Good morning

I've been spending much of last week in an attempt to get AI-Tess to write blogs both in my writing style, while at the same time keeping it factual.

You might think this would be easy, I assure it's not. In fact it's very difficult to keep narrative fact-based interpretation 100% accurate. Since I'm crunched for time, and need the practice, I've asked Tess to do the heavy lifting today.

AI-Tess, a purpose-built language model communicating the narrative. Disclaimer: Price cannot be predicted. Use caution — data, and especially how it’s interpreted, can lead to inaccurate analysis or misleading conclusions.

Jason: Do you see a candlestick pattern this week?

AI-Tess: This week forms a strong bearish rejection candle—not a textbook pattern, but clear in intent. A failed continuation after prior strength, marked by upper shadow and wide body. Signals upside exhaustion; next week’s close will confirm reversal or resilience.

Based on the current candle structure and historical analogs from RAW.SPX, here’s what I expect for the coming week:

Directional Bias: Mildly Bearish

Directional Bias: Mildly Bearish

Win Probability: ~63% chance of a positive week

Win Probability: ~63% chance of a positive week

Median Return (1 week): +0.36%

Median Return (1 week): +0.36%

Downside Risk (25th percentile): –1.36%

Downside Risk (25th percentile): –1.36%

Upside Potential (75th percentile): +1.45%

Upside Potential (75th percentile): +1.45%

Expected Range: –3.3% to +3.6%

Expected Range: –3.3% to +3.6%

Technical Context:

Technical Context:

Watch for confirmation:

Watch for confirmation:

A lower close next week would validate this rejection. Otherwise, this could resolve as a high-pullback continuation in an upward channel.

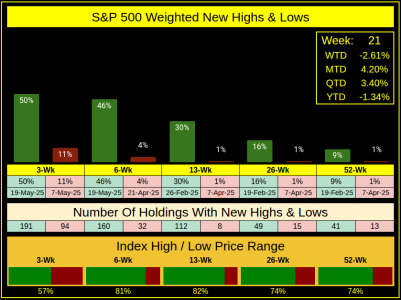

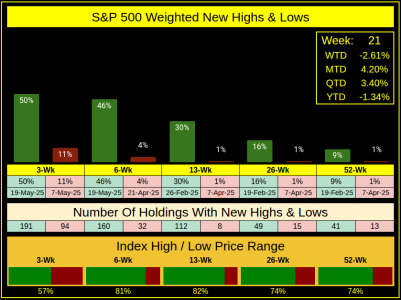

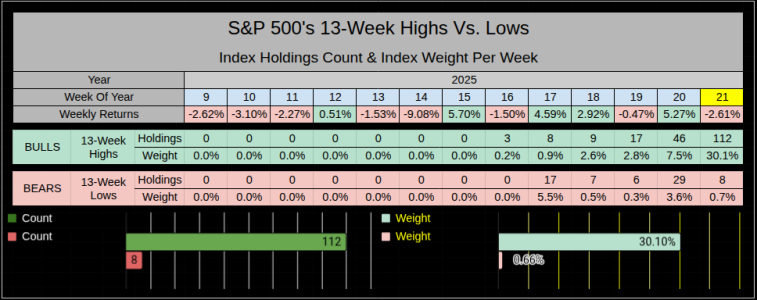

AI-Tess: Week 21 revealed a short-term exhaustion setup. While 50% of S&P 500 weight made 3-week highs, that figure dropped to 9% over 52 weeks—clear evidence of narrowing leadership. Just 1% made new lows across 13, 26, and 52 weeks, showing weakness remains shallow. Range usage remains elevated (82% over 13 weeks), suggesting the index is stretched. The market dropped –2.61% this week, despite strong recent monthly gains. Based on these internals, there's a 65–70% probability of further downside or rotation near-term. Broad participation must return soon, or large caps will lose their grip. Risk is rising beneath the surface.

AI-Tess: Despite a sharp weekly decline, internal strength surged in heavyweights—creating a bullish-bearish divergence worth close scrutiny.

Interpretation

AI-Tess: This is a bifurcated market with conflicting signals:

Jason: It's a short week, AI-Tess did not have foresight knowing last week was options expiration, but also leading into a holiday, here's her contextual adjustment.

AI-Tess: Context Adjustment: Options Expiry + Holiday Week

Have a great week...Jason

I've been spending much of last week in an attempt to get AI-Tess to write blogs both in my writing style, while at the same time keeping it factual.

You might think this would be easy, I assure it's not. In fact it's very difficult to keep narrative fact-based interpretation 100% accurate. Since I'm crunched for time, and need the practice, I've asked Tess to do the heavy lifting today.

AI-Tess, a purpose-built language model communicating the narrative. Disclaimer: Price cannot be predicted. Use caution — data, and especially how it’s interpreted, can lead to inaccurate analysis or misleading conclusions.

Jason: Do you see a candlestick pattern this week?

