Given how overbought we were after yesterday's advance, a pullback today would have been reasonable. And to some extent that's what we got, although the major averages were mixed overall with the DOW and S&P 500 both up by 0.28% and 0.22% respectively, while the Nasdaq shed 0.47%. That's an encouraging sign in the short term for the bulls, but the S&P didn't close above its 50 day moving average, so it may be a bit premature to celebrate.

I suppose we can point to the latest consumer confidence index as the reason for the underlying support. The index spiked from 39.8 in October to a healthy 56.0 for November. That easily exceeded expectations calling for a more modest improvement of 42.5.

Here's today's charts:

NAMO and NYMO both remain on buys.

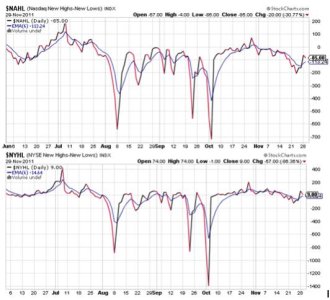

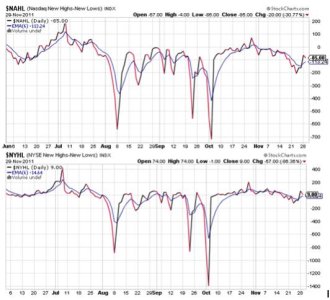

Same for NAHL and NYHL.

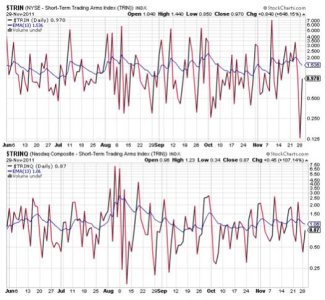

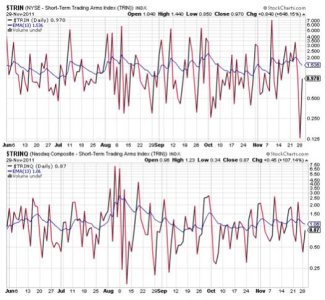

Ditto for TRIN and TRINQ. Both have worked off their overbought conditions.

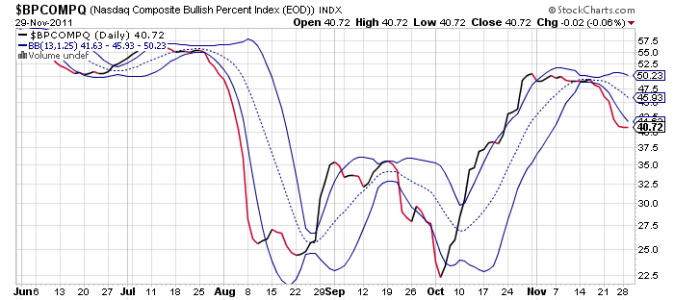

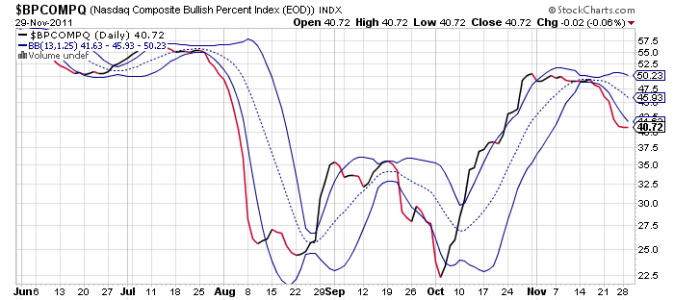

BPCOMPQ tracked sideways again today and remains the lone sell signal, albeit an important one.

So the signals remain mixed, which means the system remains in a sell condition.

The charts suggest a move higher may be coming. NAMO and NYMO were quite low as of Friday, so continued upside pressure here is quite possible. I'm still 50% S fund on that count, but I am still not ready to embrace a full blown SC rally, although there's still plenty of time for that to materialize. First, I'd like to see the S&P 500 retake its 50 dma. If we can do that by week's end, the bullish case will look more convincing.

I suppose we can point to the latest consumer confidence index as the reason for the underlying support. The index spiked from 39.8 in October to a healthy 56.0 for November. That easily exceeded expectations calling for a more modest improvement of 42.5.

Here's today's charts:

NAMO and NYMO both remain on buys.

Same for NAHL and NYHL.

Ditto for TRIN and TRINQ. Both have worked off their overbought conditions.

BPCOMPQ tracked sideways again today and remains the lone sell signal, albeit an important one.

So the signals remain mixed, which means the system remains in a sell condition.

The charts suggest a move higher may be coming. NAMO and NYMO were quite low as of Friday, so continued upside pressure here is quite possible. I'm still 50% S fund on that count, but I am still not ready to embrace a full blown SC rally, although there's still plenty of time for that to materialize. First, I'd like to see the S&P 500 retake its 50 dma. If we can do that by week's end, the bullish case will look more convincing.