I've been looking for weakness and we've been getting it, but it isn't sticking. Bullish? Or is this up move getting tired? It isn't as though the broader market is running away to the upside and it's having to fight off some moderate selling pressure so far this week.

Overseas, economic conditions in euro-land haven't changed. In fact, the euro fell more than 1% to a 15-month low today.

Here at home, the latest ADP Employment Change provided some reason for optimism ahead of the official nonfarm payrolls report due tomorrow morning. The report revealed that private payrolls had increased by 325,000 during December. The jump in payrolls more than doubled the increase of 160,000 that had been expected.

Also released this morning was the weekly initial jobless claims count, which showed a drop of 15,000 week-over-week to 372,000. That was in-line with estimates.

The ISM Services Index came in at 52.6 for December, but that was a bit lower than estimates calling for 53.0.

Here's today's charts:

NAMO and NYMO picked up a bit on today's action, but are looking tired. Both remain on buys.

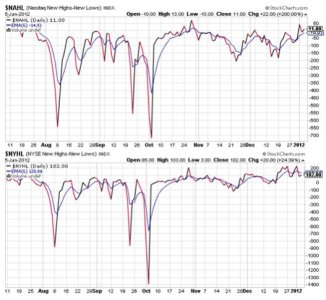

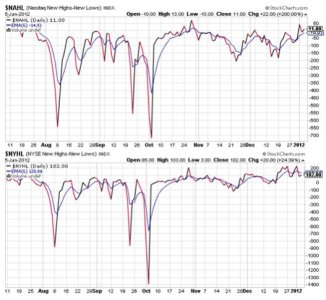

NAHL and NYHL made modest moves today, but remain on a buy and sell respectively.

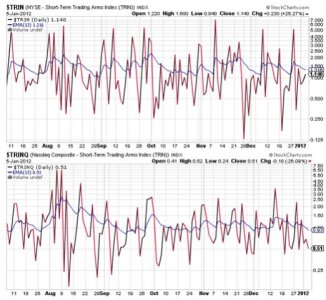

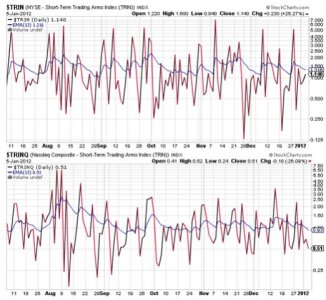

TRIN moved up a bit today, while TRINQ moved lower. Both remain on buys. They are largely neutral taken together, but TRINQ does suggest a moderately overbought market.

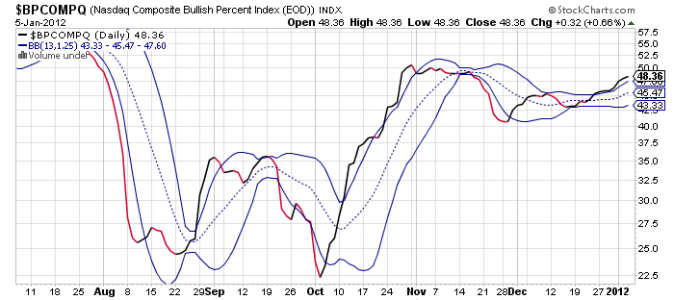

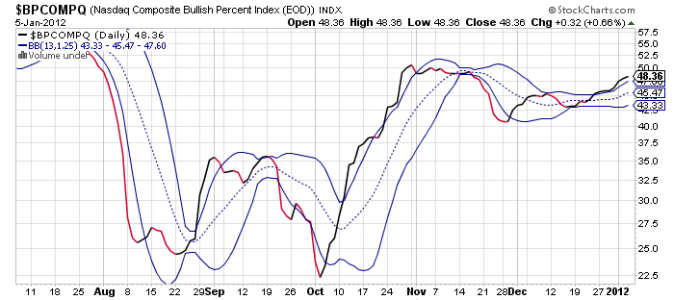

BPCOMPQ is tracking largely sideways with an upward bias. It too seems to be suggesting a up leg that's losing some steam, but it does remain on a buy.

So the signals are mixed, which keeps the system in a buy condition.

While the bulls can say that this market is holding together and remaining buoyant, the bears would probably counter that the charts look overdone. Perhaps. But a better indication of where we go in the short term may be suggested by the latest AAII sentiment survey, which showed bullish levels rising and bearish levels dropping. In fact, the survey showed only 17% were bearish and that's not much. Coupled with our survey, which is already on a sell, I'd have to say that we probably have more selling pressure coming in the days ahead. And I suspect that will be a buying opportunity should we get it.

Overseas, economic conditions in euro-land haven't changed. In fact, the euro fell more than 1% to a 15-month low today.

Here at home, the latest ADP Employment Change provided some reason for optimism ahead of the official nonfarm payrolls report due tomorrow morning. The report revealed that private payrolls had increased by 325,000 during December. The jump in payrolls more than doubled the increase of 160,000 that had been expected.

Also released this morning was the weekly initial jobless claims count, which showed a drop of 15,000 week-over-week to 372,000. That was in-line with estimates.

The ISM Services Index came in at 52.6 for December, but that was a bit lower than estimates calling for 53.0.

Here's today's charts:

NAMO and NYMO picked up a bit on today's action, but are looking tired. Both remain on buys.

NAHL and NYHL made modest moves today, but remain on a buy and sell respectively.

TRIN moved up a bit today, while TRINQ moved lower. Both remain on buys. They are largely neutral taken together, but TRINQ does suggest a moderately overbought market.

BPCOMPQ is tracking largely sideways with an upward bias. It too seems to be suggesting a up leg that's losing some steam, but it does remain on a buy.

So the signals are mixed, which keeps the system in a buy condition.

While the bulls can say that this market is holding together and remaining buoyant, the bears would probably counter that the charts look overdone. Perhaps. But a better indication of where we go in the short term may be suggested by the latest AAII sentiment survey, which showed bullish levels rising and bearish levels dropping. In fact, the survey showed only 17% were bearish and that's not much. Coupled with our survey, which is already on a sell, I'd have to say that we probably have more selling pressure coming in the days ahead. And I suspect that will be a buying opportunity should we get it.