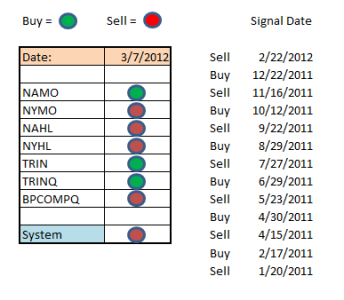

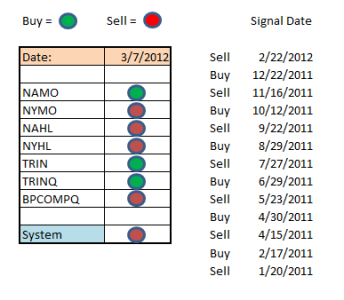

Well, not surprisingly the market retraced some of yesterday's losses. And we may see a bit more upside in the short term, but that doesn't change the intermediate term picture painted by the Seven Sentinels.

Three signals flipped back to buy conditions after today's moderate buying pressure, but it takes all seven to flip back to a buy condition to change the status of the current signal. That means the Seven Sentinels remain in an intermediate term sell condition.

Three signals flipped back to buy conditions after today's moderate buying pressure, but it takes all seven to flip back to a buy condition to change the status of the current signal. That means the Seven Sentinels remain in an intermediate term sell condition.