There's not much to read into this weeks tracker charts as neither the Top 50 or the Total Tracker made any big moves. Here's the charts:

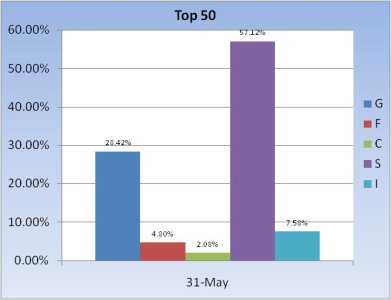

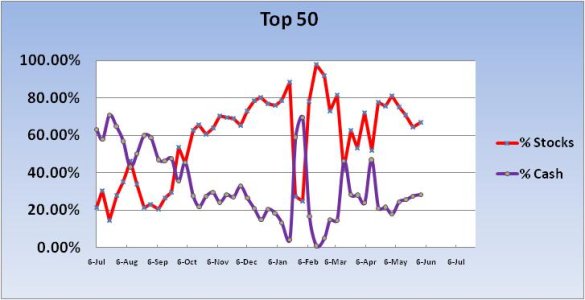

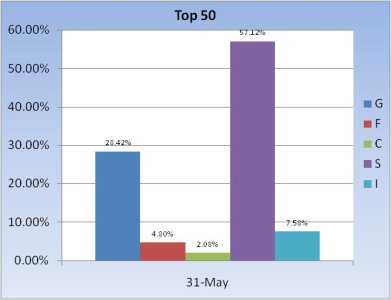

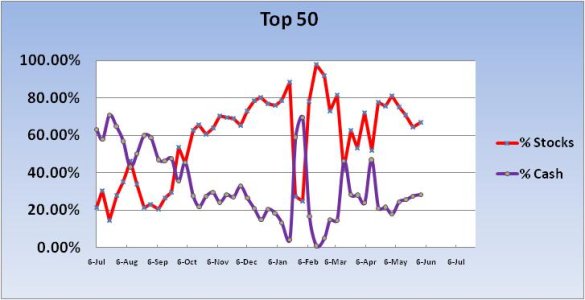

The most notable change this week for the Top 50 is that after 3 consecutive weeks of declining stock exposure, they modestly added to it. I can't read much into that however, since we had three up days in a row, which will change the mix between stock and Bond/Cash holders at the bottom of the list. In other words, some TSPers probably dropped out of the Top 50, while others entered it. So these folks are still a bit cautious with less than 67% stock exposure. That's bullish, but not necessarily in the short term.

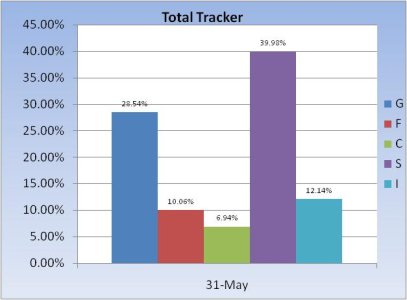

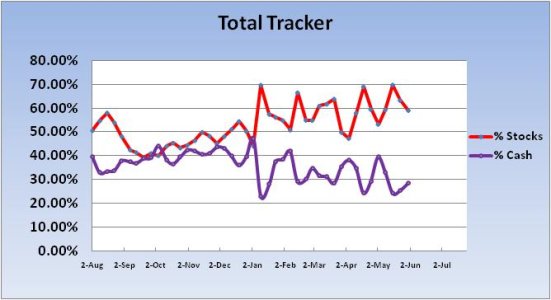

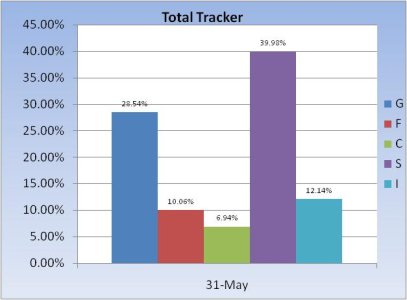

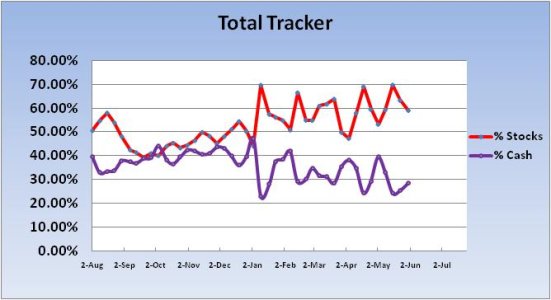

The Total Tracker shows that the herd got a bit more bearish this week. Their collective stock exposure is now around 59%.

I can certainly understand why we are holding our current positions. This is still a bull market unless proven otherwise, but the short to intermediate term is mixed. The 3 day rally we got to end last week was on low volume and it was pre-holiday and end of the month. So there's a positive bias right now and we have one more day to go before June. I wouldn't be surprised is we rally again on Tuesday, but should that happen things will get a bit more interesting. What does sentiment do if we break through resistance and how does the market respond as we begin a new month?

June is the final month of QE2, so I would expect the Fed to issue some measure of guidance in the coming days/weeks. That may be a market mover.

The most notable change this week for the Top 50 is that after 3 consecutive weeks of declining stock exposure, they modestly added to it. I can't read much into that however, since we had three up days in a row, which will change the mix between stock and Bond/Cash holders at the bottom of the list. In other words, some TSPers probably dropped out of the Top 50, while others entered it. So these folks are still a bit cautious with less than 67% stock exposure. That's bullish, but not necessarily in the short term.

The Total Tracker shows that the herd got a bit more bearish this week. Their collective stock exposure is now around 59%.

I can certainly understand why we are holding our current positions. This is still a bull market unless proven otherwise, but the short to intermediate term is mixed. The 3 day rally we got to end last week was on low volume and it was pre-holiday and end of the month. So there's a positive bias right now and we have one more day to go before June. I wouldn't be surprised is we rally again on Tuesday, but should that happen things will get a bit more interesting. What does sentiment do if we break through resistance and how does the market respond as we begin a new month?

June is the final month of QE2, so I would expect the Fed to issue some measure of guidance in the coming days/weeks. That may be a market mover.