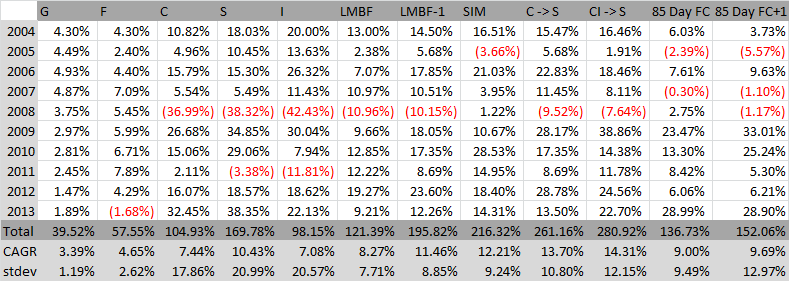

Well I ran the numbers last night on the 85 Day Lookback modified GMR for our C & F Funds including the 1 day IFT lag and here are the 10 year results.

As you can see from the results in the penultimate column, it does produce better results than the C Fund at half the risk (stdev). The author was right about that, even considering the one day lag in our IFTs. But you can't use this with our funds because there are frequently more than 2 IFTs a month -- much more. I've listed the IFT dates below by year. We start off in the C Fund so the first IFT is to F.

2013 1/2

2012 5/21 (5/30,31) 8/10 (8/14,15) 8/28 9/6 (11/19,20) 12/27

2011 6/3 (7/5,6) (7/8,11) 7/18 7/28 12/8

2010 (2/5,8) (2/24/25) (3/1,2) 5/7 (5/13/14) (6/4,7) 6/11 (6/15,16,17) 6/18 9/22 (10/5,6)

2009 (3/27,30) (4/6,7) 4/30 5/7 (5/12,13) 5/15

2008 5/15 (6/5,6) 6/23 (7/18,21)

2007 2/28 3/9 3/14 3/20 (8/6,7) 8/15 10/9 10/16 (12/7,10) 12/26 12/28

2006 (5/23,24) (6/6,7) 6/13 (6/16,19) (6/30,7/3,5) 7/10 (7/12,13) 9/6

2005 (3/30,31) 4/4 4/8 4/14 5/23 6/5 6/14 6/23 (7/14,15,18) 10/12 10/25

2004 5/10 5/13 5/18 6/1 7/2 7/13 (7/22,23) 8/2 (9/20,21) 11/5

The values in parenthasis are two or more back-to-back IFTs. As you can see this method whipsaws our IFTs quite a bit. I tried modifying this method (last column) by waiting until the second day of a signal before generating an IFT. This removed many of the whipsaw trades and actually increased our total gain. That's enough to show us that whipsaws do hurt us. Unfortunately we still end up with more than 2 IFTs a month, so this is still not a viable method.

Even if this method were workable within our IFT limits, it still produces worse results than any of the LMBF-1 family. That, and the fact that LMBF-1 is easier to compute and follow leaves me not interested in pursuing this new method any further.

They can't all be winners.