Early selling pressure gave way to dip buying interest fairly quickly in the first half hour of trade this morning, with stocks chopping around the remainder of the day. The S&P 500 managed to close higher by a modest .07%, while the Wilshire 4500 a more moderate 0.44%.

The early weakness seemed to key on some disappointing outlooks from Cisco and Akamai Tech, as the initial jobless claims report was all but ignored in spite of better than expected numbers.

I had been watching the news reports surrounding an anticipated speech from Egypt's President Mubarak in which the media was confidently predicting that Mubarak would step aside and transfer power to the military, but it wasn't until a few minutes before our markets closed that the President began to speak. And his announcement was unexpected by many as he stated he would not leave his office until elections later in the year. The market became a bit volatile at that time, but did not have time to fully digest this breaking news.

Now that we know where the Egyptian President stands it will be very interesting to see how the market responds over the coming days. I don't think it would be a stretch to assume that there will be some measure of unrest in the wake of this announcement and it may not be contained to Egypt.

The Seven Sentinels are reflecting a very challenging situation today in terms of trying to define which direction the market is headed. I've been saying I'm expecting to see a buy signal, and that still holds true for the same reasons I stated in last night's blog, but I got a curve ball thrown at me today as all seven signals flipped back to a sell condition. Remember, I never actually got confirmation of either of the two previous buy signals, which technically kept the system in sell condition. Now, just as the market appeared ready to confirm those buy signals the system flashes a sell. Where do I go with this now? Here's the charts:

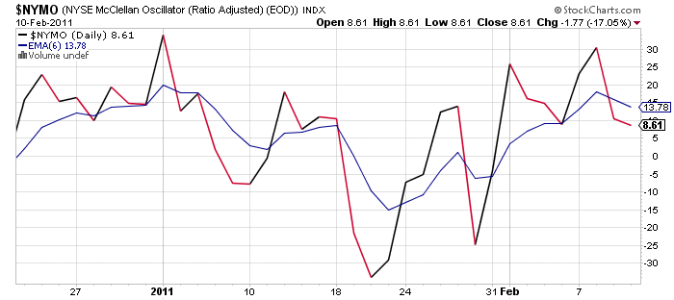

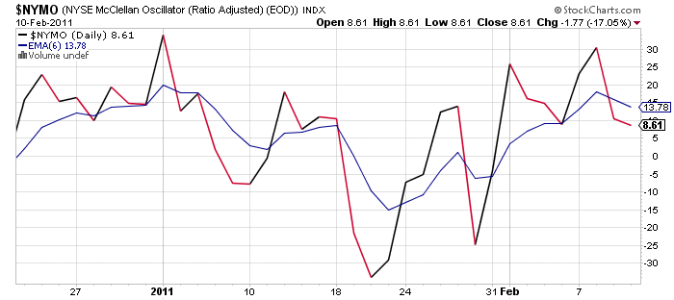

NAMO and NYMO are both flashing sells today, but these readings are really neutral in the bigger picture.

The same holds true for NAHL and NYHL. They're on sells, but not by much.

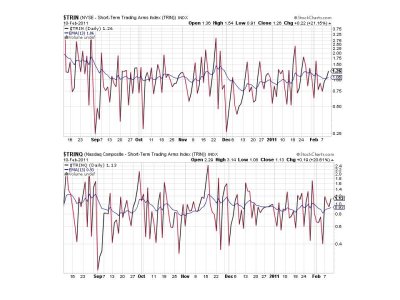

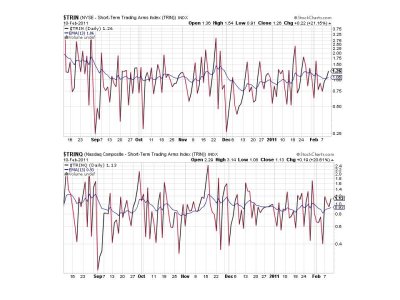

TRIN and TRINQ are also flashing sells.

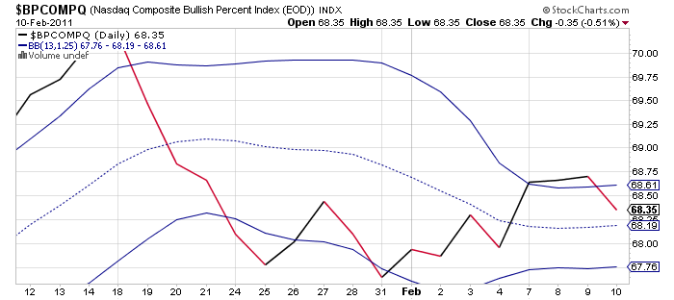

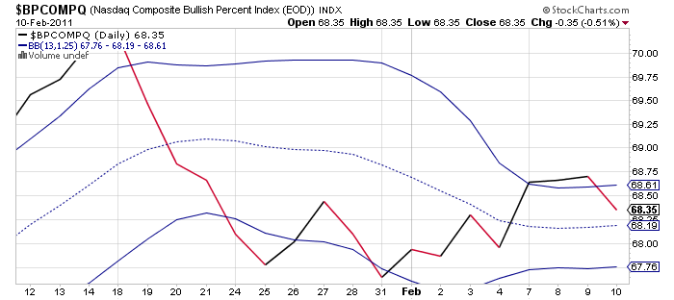

BPCOMPQ dipped a bit today and dropped below that upper bollinger band. That flips it to a sell.

So all seven signals are now back in sell mode, but what does that mean? The last sell signal, which was issued on 20 January, never saw much weakness in the 3 weeks that it was in force, and in fact the broader market has hit several new 2 year highs during this time. That is very atypical action after this system gives a sell signal and is why I felt it was probably an invalid signal after watching these new highs get tagged.

