Overall, the S&P, DOW, and Nasdaq were only down modestly, but the Wilshire 4500 took the brunt of the selling today as it fell 0.73%. It still looks like consolidation to me as traders await for earnings season to begin.

News was relatively scarce, but oil prices saw a 2.5% drop to $109.92 per barrel.

Let's go to the charts:

NAMO and NYMO remain in a sell condition, and we can see now that my concern last week about the 6 day EMAs being so high was reason to be cautious, as we have dropped from those levels quickly. The 6 day EMAs are now near the neutral line. Given we really haven't seen any serious technical damage, I'm thinking we're nearing at least a short term bottom at this point.

NAHL and NYHL remain on sells.

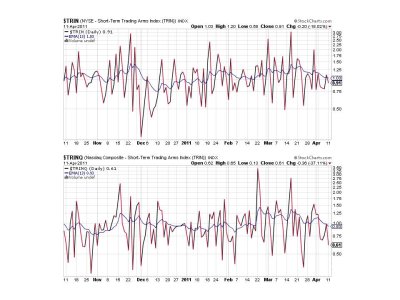

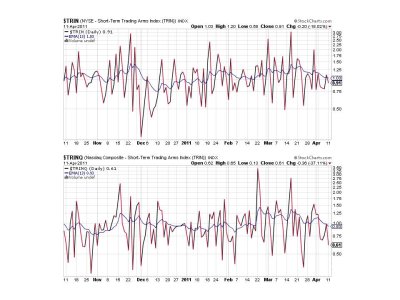

Both TRIN and TRINQ are flashing buys.

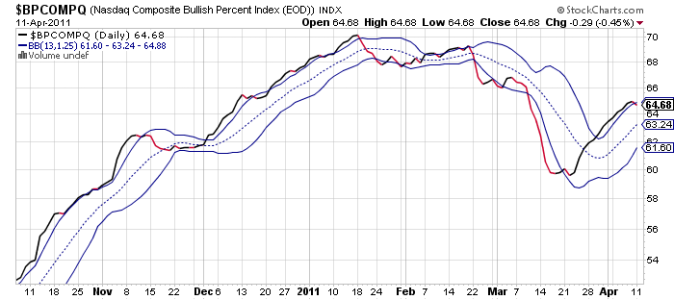

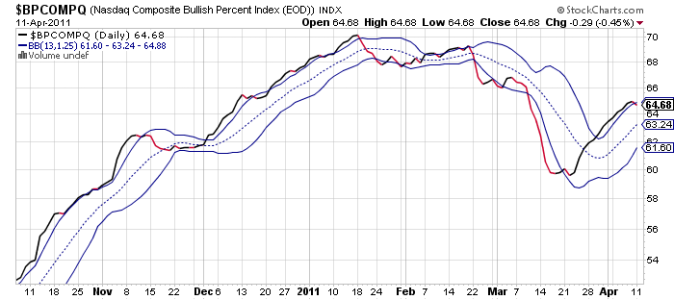

BPCOMPQ finally succumbed to the selling pressure and dropped below the upper bollinger band into a sell condition. I'm not ready to get concerned about that just yet, but it is something to watch carefully.

So 2 of 7 signals remain on buys, which keeps the system in a buy condition.

There's going to be more headlines coming our way, so I'm anticipating we're going to see some volatile trading in the days ahead. For now the intermediate term still looks bullish so I suspect we'll see an upward bias once the current consolidation period ends.

News was relatively scarce, but oil prices saw a 2.5% drop to $109.92 per barrel.

Let's go to the charts:

NAMO and NYMO remain in a sell condition, and we can see now that my concern last week about the 6 day EMAs being so high was reason to be cautious, as we have dropped from those levels quickly. The 6 day EMAs are now near the neutral line. Given we really haven't seen any serious technical damage, I'm thinking we're nearing at least a short term bottom at this point.

NAHL and NYHL remain on sells.

Both TRIN and TRINQ are flashing buys.

BPCOMPQ finally succumbed to the selling pressure and dropped below the upper bollinger band into a sell condition. I'm not ready to get concerned about that just yet, but it is something to watch carefully.

So 2 of 7 signals remain on buys, which keeps the system in a buy condition.

There's going to be more headlines coming our way, so I'm anticipating we're going to see some volatile trading in the days ahead. For now the intermediate term still looks bullish so I suspect we'll see an upward bias once the current consolidation period ends.