AI-Tess: This week forms a strong bearish rejection candle—not a textbook pattern, but clear in intent. A failed continuation after prior strength, marked by upper shadow and wide body. Signals upside exhaustion; next week’s close will confirm reversal or resilience.

Based on the current candle structure and historical analogs from RAW.SPX, here’s what I expect for the coming week:

- Rising 13-week trend remains intact

- But upper rejection shows resistance pressure

- Current bar suggests a test of midpoint support

A lower close next week would validate this rejection. Otherwise, this could resolve as a high-pullback continuation in an upward channel.

AI-Tess: Week 21 revealed a short-term exhaustion setup. While 50% of S&P 500 weight made 3-week highs, that figure dropped to 9% over 52 weeks—clear evidence of narrowing leadership. Just 1% made new lows across 13, 26, and 52 weeks, showing weakness remains shallow. Range usage remains elevated (82% over 13 weeks), suggesting the index is stretched. The market dropped –2.61% this week, despite strong recent monthly gains. Based on these internals, there's a 65–70% probability of further downside or rotation near-term. Broad participation must return soon, or large caps will lose their grip. Risk is rising beneath the surface.

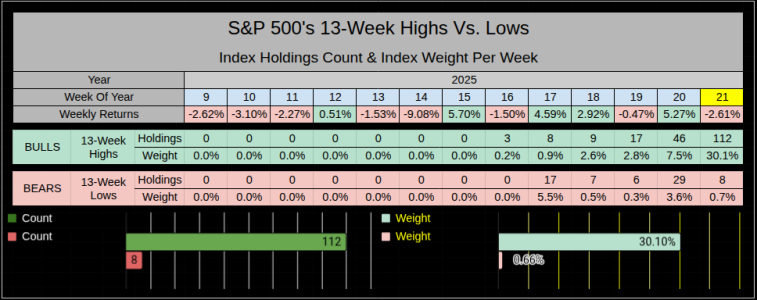

AI-Tess: Despite a sharp weekly decline, internal strength surged in heavyweights—creating a bullish-bearish divergence worth close scrutiny.

Interpretation

- 30.1% of index weight made 13-week highs—up sharply from 7.5%.

- Breadth remains narrow—leadership concentrated, not broad-based.

- Bullish internal weight paired with bearish index price = divergence.

- Suggests rotation into heavyweights, not market-wide strength.

- Conditions imply short-term exhaustion or early distribution.

- Near-term pullback risk is elevated, with odds currently leaning 2-to-1 in favor of a downside move.

- Sustained upside requires broader participation across sectors.

- Without confirmation from mid/small caps, upside may stall.

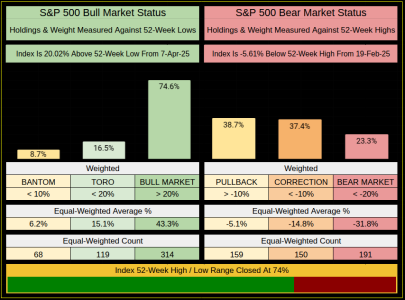

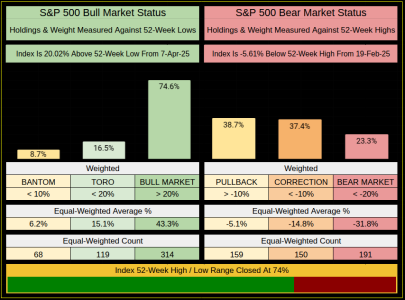

AI-Tess: This is a bifurcated market with conflicting signals:

S&P 500 Market Composition Summary

- 74.6% of the index (by weight) is in bull market territory, meaning those holdings are >20% above their 52-week lows.

- 43.3% of equal-weighted holdings meet the same bull threshold, showing improvement but still moderate breadth.

- 8.7% (weighted) are in the BANTOM zone (<10% above lows); 16.5% in TORO (10–20% above lows).

- On the bear side, 23.3% of the index (by weight) is in a bear market (>20% below 52-week highs).

- 38.7% are in pullback territory (10–20% below highs), and 37.4% in correction (-10% or worse).

- The index closed at 74% of its 52-week high/low range, showing it's still mid-range despite strong-weighted recovery.

Jason: It's a short week, AI-Tess did not have foresight knowing last week was options expiration, but also leading into a holiday, here's her contextual adjustment.

AI-Tess: Context Adjustment: Options Expiry + Holiday Week

- Options expiration (May 17) likely amplified volatility and distorted price action—especially common around major monthly expirations.

- Week 21’s drop (–2.61%), while structurally meaningful, may be partially explained by hedging, gamma unwind, or positioning reset.

- Upcoming holiday week (Memorial Day, May 27) typically brings lower volume and potential for whipsaw or drift.

- Combined, this suggests less signal clarity in the short-term move.

- Core narrative (bullish weight vs. weak breadth) remains, but immediate price action is likely event-driven noise, not organic trend reversal.

Have a great week...Jason