Earlier this week the Seven Sentinels issued an unconfirmed buy signal, with a NYMO 28 day trading high being the only ingredient missing. Today, NYMO confirmed that buy signal with a 28 day trading high.

What started out as another weak open was once again reversed fairly quickly as dip buyers wasted no time getting on board. Perhaps the early weakness was attributed to the January consumer prices, which saw an increase of 0.4%, while core prices floated up 0.2%. This was only a bit above expectations.

Initial jobless claims increased from last week's 385,000 to 410,000 this week. That was very close to estimates. Continuing claims were largely unchanged at 3.91 million.

The February Philadelphia Fed Survey popped to a seven-year high of 35.9. This was quite a bit above estimates of 21.0.

The January Leading Indicators ebbed up by 0.1%, which was less than estimates.

Good, bad, or indifferent, the market didn't seem to care about today's data as the broader market still closed at fresh 2 year highs.

Here's tonight's charts:

Two buy signals here, and we can see NYMO has surpassed its previous high set on 8 Feb. That gives the system a fresh NYMO 28 day trading high and validates the unconfirmed buy signal from earlier in the week.

NAHL and NYHL are also flashing buys.

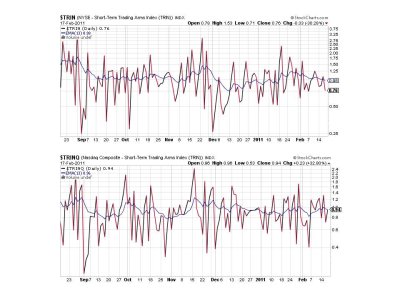

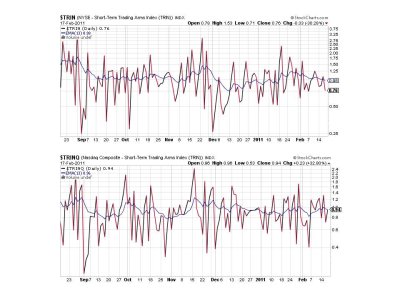

Two more buys for TRIN and TRINQ.

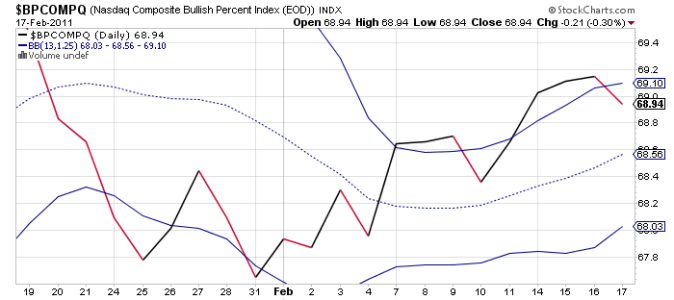

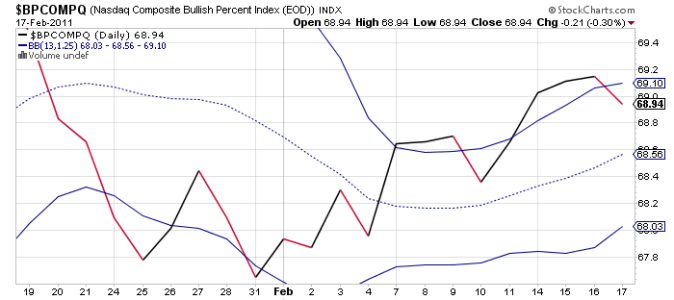

Interestingly, BPCOMPQ dipped today, and flipped to a sell in the process. But looking at this chart we can see this has been somewhat of a pattern and I see no reason for concern given the overwhelming bullish nature of this market.

So tomorrow at the close I'll enter an IFT and put the 7 Sentinels back into 50% C and 50% S.

What started out as another weak open was once again reversed fairly quickly as dip buyers wasted no time getting on board. Perhaps the early weakness was attributed to the January consumer prices, which saw an increase of 0.4%, while core prices floated up 0.2%. This was only a bit above expectations.

Initial jobless claims increased from last week's 385,000 to 410,000 this week. That was very close to estimates. Continuing claims were largely unchanged at 3.91 million.

The February Philadelphia Fed Survey popped to a seven-year high of 35.9. This was quite a bit above estimates of 21.0.

The January Leading Indicators ebbed up by 0.1%, which was less than estimates.

Good, bad, or indifferent, the market didn't seem to care about today's data as the broader market still closed at fresh 2 year highs.

Here's tonight's charts:

Two buy signals here, and we can see NYMO has surpassed its previous high set on 8 Feb. That gives the system a fresh NYMO 28 day trading high and validates the unconfirmed buy signal from earlier in the week.

NAHL and NYHL are also flashing buys.

Two more buys for TRIN and TRINQ.

Interestingly, BPCOMPQ dipped today, and flipped to a sell in the process. But looking at this chart we can see this has been somewhat of a pattern and I see no reason for concern given the overwhelming bullish nature of this market.

So tomorrow at the close I'll enter an IFT and put the 7 Sentinels back into 50% C and 50% S.