But NYMO never hit a 28 day trading high after the system issued two separate unconfirmed buy signals. The way I'm looking at those two unconfirmed buys is that they are telling me something. They are reflective of an obviously strong bullish market bias.

So "if" the 20 January sell signal was not valid then the system should have been in a buy condition up to this point. But that's hind sight.

Now the same condition applies to a sell signal as applies to a buy signal. The signal itself needs to be confirmed to be considered valid. In this case a sell signal needs to see NYMO hit a 28 day trading low. Now let's look at that chart.

The 28th trading day from today's action is 3 January. That just happens to be the peak for this signal during that time frame. At today's close NYMO settled at 8.16. For today's sell signal to be valid it would need to hit better than a -36.0. It's not even close, so today's sell condition remains unconfirmed and it would take some serious selling pressure to get us there.

Can it happen? Yes, but even today's action revealed that the dip buyers are alive and well and still in control of this market.

Have I confused you enough yet?

In spite of the fact that I now believe the 20 January sell signal was false, I had already made the trade and couldn't simply reverse it. I was looking for the next confirmed signal for my next trade, which I believed would be another buy signal. And I still think that's where the system is headed, but there are no guarantees here. Geopolitical events could potentially drive the markets given the Egyptian situation. That hasn't been the case yet and I'm not saying it will, but it's a potential catalyst depending on how things unfold. Also, next week is Options Expiration week and while it will probably be volatile, I expect the market to hold together as the Options guys need to set the table for the next month of Options trading.

Things appear to be very tricky right now, but one constant has been the unwavering bullish bias that this market has shown. And admittedly, it has been making it a bit more challenging than I'd like in using the Seven Sentinels as a guide in discerning the Intermediate Term direction of this market. No system is perfect, and I simply view the current difficulty as a bump in a very long road.

The early weakness seemed to key on some disappointing outlooks from Cisco and Akamai Tech, as the initial jobless claims report was all but ignored in spite of better than expected numbers.

I had been watching the news reports surrounding an anticipated speech from Egypt's President Mubarak in which the media was confidently predicting that Mubarak would step aside and transfer power to the military, but it wasn't until a few minutes before our markets closed that the President began to speak. And his announcement was unexpected by many as he stated he would not leave his office until elections later in the year. The market became a bit volatile at that time, but did not have time to fully digest this breaking news.

Now that we know where the Egyptian President stands it will be very interesting to see how the market responds over the coming days. I don't think it would be a stretch to assume that there will be some measure of unrest in the wake of this announcement and it may not be contained to Egypt.

The Seven Sentinels are reflecting a very challenging situation today in terms of trying to define which direction the market is headed. I've been saying I'm expecting to see a buy signal, and that still holds true for the same reasons I stated in last night's blog, but I got a curve ball thrown at me today as all seven signals flipped back to a sell condition. Remember, I never actually got confirmation of either of the two previous buy signals, which technically kept the system in sell condition. Now, just as the market appeared ready to confirm those buy signals the system flashes a sell. Where do I go with this now? Here's the charts:

NAMO and NYMO are both flashing sells today, but these readings are really neutral in the bigger picture.

The same holds true for NAHL and NYHL. They're on sells, but not by much.

TRIN and TRINQ are also flashing sells.

BPCOMPQ dipped a bit today and dropped below that upper bollinger band. That flips it to a sell.

So all seven signals are now back in sell mode, but what does that mean? The last sell signal, which was issued on 20 January, never saw much weakness in the 3 weeks that it was in force, and in fact the broader market has hit several new 2 year highs during this time. That is very atypical action after this system gives a sell signal and is why I felt it was probably an invalid signal after watching these new highs get tagged.

But NYMO never hit a 28 day trading high after the system issued two separate unconfirmed buy signals. The way I'm looking at those two unconfirmed buys is that they are telling me something. They are reflective of an obviously strong bullish market bias.

So "if" the 20 January sell signal was not valid then the system should have been in a buy condition up to this point. But that's hind sight.

Now the same condition applies to a sell signal as applies to a buy signal. The signal itself needs to be confirmed to be considered valid. In this case a sell signal needs to see NYMO hit a 28 day trading low. Now let's look at that chart.

The 28th trading day from today's action is 3 January. That just happens to be the peak for this signal during that time frame. At today's close NYMO settled at 8.16. For today's sell signal to be valid it would need to hit better than a -36.0. It's not even close, so today's sell condition remains unconfirmed and it would take some serious selling pressure to get us there.

Can it happen? Yes, but even today's action revealed that the dip buyers are alive and well and still in control of this market.

Have I confused you enough yet?

In spite of the fact that I now believe the 20 January sell signal was false, I had already made the trade and couldn't simply reverse it. I was looking for the next confirmed signal for my next trade, which I believed would be another buy signal. And I still think that's where the system is headed, but there are no guarantees here. Geopolitical events could potentially drive the markets given the Egyptian situation. That hasn't been the case yet and I'm not saying it will, but it's a potential catalyst depending on how things unfold. Also, next week is Options Expiration week and while it will probably be volatile, I expect the market to hold together as the Options guys need to set the table for the next month of Options trading.

Things appear to be very tricky right now, but one constant has been the unwavering bullish bias that this market has shown. And admittedly, it has been making it a bit more challenging than I'd like in using the Seven Sentinels as a guide in discerning the Intermediate Term direction of this market. No system is perfect, and I simply view the current difficulty as a bump in a very long road.