If you've been invested in the I or S funds the past couple of trading days, you've picked up some gains. For the C fund, not so much as it's been just barely north of flat. And while flat to positive returns are better than losses, stocks have had to rally back from negative territory two days in a row. Right now, it's a battle between bulls and bears for control of market direction.

At the open stocks fell dramatically, perhaps as a result of a disappointing initial jobless claim number, which saw claims increase by 27,000 to 412,000. This is unexpected as analysts were looking for something closer to 385,000.

Another data point that spooked traders was the March Producer Price Index, which was up 0.7% (even though economists were looking for 1.1%). Remove food and energy and that number drops to 0.3%, which was a tad higher than estimates (0.2%).

While I haven't been pointing it out of late, the dollar index continues to see selling pressure and hit a new 52-week low today. That's certainly helped the I fund of late.

Here's today's charts:

NAMO and NYMO ticked up for a second day in a row, but remain on sells.

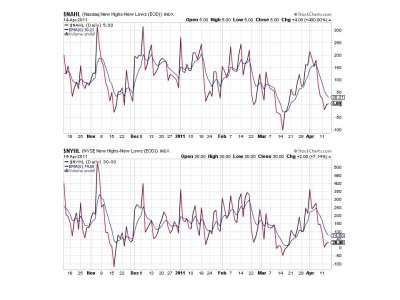

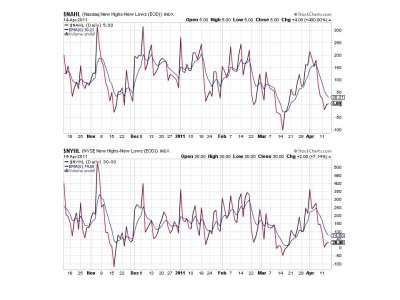

NAHL and NYHL tracked sideways and suggest internals have not improved much these past two days. They also remain on sells.

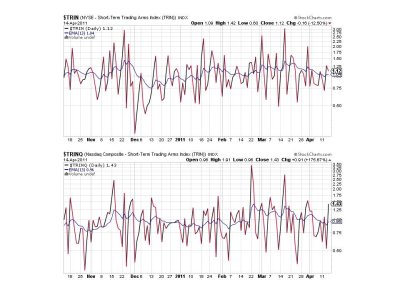

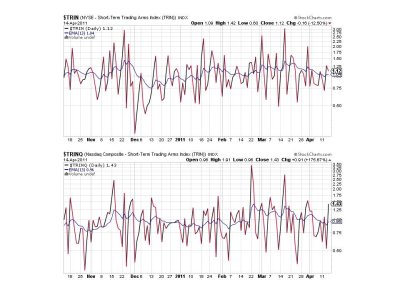

Both TRIN and TRINQ are now flashing sells.

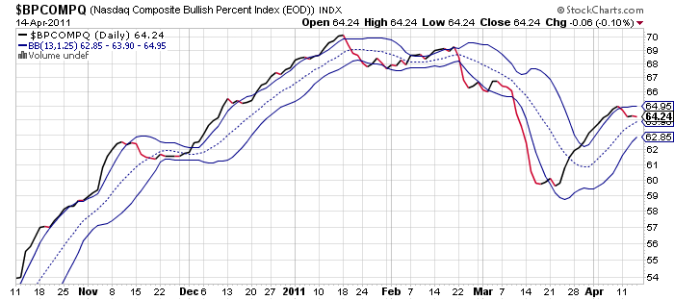

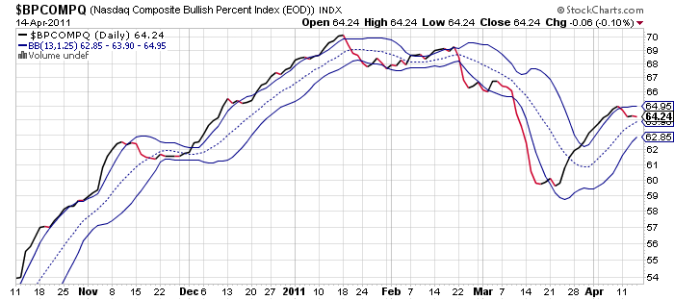

BPCOMPQ ticked lower today and that's a bit troubling, but it was a very modest move so I can't read too much into it at the moment. This signal also remains in a sell condition.

So the Seven Sentinels are all flashing sells today, which translates into an "unconfirmed" sell condition. As long as the sell is unconfirmed the system itself remains on a buy, but this could be a warning of more selling pressure to come.

In order for this unconfirmed sell to be confirmed, NYMO needs to hit a new 28 day trading low. At the moment it is nowhere near it. Currently NYMO sits at -37.78. It needs to drop below approximately -89 for the sentinels to confirm an intermediate term sell condition. In spite of the 50+ point difference, I would not rule this out as a possibility even if I'm not looking for it to occur.

At the open stocks fell dramatically, perhaps as a result of a disappointing initial jobless claim number, which saw claims increase by 27,000 to 412,000. This is unexpected as analysts were looking for something closer to 385,000.

Another data point that spooked traders was the March Producer Price Index, which was up 0.7% (even though economists were looking for 1.1%). Remove food and energy and that number drops to 0.3%, which was a tad higher than estimates (0.2%).

While I haven't been pointing it out of late, the dollar index continues to see selling pressure and hit a new 52-week low today. That's certainly helped the I fund of late.

Here's today's charts:

NAMO and NYMO ticked up for a second day in a row, but remain on sells.

NAHL and NYHL tracked sideways and suggest internals have not improved much these past two days. They also remain on sells.

Both TRIN and TRINQ are now flashing sells.

BPCOMPQ ticked lower today and that's a bit troubling, but it was a very modest move so I can't read too much into it at the moment. This signal also remains in a sell condition.

So the Seven Sentinels are all flashing sells today, which translates into an "unconfirmed" sell condition. As long as the sell is unconfirmed the system itself remains on a buy, but this could be a warning of more selling pressure to come.

In order for this unconfirmed sell to be confirmed, NYMO needs to hit a new 28 day trading low. At the moment it is nowhere near it. Currently NYMO sits at -37.78. It needs to drop below approximately -89 for the sentinels to confirm an intermediate term sell condition. In spite of the 50+ point difference, I would not rule this out as a possibility even if I'm not looking for it to occur.