The market gapped up at the open today in an early follow-through after Friday's advance. But the highs of the day were set in the morning session as the broader market then chopped lower until mid-afternoon, when some modest buying interest lifted up the major averages into the close where they ended up posting modest to moderate gains for the day.

April crude oil gave back it's gains from Friday and closed down by about 0.9% to $96.97 a barrel.

The morning's session saw January personal income gain 1.0%, which was much better than economists had expected. But January personal spending only increased 0.2%, which was lower than expected.

The February Chicago PMI hit a 20-year high, coming in at 71.2, while January pending home sales dropped 2.8%.

The market didn't seem to have much reaction to any the market data today, but instead seemed to be preoccupied with the continuing unrest overseas. A situation that appears to be with us for the foreseeable future.

Here's today's charts:

NAMO and NYMO remain on buys.

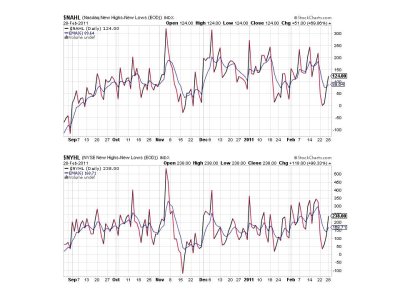

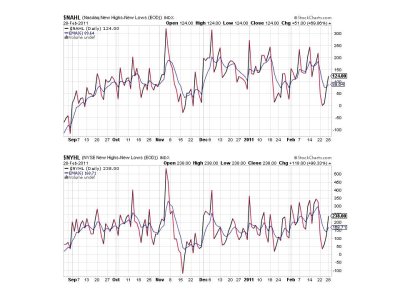

NAHL and NYHL moved higher and are now both flashing buys.

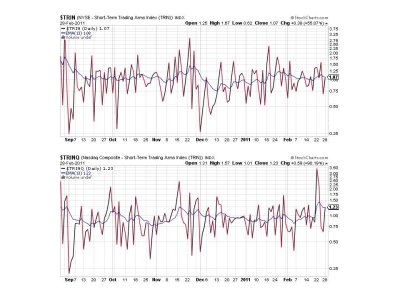

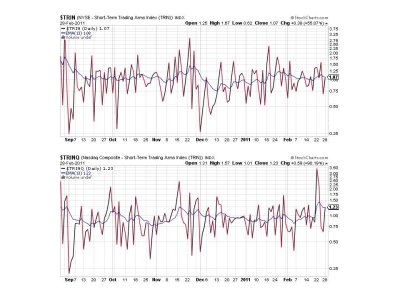

TRIN and TRINQ settled very near their 13 day EMAs, which is a neutral reading.

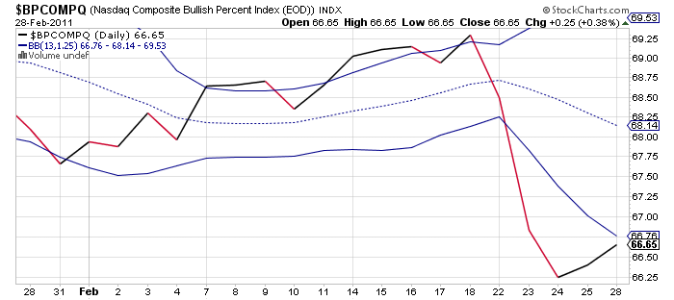

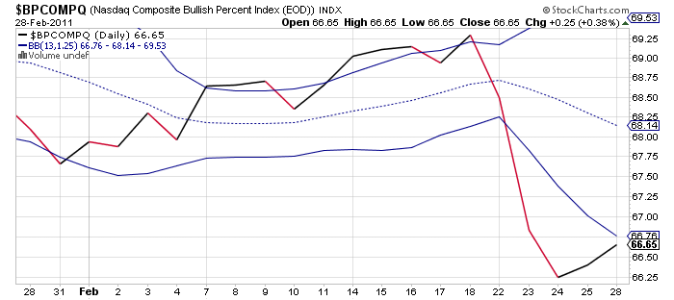

BPCOMPQ moved higher today, but stayed just below that lower bollinger band and therefore remains on a sell.

So the system remains on a buy. The market does seem intent on trying to hit fresh 2 year highs in spite of last week's decline and the uncertainty surrounding geopolitical events. And that uncertainty will probably help contribute to more volatility than we've become accustomed to these last several months.

April crude oil gave back it's gains from Friday and closed down by about 0.9% to $96.97 a barrel.

The morning's session saw January personal income gain 1.0%, which was much better than economists had expected. But January personal spending only increased 0.2%, which was lower than expected.

The February Chicago PMI hit a 20-year high, coming in at 71.2, while January pending home sales dropped 2.8%.

The market didn't seem to have much reaction to any the market data today, but instead seemed to be preoccupied with the continuing unrest overseas. A situation that appears to be with us for the foreseeable future.

Here's today's charts:

NAMO and NYMO remain on buys.

NAHL and NYHL moved higher and are now both flashing buys.

TRIN and TRINQ settled very near their 13 day EMAs, which is a neutral reading.

BPCOMPQ moved higher today, but stayed just below that lower bollinger band and therefore remains on a sell.

So the system remains on a buy. The market does seem intent on trying to hit fresh 2 year highs in spite of last week's decline and the uncertainty surrounding geopolitical events. And that uncertainty will probably help contribute to more volatility than we've become accustomed to these last several months.