It looks that way. After tracking mostly sideways for days now, the market made a decided turn North today. And I can't argue with the charts either. Let's take a look:

NAMO and NYMO are now hitting fresh multi-week highs. They also remain on buys.

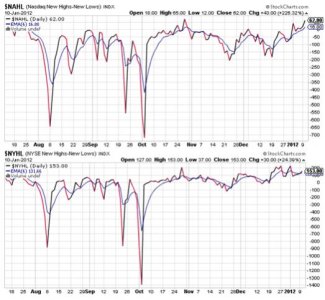

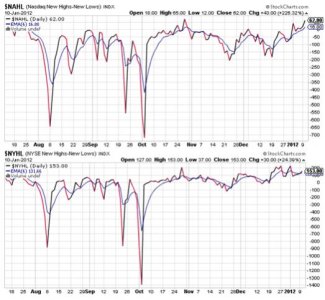

NAHL and NYHL are also on buys with NAHL in particular hitting fresh multi-week highs. NYHL is lagging a bit, but I won't argue with the overall bullish picture here.

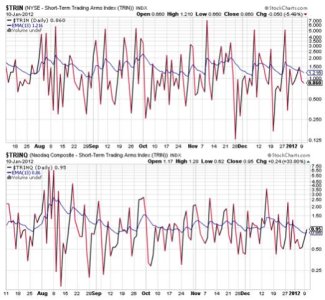

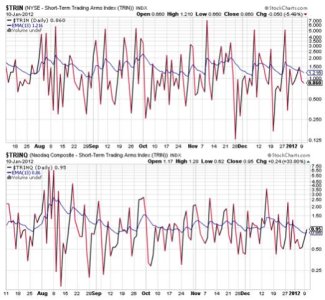

TRIN remains solidly on a buy, while TRINQ just did flip to a sell. Nothing bearish here.

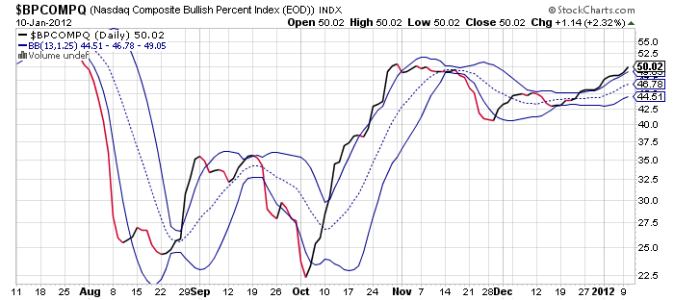

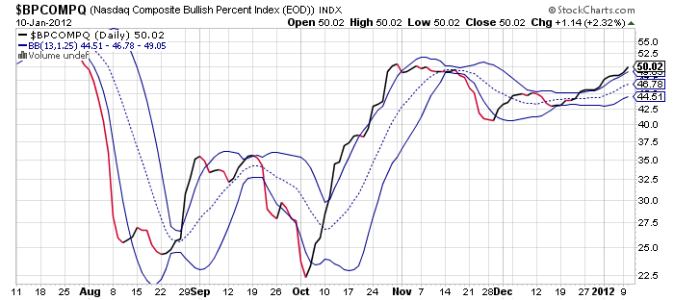

BPCOMPQ continues to lift higher and remains on a solid buy.

So all but TRINQ are sporting buys, which keeps the Seven Sentinels firmly in an intermediate term buy condition.

Yesterday I mentioned that BPCOMPQ's upward move might be a clue to the short term direction of this market.

It was. We broke out to the upside and while I have reservations about this market the charts are quite bullish. I had taken a wait and see approach to begin the new year and now that we've broken out to the upside I feel compelled to take a position in stocks. I executed my first IFT for the month at 100% S fund.

I'm not comfortable with that, but that's probably a good thing. Given the tracker charts showed we only had a collective 39% stock exposure yesterday, I suspect this market will continue to melt up until more bulls get on board, short term weakness notwithstanding.

NAMO and NYMO are now hitting fresh multi-week highs. They also remain on buys.

NAHL and NYHL are also on buys with NAHL in particular hitting fresh multi-week highs. NYHL is lagging a bit, but I won't argue with the overall bullish picture here.

TRIN remains solidly on a buy, while TRINQ just did flip to a sell. Nothing bearish here.

BPCOMPQ continues to lift higher and remains on a solid buy.

So all but TRINQ are sporting buys, which keeps the Seven Sentinels firmly in an intermediate term buy condition.

Yesterday I mentioned that BPCOMPQ's upward move might be a clue to the short term direction of this market.

It was. We broke out to the upside and while I have reservations about this market the charts are quite bullish. I had taken a wait and see approach to begin the new year and now that we've broken out to the upside I feel compelled to take a position in stocks. I executed my first IFT for the month at 100% S fund.

I'm not comfortable with that, but that's probably a good thing. Given the tracker charts showed we only had a collective 39% stock exposure yesterday, I suspect this market will continue to melt up until more bulls get on board, short term weakness notwithstanding.