Given the final GDP number for last quarter came in at 2.0% (economists were looking for 2.5%), I suppose the market held up rather well in spite of the bears winning the overall battle by the close.

And perhaps it's also not surprising that the FOMC minutes revealed that some members are anticipating further weakness in economic growth.

I'm sure that volume is about to dry up for a couple of trading days as we go into the Thanksgiving holiday, which could make it easier to rally the market. Sentiment has gotten bearish in many pockets with seasonality in our favor. That may be a prescription for higher prices beyond Thanksgiving.

Here's today's charts:

NAMO and NYMO stretched it out to the downside a bit more today. Both remain on sells.

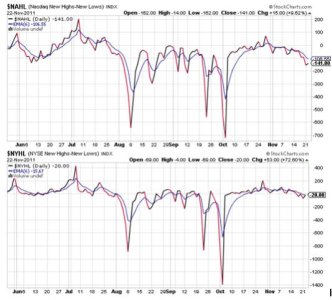

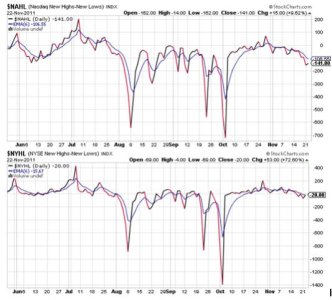

NAHL and NYHL actually ebbed a bit higher, but remain on sells.

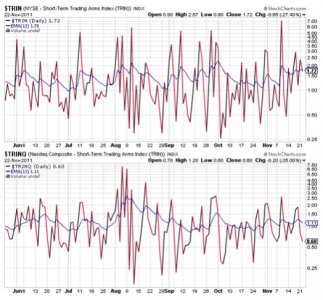

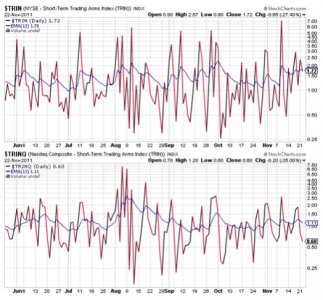

TRIN and TRINQ are both on buys.

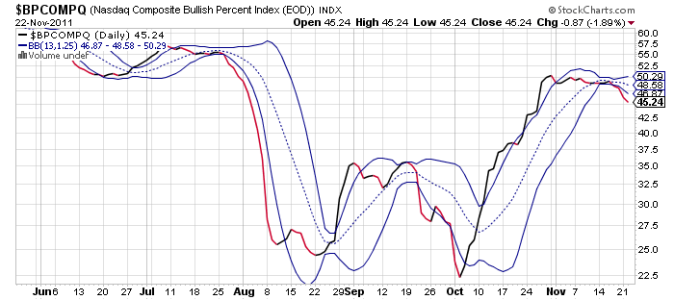

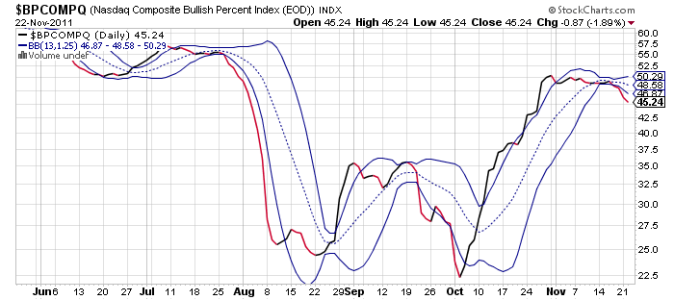

BPCOMPQ dipped a bit further and remains on a sell.

So the signals are mixed, but are showing signs that at least a short term bottom "may" be near. But rally or not, the Seven Sentinels remain in an Intermediate Term sell condition.

While I believe a short term rally is probably going to happen, it could be a mistake to get complacent about the risks to the market. The EU has found few answers to their debt problem and yields in some of the member countries are at high levels. And we aren't dealing with our own debt very effectively either. This is a complicated situation, but depending on how things unfold there is a potential for serious dislocations if the EU situation goes from bad to worse. That may sound like a good wall of worry, but if the financial pillars holding things together become unstable a wall of worry will quickly become a slope of hope.

Understand, these are just my opinions as no one can be sure how the global economic picture will unfold. But I think it's safe to say that risk management still applies.

And perhaps it's also not surprising that the FOMC minutes revealed that some members are anticipating further weakness in economic growth.

I'm sure that volume is about to dry up for a couple of trading days as we go into the Thanksgiving holiday, which could make it easier to rally the market. Sentiment has gotten bearish in many pockets with seasonality in our favor. That may be a prescription for higher prices beyond Thanksgiving.

Here's today's charts:

NAMO and NYMO stretched it out to the downside a bit more today. Both remain on sells.

NAHL and NYHL actually ebbed a bit higher, but remain on sells.

TRIN and TRINQ are both on buys.

BPCOMPQ dipped a bit further and remains on a sell.

So the signals are mixed, but are showing signs that at least a short term bottom "may" be near. But rally or not, the Seven Sentinels remain in an Intermediate Term sell condition.

While I believe a short term rally is probably going to happen, it could be a mistake to get complacent about the risks to the market. The EU has found few answers to their debt problem and yields in some of the member countries are at high levels. And we aren't dealing with our own debt very effectively either. This is a complicated situation, but depending on how things unfold there is a potential for serious dislocations if the EU situation goes from bad to worse. That may sound like a good wall of worry, but if the financial pillars holding things together become unstable a wall of worry will quickly become a slope of hope.

Understand, these are just my opinions as no one can be sure how the global economic picture will unfold. But I think it's safe to say that risk management still applies.