As expected, the market broke out to the upside today. It didn't start out fast, but once the rally began, it was a broad-based advance. Volume remained light.

There was a number of data points released today. Initial jobless claims came in at 348,000, which was below estimates. Continuing claims fell rather hard, from 3.53 million to 3.43 million.

Housing starts in January hit 699,000 from 689,000 the previous month. That was above estimates. Building permits were up, posting annualized rate of 676,000. That was about in-line with estimates.

Producer prices for January eked up 0.1%, which was under the 0.3% increase economists were looking for. Core prices rose 0.4%, which was twice estimates.

Also released was February's Philadelphia Fed Survey, which posted a 10.2. That was just a tad above estimates looking for 10.2.

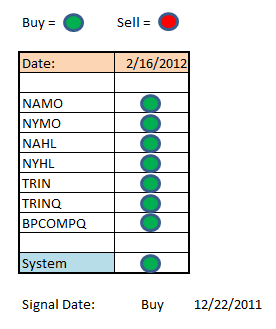

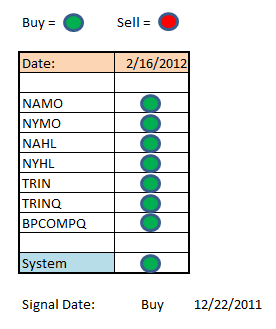

As I've already mentioned, I am changing the Seven Sentinels format.

This new format may change some as I get used to using it, but it will give you a quick look at where the system is at. Please don't be concerned over the lack of commentary. You really don't need it most of the time. I will provide commentary if something gets my attention, but I really need to keep this simple as the system is not complex at all. Of course, if you have any questions, I'll be happy to answer them.

There was a number of data points released today. Initial jobless claims came in at 348,000, which was below estimates. Continuing claims fell rather hard, from 3.53 million to 3.43 million.

Housing starts in January hit 699,000 from 689,000 the previous month. That was above estimates. Building permits were up, posting annualized rate of 676,000. That was about in-line with estimates.

Producer prices for January eked up 0.1%, which was under the 0.3% increase economists were looking for. Core prices rose 0.4%, which was twice estimates.

Also released was February's Philadelphia Fed Survey, which posted a 10.2. That was just a tad above estimates looking for 10.2.

As I've already mentioned, I am changing the Seven Sentinels format.

This new format may change some as I get used to using it, but it will give you a quick look at where the system is at. Please don't be concerned over the lack of commentary. You really don't need it most of the time. I will provide commentary if something gets my attention, but I really need to keep this simple as the system is not complex at all. Of course, if you have any questions, I'll be happy to answer them.