It was an uninspiring day of market activity although we did see a little bit of volatility here and there, but overall it was relatively dull after the early gap down. This action makes me think the market is waiting for something to happen. It's coiling for a move in one direction or the other.

While the C and S funds finished flat, the I fund took a moderate hit. Strength in the dollar was largely responsible for the loss in that fund. Overall the dollar managed a 0.7% advance by the close.

The Consumer Confidence Index for October came in at 50.2, which was an improvement over September's 48.5.

Treasuries didn't fare too well today as the 10-year Note shed 21 ticks, while the 30-year Bond fell more than a full point. I'm beginning to wonder if bonds are finally beginning to top, but it's really too early to tell. I suspect next week's FOMC announcement will be a market mover in this regard as QE2 will probably be defined in the Fed's statement.

Here's today's charts:

NAMO and NYMO both flipped to sells, but they really didn't move much and are pretty neutral overall.

NAHL and NYHL flipped to sells too.

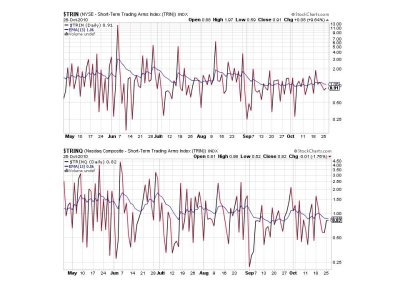

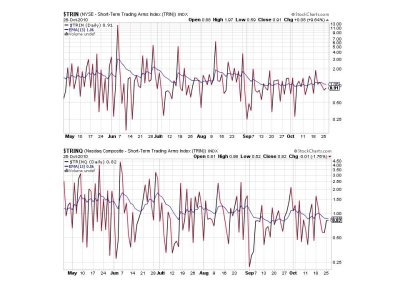

TRIN and TRINQ remained on buys, but not by much.

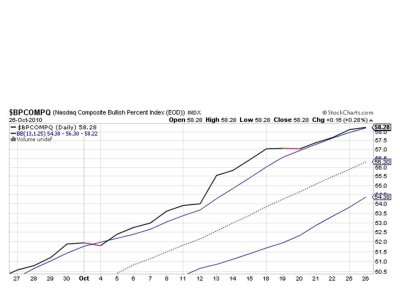

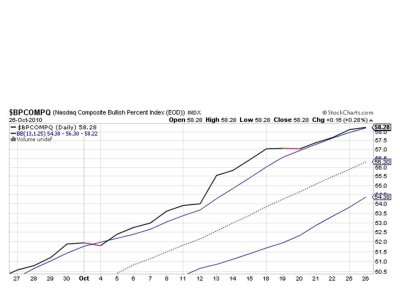

Same with BPCOMPQ. It remained on a buy, but is sitting right on top of the upper bollinger band.

So the system remains on a buy.

I had mentioned yesterday that although the Seven Sentinels were all on buys, it wouldn't take much to flip them to sells. Today we saw a flat market and 4 of the signals rolled over while the other three just barely held their buy status. That's why I think this market is setting up for another move, but I'm not sure when we'll see it as the big stories appear to be coming next week in the form of election results and the FOMC announcement. What kind of reaction can we expect? Sell the news? That seems to be the "obvious" choice, which is why I would not be surprised by another advance in spite of moderately bullish sentiment.

But don't take my musings too seriously. I really don't know what might happen. At this point all I do know is the Sentinels are sitting on the fence. Which way they fall when the market makes its next big move is up in the air.

While the C and S funds finished flat, the I fund took a moderate hit. Strength in the dollar was largely responsible for the loss in that fund. Overall the dollar managed a 0.7% advance by the close.

The Consumer Confidence Index for October came in at 50.2, which was an improvement over September's 48.5.

Treasuries didn't fare too well today as the 10-year Note shed 21 ticks, while the 30-year Bond fell more than a full point. I'm beginning to wonder if bonds are finally beginning to top, but it's really too early to tell. I suspect next week's FOMC announcement will be a market mover in this regard as QE2 will probably be defined in the Fed's statement.

Here's today's charts:

NAMO and NYMO both flipped to sells, but they really didn't move much and are pretty neutral overall.

NAHL and NYHL flipped to sells too.

TRIN and TRINQ remained on buys, but not by much.

Same with BPCOMPQ. It remained on a buy, but is sitting right on top of the upper bollinger band.

So the system remains on a buy.

I had mentioned yesterday that although the Seven Sentinels were all on buys, it wouldn't take much to flip them to sells. Today we saw a flat market and 4 of the signals rolled over while the other three just barely held their buy status. That's why I think this market is setting up for another move, but I'm not sure when we'll see it as the big stories appear to be coming next week in the form of election results and the FOMC announcement. What kind of reaction can we expect? Sell the news? That seems to be the "obvious" choice, which is why I would not be surprised by another advance in spite of moderately bullish sentiment.

But don't take my musings too seriously. I really don't know what might happen. At this point all I do know is the Sentinels are sitting on the fence. Which way they fall when the market makes its next big move is up in the air.