♗ Weekly Recap

Overview: Risk-on: equities rose with SPX, NDX, and transports green; leadership was modestly narrow, but participation improved in cyclicals. Rates eased, the dollar softened, and volatility fell; real estate and consumer discretionary drew bids while financials lagged.

• • Key Takeaway: Watch long-end yields: further easing would confirm risk-on and keep real estate and growth in charge.

"Markets chose rates-led risk: stocks climbed as yields fell and the dollar eased; gold rode lower real yields, while Bitcoin slipped on 200-day selling."

$↗︎ Net Flows $↘︎ — Wednesday Series

● Fund Inflows — Wednesday Series

● Equity (mutual funds): Near vs 4-wk median −$25.47B (week ended Oct 08, 2025) ici.org. ICI

● Bonds (mutual funds): Above vs 4-wk median +$10.54B total; +$10.17B taxable; +$0.37B muni (week ended Oct 08, 2025) ici.org. ICI

● ETFs (net issuance): Near — +$39.55B (week ended Oct 08, 2025) ici.org. ICI

● Combined (MF + ETF): Net inflows +$23.23B (week ended Oct 08, 2025) ici.org. ICI

● Money Market Funds: Down w/w −$17.75B to $7.37T (week ended Oct 15, 2025) ici.org. ICI

● ● Key Takeaway: Equity MF outflows persisted; bond MF inflows strengthened; ETF flows were steady; cash balances ticked lower. ICI×3

● ● ● Compared to last week: equity MF outflows worsened; bond MF inflows strengthened; ETF inflows softened; cash inflows slowed. ici.org+2ici.org+2

● Key Takeaway: If yields ease again, expect real estate and growth to extend gains.

Leaders & Relative Holds

● Bias: Risk-on. Mid-pack helped, defensives mixed; small caps and cyclicals improved late in the week.

● Breadth: Participation widened; cyclicals lagged less while financials underperformed.

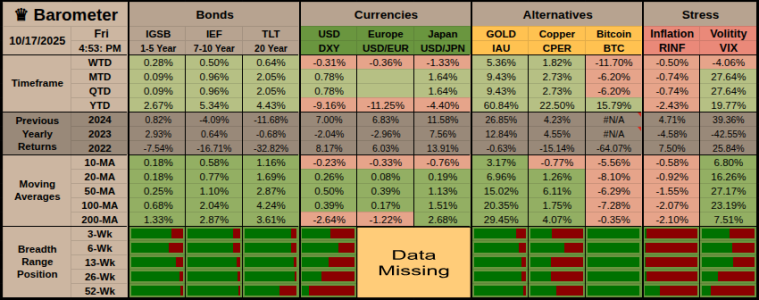

♛ Barometer

Weekly Overview: Bonds firmed while gold rallied; the dollar slipped and volatility fell. Crypto slumped; industrial metals held up.

● Key Takeaway: Rates, dollar, and vol read risk-on; a softer dollar with calm vol would lift global risk further.

Hedges & Risk Bias

● Bias: Risk-on. The curve bull-steepened in long duration; gold outpaced industrials; inflation expectations eased; a softer USD supported non-US risk.

● Breadth: Safety trades mixed; cyclic proxies firm; participation tilted to offense.

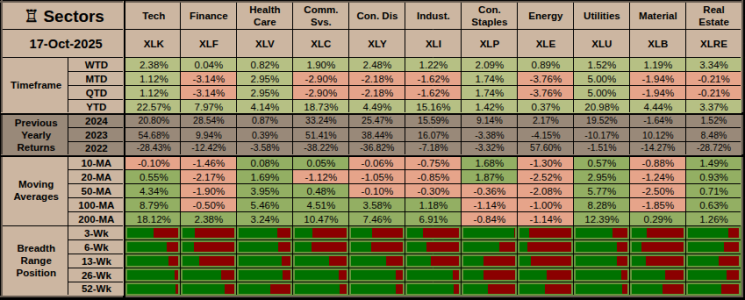

♖ Sectors & Rotation

Weekly Sector Overview: Cyclicals outperformed; breadth was mixed as real estate led and financials lagged.

• Key Takeaway: Another dip in yields would keep rate-sensitives on top and improve banks only if curves steepen.

Offensive Assets

● Top WTD gainers: XLRE +3.34%, XLY +2.48% — yield relief and consumer strength.

● Breadth/outperformance: Cyclicals > SPX; participation widened.

Defensive Assets

● Standout hedge/defense: XLU +1.52% — lower yields aided utilities.

● Safety tone or drag: Financials lagged as XLF +0.04% trailed; energy’s XLE +0.89% underperformed.

