Or

Cry & Fold?

1150 rejects

Cry & Fold?

1150 rejects

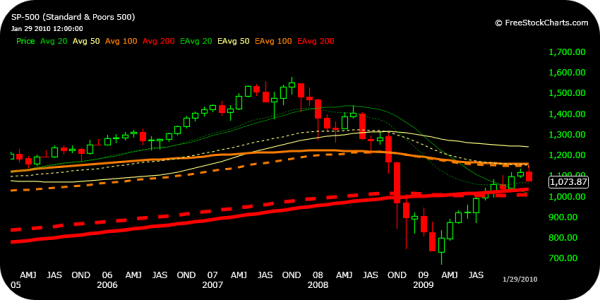

A while back, I did a blog called Stop, Drop, & Roll based on the 1987 Stock Market crash. I used that blog to illustrate how moving averages can serve as warning signs. One of the reasons I like moving averages so much, is because they tend to line up support/resistance levels on multiple time frames. Here are some S&P 500 timeframes with the popular 20/50/100/200 SMA/EMAs. The SMAs are solid, the EMAs are dashed.

Since 1150 on the hourly charts we've failed four times to confirm a close above the green 20 SMA/EMAs.

The Daily charts show our first close below the orange 100 SMA/EMAs since June 2008. Does anyone remember how sucky it was back then?

1150 shows strong resistance with the red 200 EMA on the weekly charts.

1150 shows strong resistance with the yellow 50 EMA and orange 150 SMA/EMAs on the Monthly charts.

The Quarterly charts (that's right I said quarterly :blink

Note: My system has me exiting to the G-Fund EOB Monday. The last sell signal this system gave was in June 2008.

Take care... Jason