It took most of the day, but aside from some early market weakness the market waited until the final hour of the quarter to sell down. It was on low volume and it can't be construed as more than end of quarter profit taking at this point.

The ADP Employment report came in at -23,000, which was in contrast to the expected 40,000 gain. The Chicago PMI also disappointed coming in at 58.8 vice the expected 61.0. But market losses were contained rather quickly once the market opened and it appeared we might be headed for a green close, but in that final hour the profit takers came in and sold the market down in moderate fashion. No real damage as of yet, but given the resistance the market has been hitting one has to wonder if we need to see some serious selling pressure before resuming any uptrend.

But we have some potential headwinds to contend with first. As I mentioned yesterday, tomorrow is the first day of the 2nd quarter and it remains to be seen if we see any follow-through selling on that front. We also have some market data being released tomorrow in the form of Continuing Claims, Initial Claims, Construction Spending, and the ISM (which is more important that the Chicago PMI release we saw today). All of these data points could provide an excuse to continue to take profits.

Friday doesn't lack for some suspense either. We'll see the Non-Farm Payrolls and Unemployment Rate data hit the market too. After today's negative ADP number there may be some trepidation that those numbers may not be as healthy as expected. And the market will be closed, so we won't get a reaction until Monday. This is one reason we could see some follow-through selling pressure as many traders may not want to hold long positions over a three day weekend.

Here's the charts:

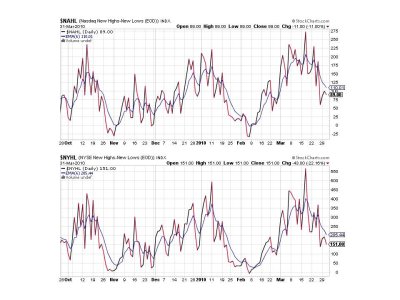

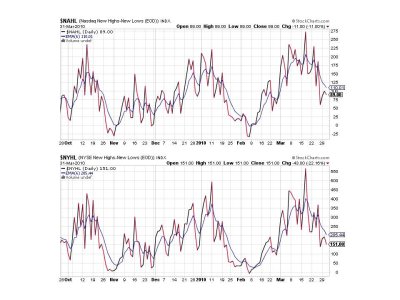

We're slowly stepping these signals lower, but not much to show for it at this point. Both are on sells.

We're still on sells here too.

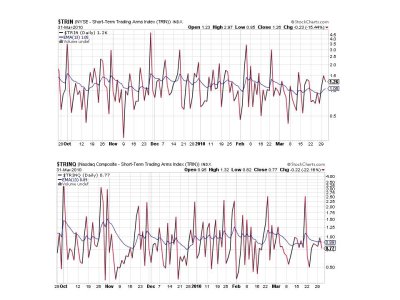

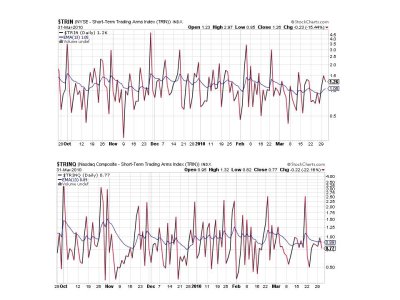

TRIN remained on a sell today, but TRINQ flipped back to a buy.

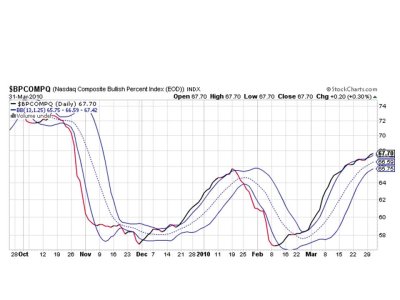

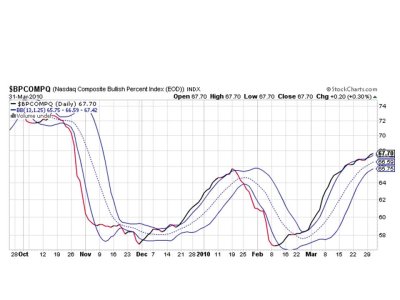

BPCOMPQ also remains on a buy.

So 5 of 7 signals remain on a sell, keeping the system on a sell. If we do see some follow-through selling pressure in the next few trading days I'm not sure it will go too deep given the underlying strength in this market. I suspect higher prices may come shortly after any corrective market action. Assuming of course that we get corrective market action.

Remember, tomorrow we get two new IFTs. It's just not enough, is it? See you tomorrow.

The ADP Employment report came in at -23,000, which was in contrast to the expected 40,000 gain. The Chicago PMI also disappointed coming in at 58.8 vice the expected 61.0. But market losses were contained rather quickly once the market opened and it appeared we might be headed for a green close, but in that final hour the profit takers came in and sold the market down in moderate fashion. No real damage as of yet, but given the resistance the market has been hitting one has to wonder if we need to see some serious selling pressure before resuming any uptrend.

But we have some potential headwinds to contend with first. As I mentioned yesterday, tomorrow is the first day of the 2nd quarter and it remains to be seen if we see any follow-through selling on that front. We also have some market data being released tomorrow in the form of Continuing Claims, Initial Claims, Construction Spending, and the ISM (which is more important that the Chicago PMI release we saw today). All of these data points could provide an excuse to continue to take profits.

Friday doesn't lack for some suspense either. We'll see the Non-Farm Payrolls and Unemployment Rate data hit the market too. After today's negative ADP number there may be some trepidation that those numbers may not be as healthy as expected. And the market will be closed, so we won't get a reaction until Monday. This is one reason we could see some follow-through selling pressure as many traders may not want to hold long positions over a three day weekend.

Here's the charts:

We're slowly stepping these signals lower, but not much to show for it at this point. Both are on sells.

We're still on sells here too.

TRIN remained on a sell today, but TRINQ flipped back to a buy.

BPCOMPQ also remains on a buy.

So 5 of 7 signals remain on a sell, keeping the system on a sell. If we do see some follow-through selling pressure in the next few trading days I'm not sure it will go too deep given the underlying strength in this market. I suspect higher prices may come shortly after any corrective market action. Assuming of course that we get corrective market action.

Remember, tomorrow we get two new IFTs. It's just not enough, is it? See you tomorrow.