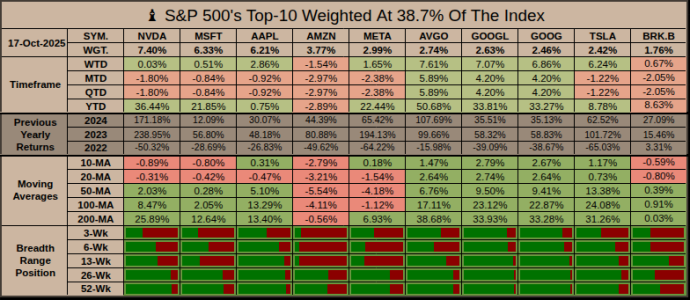

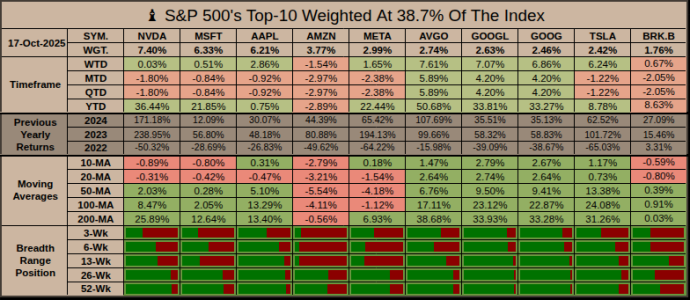

♗ S&P 500’s Weighted Top-10

Overview: Mixed-to-strong: seven of ten advanced; dispersion widened on large gains in search and semis.

● Key Takeaway: Leadership broadened beyond one or two mega caps, a healthier tone for the tape if it persists.

Offensive Leaders

● Winners: AVGO +7.61%, GOOGL +7.07%/GOOG +6.86% — AI and ad momentum.

● Secondary: TSLA +6.24% and AAPL +2.86% added breadth.

Defensive Laggards

● Decliners: AMZN −1.54%; NVDA +0.03% lagged relative.

● Drag: retailers paused; semis were mixed, but software and search strength dominated breadth.

Net Flow Breadth Score (NFBS)

● NFBS Range: −7 to +7 signal

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

Have a great week...Jason

Overview: Risk-on: equities rose with SPX, NDX, and transports green; leadership was modestly narrow, but participation improved in cyclicals. Rates eased, the dollar softened, and volatility fell; real estate and consumer discretionary drew bids while financials lagged.

• • Key Takeaway: Watch long-end yields: further easing would confirm risk-on and keep real estate and growth in charge.

"Markets chose rates-led risk: stocks climbed as yields fell and the dollar eased; gold rode lower real yields, while Bitcoin slipped on 200-day selling."

$↗︎ Net Flows $↘︎ — Wednesday Series

● Fund Inflows — Wednesday Series

● Equity (mutual funds): Near vs 4-wk median −$25.47B (week ended Oct 08, 2025) ici.org. ICI

● Bonds (mutual funds): Above vs 4-wk median +$10.54B total; +$10.17B taxable; +$0.37B muni (week ended Oct 08, 2025) ici.org. ICI

● ETFs (net issuance): Near — +$39.55B (week ended Oct 08, 2025) ici.org. ICI

● Combined (MF + ETF): Net inflows +$23.23B (week ended Oct 08, 2025) ici.org. ICI

● Money Market Funds: Down w/w −$17.75B to $7.37T (week ended Oct 15, 2025) ici.org. ICI

● ● Key Takeaway: Equity MF outflows persisted; bond MF inflows strengthened; ETF flows were steady; cash balances ticked lower. ICI×3

● ● ● Compared to last week: equity MF outflows worsened; bond MF inflows strengthened; ETF inflows softened; cash inflows slowed. ici.org+2ici.org+2

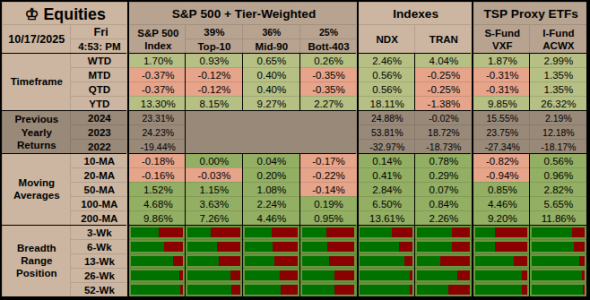

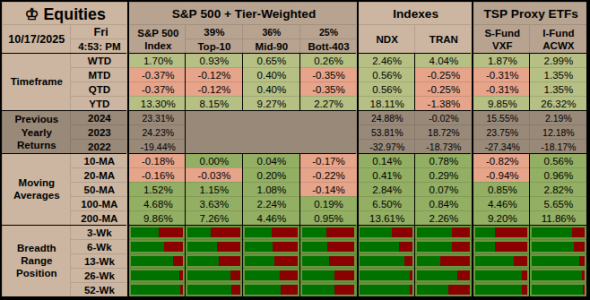

♔ Equities

Weekly Overview: Risk-on week: equities rose and leadership narrowed slightly. Real estate and consumer discretionary cushioned while financials trailed.● Key Takeaway: If yields ease again, expect real estate and growth to extend gains.

Leaders & Relative Holds

● Bias: Risk-on. Mid-pack helped, defensives mixed; small caps and cyclicals improved late in the week.

● Breadth: Participation widened; cyclicals lagged less while financials underperformed.

