Week 11 saw more selling pressure.

On the weekly timeframe we are still in a downtrend, with 3 clearly defined lower highs & lower lows.

The Index closed just under the 52-Week Moving Average, and the candlestick's lower shadow almost pierced Standard Deviation 3 Support.

Within 63-Years of of Percentile Ranges, Week 11's ATR was Top 15%, Volume Top 10%, & Volume > 13-MA Top 5%

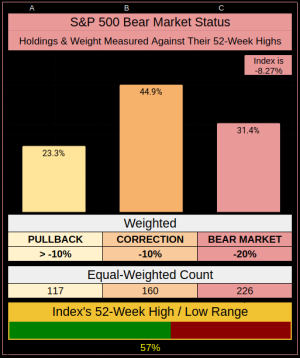

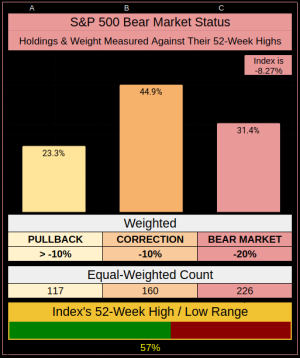

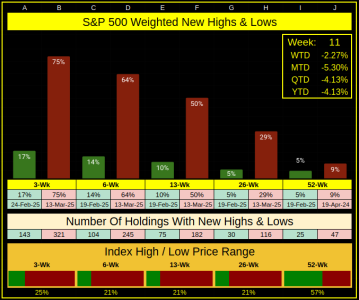

I've heard a lot of talk about the internals of the index being weaker than the index is perceived to be, here's how we stack up by Weight and Holdings.

As of Friday's close, on the 52-Week Scale, the Index is down -8.27%.

By weight 23% of the Index is in a Pullback, 45% in a correction, and 31% in a Bear Market.

By equally-weighted holdings 117 are in a Pullback, 160 in a correction, and 226 in a Bear Market.

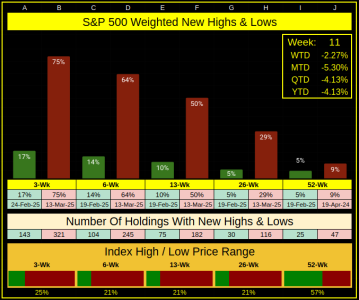

Across multiple time ranges, 13-March gave us a fresh set of lows over the 3/6/13/26-Week timeframes.

In each instance, sellers control both the weight and holdings of the index.

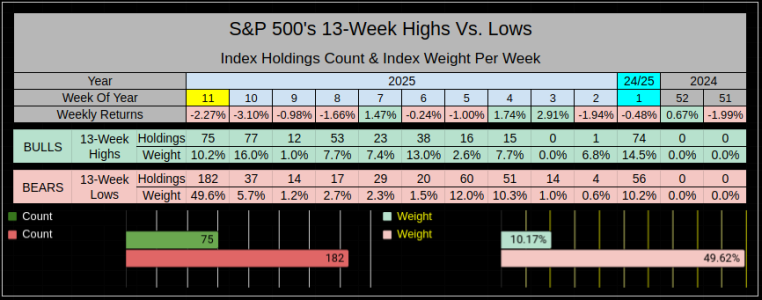

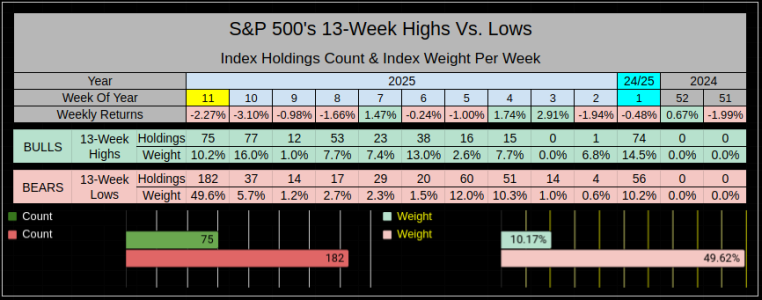

My favorite timeframe is the 13-Week scale, it's short enough to keep it interesting and long enough to cover what's important.

9 or 13 weeks have closed down, here we can see selling weight & holdings for week 11, outpaced previous weeks.

This week we have Options Expiration, is it important?

There are 254 sessions needed to cover 12 Options Expiration +/- 4 sessions before & after.

Average Volume on the last 12 OptX sessions is 3.40B, average Volume on the other 242 Non-Options sessions is 2.51B

So basically Average Volume on OptX has been 35% higher.

Anyhow, have a great week...Jason

On the weekly timeframe we are still in a downtrend, with 3 clearly defined lower highs & lower lows.

The Index closed just under the 52-Week Moving Average, and the candlestick's lower shadow almost pierced Standard Deviation 3 Support.

Within 63-Years of of Percentile Ranges, Week 11's ATR was Top 15%, Volume Top 10%, & Volume > 13-MA Top 5%

I've heard a lot of talk about the internals of the index being weaker than the index is perceived to be, here's how we stack up by Weight and Holdings.

As of Friday's close, on the 52-Week Scale, the Index is down -8.27%.

By weight 23% of the Index is in a Pullback, 45% in a correction, and 31% in a Bear Market.

By equally-weighted holdings 117 are in a Pullback, 160 in a correction, and 226 in a Bear Market.

Across multiple time ranges, 13-March gave us a fresh set of lows over the 3/6/13/26-Week timeframes.

In each instance, sellers control both the weight and holdings of the index.

My favorite timeframe is the 13-Week scale, it's short enough to keep it interesting and long enough to cover what's important.

9 or 13 weeks have closed down, here we can see selling weight & holdings for week 11, outpaced previous weeks.

This week we have Options Expiration, is it important?

There are 254 sessions needed to cover 12 Options Expiration +/- 4 sessions before & after.

Average Volume on the last 12 OptX sessions is 3.40B, average Volume on the other 242 Non-Options sessions is 2.51B

So basically Average Volume on OptX has been 35% higher.

And for next week we have Options Expiration which may prove to be the catalyst we need to throw in an exhaustive top or bottom.

From the last 12, it would appear the Day prior to OptX (Thursday) has the lowest win ratio.

View attachment 68369

Anyhow, have a great week...Jason