FogSailing

Market Veteran

- Reaction score

- 61

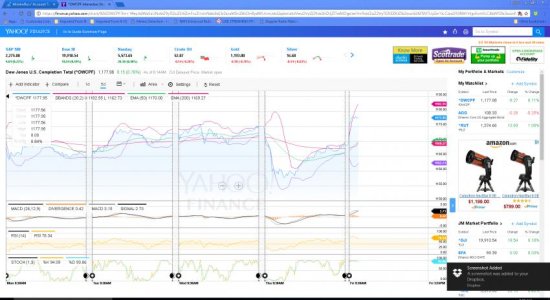

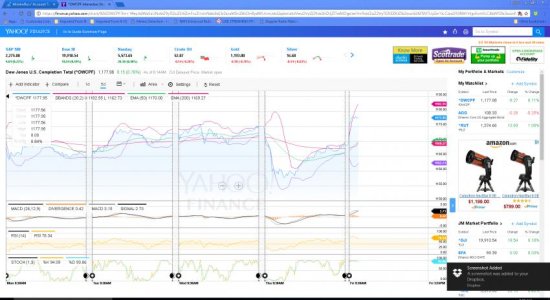

BQ: Here's a 5 Day on DWCPF. Look at how the Bollinger Bands just opened up and the 50 EMA has swung above the 200 EMA. Volume is low so no telling how that will impact the Relative Strength of the Index, but MACD is still positive so at least one indicator says there is some strength in the current price. I haven't checked the Aroon Oscillator or McClellan Oscillator today but they would be helpful because Volume is low. VIX$ looks good BUT Yen is down against the Dollar and Gold and Oil are down. Next week is Options Expiration week and I understand there is a lot of economic activity next week. The market is always looking ahead and the inauguration is next Friday I think. My instinct says beware because so many Mom and Pops are still jumping in. But because volume is low there doesn't appear to be a lot of selling (at least today). I heard through a separate analyst that Oil is supposed to trade down to around $45 before a bounce. It may be headed there. And if it goes down DJI Transportation may be headed up and that would probably be good for DWCPF. Just a guess. No idea how all these things really work. Thanks for your charts. I really enjoy them.

FS

FS