C&S Weekend Update

This week reminded me of the time we bounced off the March 666 bottom. While many of you got smart and gradually started getting back in the market...

I was the the big bear pounding my fist on the table in disbelief, telling myself we are due for a pullback! Meanwhile I'm manipulating the charts to fit my beliefs. Yes I was the guy reading the "doom & gloom" blogs, & reading about the horrible economy thinking "Bad economy = Bad Market."

Truth of the matter is none of what I think, the charts think, or the CNBC clowns think matters because "Price Pays." I'm not telling you to get into the market, but if you're a HUGE bear, chances are you will be the last to climb aboard this train and when you do it will be called "buying at the top." I should know, I've done it more than once...

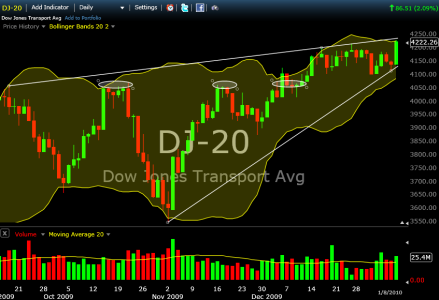

As far as the technicals go, these charts aren't doing what I think they should do, so for the most part I'm only watching price. The Big 3 gave us an increase in volume this week. Today the Transports broke and closed above the previous shelve of resistance.

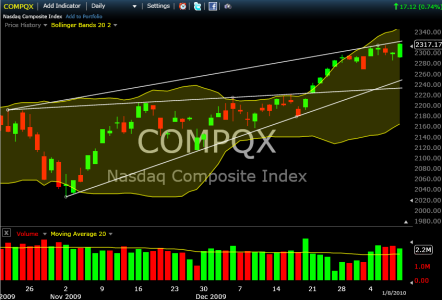

The NASDAQ was the first to give us a substantial breakout ahead of the pack. Is it due for a pullback? I think it is, but like I said, I'm just watching price and today prices pushed and closed higher.

For the S&P 500 I've drawn in a rising Price Channel I'll be watching.

Here is a look at the Slow Stochastic American Market Quilt. Check out these readings, all of them are pegging the high 99s except for the inverse VIX closing at .26 I admit that when I created this quilt I wasn't expecting to see so much green across the broad American Markets. Large, Mid, Small, & even the Micros are hitting on all 8 cylinders.

On the monthly price performance charts, the S&P 600 small caps are leading the way with the S&P 400 mid caps just behind. I was expecting the S&P 100 large caps to overtake the others this week, but it didn't happen.

Thanks for reading, I'll do another update for the Bonds & Overseas Markets later this weekend.