold market by this measure, so follow through to the downside is a good possibility.

BPCOMPQ dipped for the first time in weeks, but it stopped just short of triggering a sell signal. It doesn't get much closer than that.

So "technically" the Seven Sentinels remain in a buy condition, but only because BPCOMPQ remained a hair's width away from flipping to a sell. That's not very reassuring if one is a bull.

Given that NAMO and NYMO were looking bearish to me yesterday and given the way our market opened after significant losses overseas, I decided to move the Seven Sentinels into a 50/50 G and S position at the close of trade today. I could not be sure the dip buyers would turn this market again and I also couldn't be sure a sell signal would indeed be triggered, but I felt risk was high enough to warrant a more defensive posture.

At the moment I am comfortable with that position and will decide Monday whether to move to 100% G fund or not. For several reasons. First, I'd like to see BPCOMPQ make a more decisive move lower and actually trigger a sell. Second, it was only one day of selling and I'm not so sure momentum to the upside will be extinguished so easily. Third, next week is OPEX and today's action could have been pre-OPEX positioning by the big boys. Fourth, the week of OPEX tends to be supportive of market prices even if volatility is present.

So it's not a slam dunk that the selling pressure we saw today will lead to significant losses in the short term. Or that we won't recover relatively quickly and resume the upward bias.

For now I'm just going to wait and see how Monday plays out before I commit to taking a more defensive posture.

Stop by Sunday evening when I'll have the Tracker charts posted. See you then.