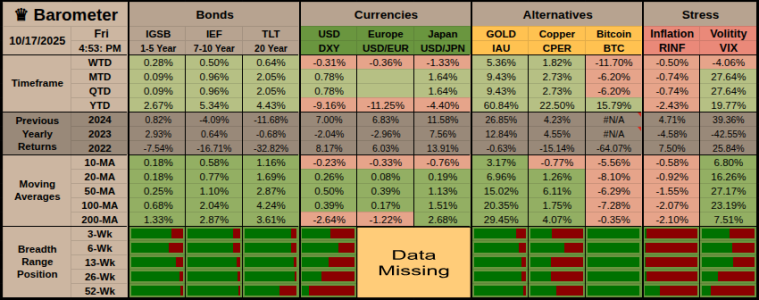

♛ Barometer

Weekly Overview: Bonds firmed while gold rallied; the dollar slipped and volatility fell. Crypto slumped; industrial metals held up.

● Key Takeaway: Rates, dollar, and vol read risk-on; a softer dollar with calm vol would lift global risk further.

Hedges & Risk Bias

● Bias: Risk-on. The curve bull-steepened in long duration; gold outpaced industrials; inflation expectations eased; a softer USD supported non-US risk.

● Breadth: Safety trades mixed; cyclic proxies firm; participation tilted to offense.

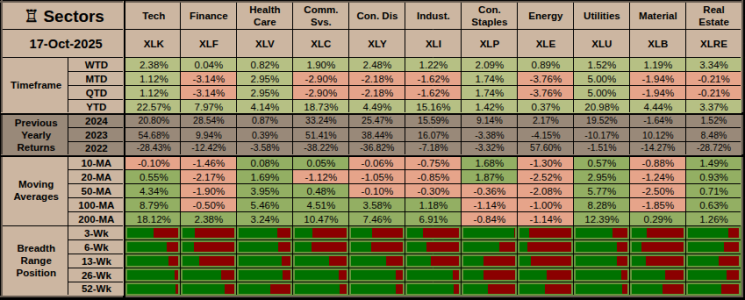

♖ Sectors & Rotation

Weekly Sector Overview: Cyclicals outperformed; breadth was mixed as real estate led and financials lagged.

• Key Takeaway: Another dip in yields would keep rate-sensitives on top and improve banks only if curves steepen.

Offensive Assets

● Top WTD gainers: XLRE +3.34%, XLY +2.48% — yield relief and consumer strength.

● Breadth/outperformance: Cyclicals > SPX; participation widened.

Defensive Assets

● Standout hedge/defense: XLU +1.52% — lower yields aided utilities.

● Safety tone or drag: Financials lagged as XLF +0.04% trailed; energy’s XLE +0.89% underperformed.

Rotation & Odds (4–6 Weeks)

| Aspect | State | Evidence / Notes |

|---|---|---|

| Cycle Map | Early ⟳ Mid ⟳ Late ⟳ Contraction | Ordered sequence for rotation framing. |

| Primary Stage | Early | Cyclicals led; trend firm; breadth early tilt. |

| Alternate Stage | Mid | Mixed spread; trend mixed; breadth neutral. |

| Confidence | High | Timeframe and Trend lenses Neutral; Breadth lens Mid. |

Path Probabilities

| Scenario | Probability | What Tips It |

|---|---|---|

| 51% | Carry if rates ease and breadth holds. | |

| 29% | Range if yields stall near recent lows. | |

| 20% | Risk-off if yields back up and dollar firms. |

♗ S&P 500’s Weighted Top-10

Overview: Mixed-to-strong: seven of ten advanced; dispersion widened on large gains in search and semis.

● Key Takeaway: Leadership broadened beyond one or two mega caps, a healthier tone for the tape if it persists.

Offensive Leaders

● Winners: AVGO +7.61%, GOOGL +7.07%/GOOG +6.86% — AI and ad momentum.

● Secondary: TSLA +6.24% and AAPL +2.86% added breadth.

Defensive Laggards

● Decliners: AMZN −1.54%; NVDA +0.03% lagged relative.

● Drag: retailers paused; semis were mixed, but software and search strength dominated breadth.

Net Flow Breadth Score (NFBS)

● NFBS Range: −7 to +7 signal

- MF: outflow → −1.

- ETF: inflow → +1.

- Combined: inflow → +1.

- Money markets: down → +1.

- Breadth: Top-10 > Mid-90 → −1.

- Rates: long duration up → +1.

- Dollar and vol: both down → +1.

| Scenario | Probability | Evidence (Weekly-Based) |

|---|---|---|

| 45% | Long yields eased. DXY slipped. VIX fell. XLRE and XLY led. Transports outperformed. ETFs and combined flows were positive. Money-market assets fell. | |

| 35% | Leadership was a bit narrow. XLF lagged on the curve. Mid-90 trailed SPX. Top-10 was mixed. Bitcoin stayed heavy at the 200-day. | |

| 20% | Reversal risk if yields back up or the dollar firms. Financials remain fragile. Recent winners look stretched. Low vol can rebound quickly. |

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

Have a great week...Jason

Attachments

Last edited: