Yesterday, I had said that I expected some selling pressure very soon based on TRIN and TRINQs overbought readings, but that I anticipated the downside would be limited. Well, we got the selling pressure, and the downside was limited. I also said weakness should probably be bought, but that we may not get a chance to buy the dip. We didn't.

Be that as it may we are coming up on the end of the month and it's holiday weekend with Monday being Labor Day. I doubt the market does much of anything on the downside before next week, but come Tuesday I'm not sure how this market is going to react once folks start returning from their vacations.

Early on today, stocks were weak, primarily in response to a very bearish Consumer Confidence Index reading for August. The expected number was 59, but we got 44.5, which was the lowest reading since April 2009. But the selling pressure this report generated didn't last very long at all, as stocks chopped their way back from the lows to the neutral line in less than 90 minutes.

The market then chopped above and below that line until the FOMC minutes were released in mid-afternoon. The minutes were largely ignored by the market, but the major averages did put on a positive bias from there until the last few minutes of trade when some selling pressure kicked in to take those averages well off their highs of the day.

Here's the charts:

NAMO and NYMO took a bit of a breather today and remain in buy conditions.

Same with NAHL and NYHL.

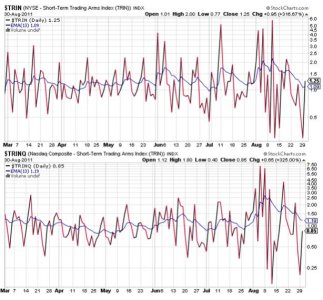

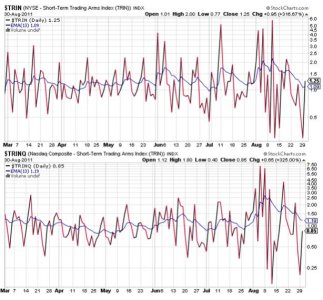

TRIN spiked back into a modest sell condition, while TRINQ rose, but remained on a buy. The overbought condition has been largely neutralized after today.

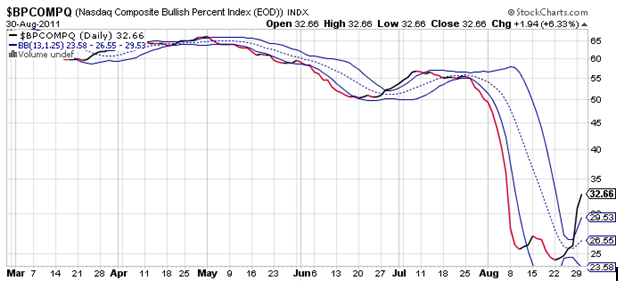

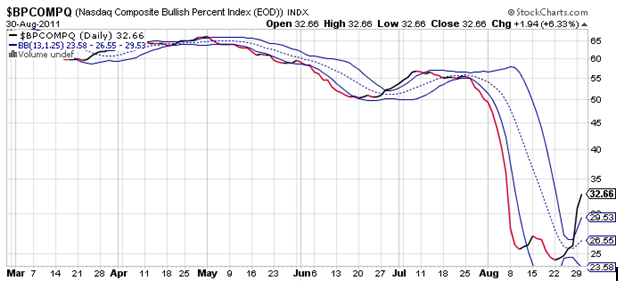

BPCOMPQ bumped a bit higher also remains on a buy.

The Seven Sentinels are now officially in an intermediate term buy condition, but I'm not in a hurry to buy this market.

While the S&P 500 has rallied 8% off its lows so far, it still down about 6% for the month. If this is still a bear market, it will only be a matter of time before the bear returns, but if this rally indeed turned this market then the upside could still be substantial. I do not which will be the case at this point, but I'm still on alert sitting in the F fund.

Be that as it may we are coming up on the end of the month and it's holiday weekend with Monday being Labor Day. I doubt the market does much of anything on the downside before next week, but come Tuesday I'm not sure how this market is going to react once folks start returning from their vacations.

Early on today, stocks were weak, primarily in response to a very bearish Consumer Confidence Index reading for August. The expected number was 59, but we got 44.5, which was the lowest reading since April 2009. But the selling pressure this report generated didn't last very long at all, as stocks chopped their way back from the lows to the neutral line in less than 90 minutes.

The market then chopped above and below that line until the FOMC minutes were released in mid-afternoon. The minutes were largely ignored by the market, but the major averages did put on a positive bias from there until the last few minutes of trade when some selling pressure kicked in to take those averages well off their highs of the day.

Here's the charts:

NAMO and NYMO took a bit of a breather today and remain in buy conditions.

Same with NAHL and NYHL.

TRIN spiked back into a modest sell condition, while TRINQ rose, but remained on a buy. The overbought condition has been largely neutralized after today.

BPCOMPQ bumped a bit higher also remains on a buy.

The Seven Sentinels are now officially in an intermediate term buy condition, but I'm not in a hurry to buy this market.

While the S&P 500 has rallied 8% off its lows so far, it still down about 6% for the month. If this is still a bear market, it will only be a matter of time before the bear returns, but if this rally indeed turned this market then the upside could still be substantial. I do not which will be the case at this point, but I'm still on alert sitting in the F fund.