Some choppy trade today, but no real damage was done to technicals.

As if on cue, the market and euro traded in similar fashion, with the euro being down as much as 0.6% against the dollar, while the S&P opened up with loss of about 0.5%, but by the end of the day the euro had trimmed its losses to finish only 0.2% down, while the S&P closed near the flat line, but off -0.06%.

Some economic data that was released this morning saw the May Producer Price Index fall 0.3% month-over-month, a bit better than the 0.5% decline that was expected. Strip out food and energy and the PPI realized a 0.2% gain. No real surprise there.

Housing starts and building permits were another story. May housing starts fell 10% month-over-month to an annualized rate of 593,000 units, which was much lower than the expected 655,000 units. In addition, building permits dropped 5.9% month-over-month to an annualized rate of 574,000, again well below expectations of 631,000.

Industrial production was up 1.2%, a bit higher than the forecast of a 0.9% increase. Finally, capacity utilization was posted at 74.7, just a bit higher than the 74.5% that was expected.

Still on buys here and looking good.

NAHL ebbed a bit higher, but curiously NYHL continues to dip and is close to its trigger point on the 6 day EMA.

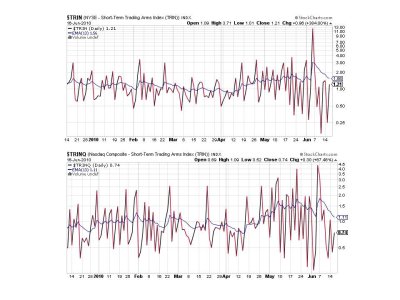

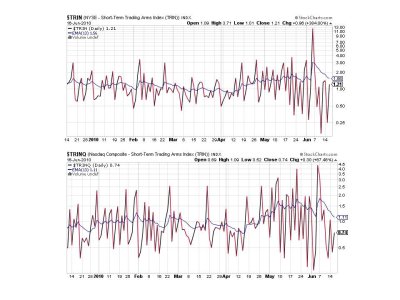

TRIN and TRINQ remain on buys.

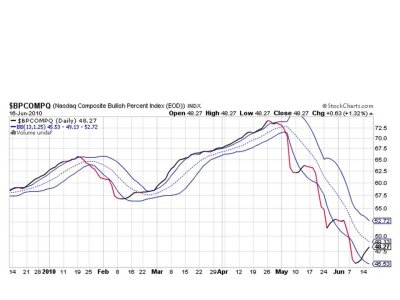

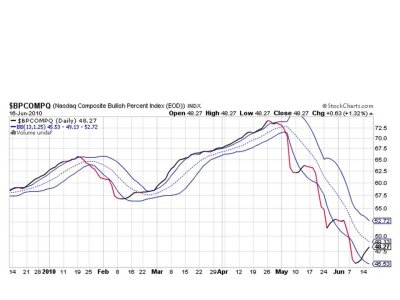

BPCOMPQ continues to rise and remains on a buy.

So we still have all signals flashing buys, which keeps the system on a buy. We could see a short term reversal before this week is over, but the trend is definitely up longer term. I didn't get to buy into the market today as my internet access was unavailable for a good part of the morning. Maybe I'll get lucky and catch some lower prices, but I'm not holding my breath.

That's it for this evening. See you tomorrow.

As if on cue, the market and euro traded in similar fashion, with the euro being down as much as 0.6% against the dollar, while the S&P opened up with loss of about 0.5%, but by the end of the day the euro had trimmed its losses to finish only 0.2% down, while the S&P closed near the flat line, but off -0.06%.

Some economic data that was released this morning saw the May Producer Price Index fall 0.3% month-over-month, a bit better than the 0.5% decline that was expected. Strip out food and energy and the PPI realized a 0.2% gain. No real surprise there.

Housing starts and building permits were another story. May housing starts fell 10% month-over-month to an annualized rate of 593,000 units, which was much lower than the expected 655,000 units. In addition, building permits dropped 5.9% month-over-month to an annualized rate of 574,000, again well below expectations of 631,000.

Industrial production was up 1.2%, a bit higher than the forecast of a 0.9% increase. Finally, capacity utilization was posted at 74.7, just a bit higher than the 74.5% that was expected.

Still on buys here and looking good.

NAHL ebbed a bit higher, but curiously NYHL continues to dip and is close to its trigger point on the 6 day EMA.

TRIN and TRINQ remain on buys.

BPCOMPQ continues to rise and remains on a buy.

So we still have all signals flashing buys, which keeps the system on a buy. We could see a short term reversal before this week is over, but the trend is definitely up longer term. I didn't get to buy into the market today as my internet access was unavailable for a good part of the morning. Maybe I'll get lucky and catch some lower prices, but I'm not holding my breath.

That's it for this evening. See you tomorrow.