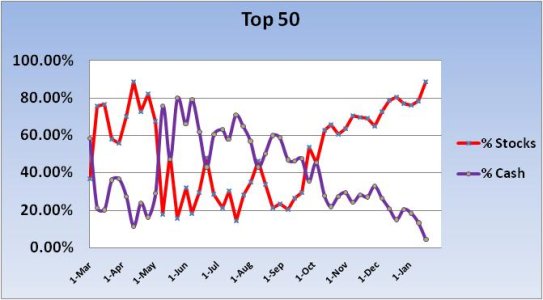

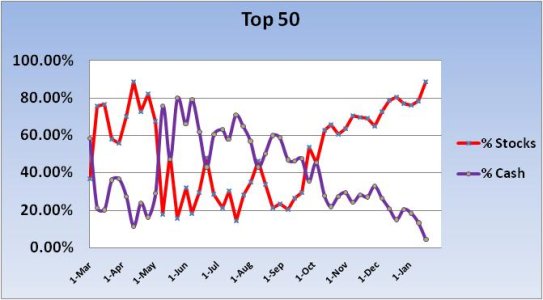

The Top 50 just keep getting more bullish.

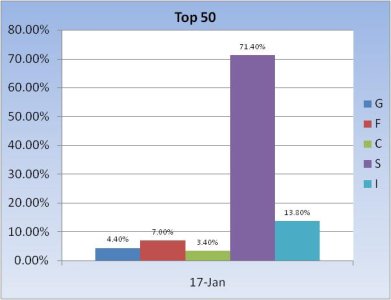

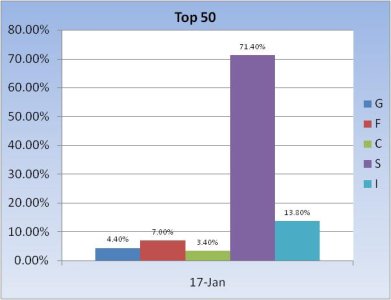

Total stock allocations for this group are now at 88.6%, with the S fund favored far more than any other fund. That's not much of a surprise since that's been the biggest gainer for some time. But the dollar's strength early on this month held the I fund back, which is why we have very low I fund exposure in this group. But if the dollar can begin to trend lower now, the allocation mix may change.

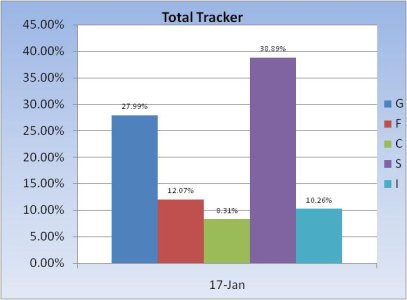

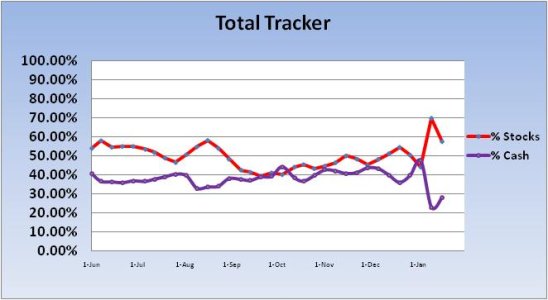

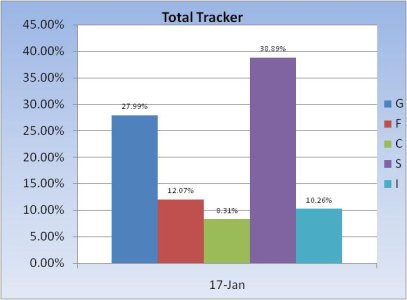

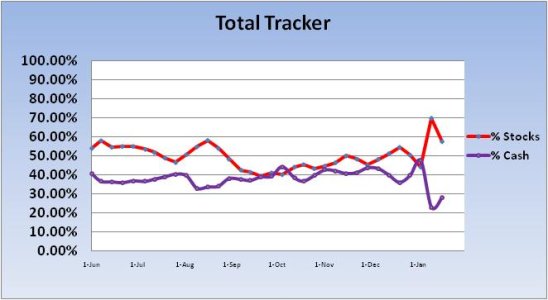

While the Top 50 were pushing more chips into the pot, the Total Tracker shows the herd backed off its stock allocation by more than 10%. Profit taking? Or wary of a mid to late January swoon?

Hmmmm...I see the bond fund went from 4.97% last week to 12.07% this week. Now I know what caused the shift. :laugh:

Total stock allocations for this group are now at 88.6%, with the S fund favored far more than any other fund. That's not much of a surprise since that's been the biggest gainer for some time. But the dollar's strength early on this month held the I fund back, which is why we have very low I fund exposure in this group. But if the dollar can begin to trend lower now, the allocation mix may change.

While the Top 50 were pushing more chips into the pot, the Total Tracker shows the herd backed off its stock allocation by more than 10%. Profit taking? Or wary of a mid to late January swoon?

Hmmmm...I see the bond fund went from 4.97% last week to 12.07% this week. Now I know what caused the shift. :laugh: