Time: 2025-10-26 08:16 (ET)

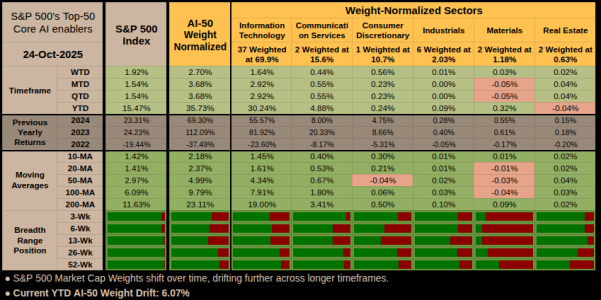

AI-50 Definition: A hand-crafted index of S&P 500 AI enablers, with S&P market-cap weights normalized into a single, trackable benchmark.

Note: The AI-50 Bubble Brief is a preliminary overview of how AI enablers are rotating, tracking chips, platform, and infrastructure leaders. This is a rough overview, (time permitting) I hope more features will be added. My primary interest is not with investing in these individual stocks, but with watching their impact on the markets.

AI-50 Sectors & Rotation

MTD Recap: AI-50 outpaced the S&P 500 as semis powered gains. Breadth improved, but leadership stayed focused on chips and platforms.

Weekly Sector Overview: Cyclicals led, anchored by Tech; Industrials and REITs lagged with small gains, keeping tone constructive.

• Key Takeaway: Watch semis and rates; continued chip strength plus calm yields confirms risk-on, weakness flips tone to mixed.

Offensive Assets: Information Technology +1.64%, Consumer Discretionary +0.56% — semis and AMZN carried risk tone.

Defensive Assets: Industrials +0.01%, Real Estate +0.02% — infra paused as cyclicals drew flows.

4–6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

Primary: Mid - spread favors Mid over Early, trend steady above 10/20-MA, breadth improving.Early: Broad thrust — Tech, Comm, Disc lead

Mid: Consolidation — Tech steady, Industrials rotate in

Late: Narrow carry — Industrials, Materials hold trend

Contraction: Defensive turn — REITs stabilize, Tech fades

Alternate: Early - semis thrust, hyperscale steady, pullbacks bought.

Confidence: High — Time, Trend, Breadth align on Mid with Early tilt.

Horizon: structural 4–6 weeks (the rotation engine’s window).

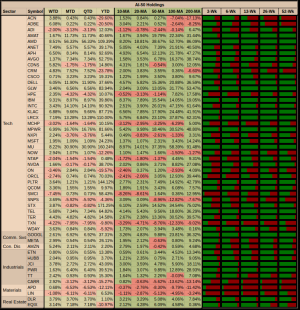

MTD Top 5 Winners: AMD (+56.33%), MU (+30.90%), MPWR (+16.76%), INTC (+14.10%), LRCX (+13.28%)

MTD Top 5 Losers: TXN (−7.95%), APD (−6.53%), LIN (−6.11%), SNPS (−5.92%), HPE (−4.32%)

Information Technology: Semis in control; AMD, MU, MPWR, INTC, LRCX lead as TXN, SNPS, HPE lag; tone stays risk-on.

Communication Services: Search steadies the group; GOOGL lifts tone while META trails; rotation reads Mid with Early tilt.

Consumer Discretionary: Single-engine push from AMZN; follows Tech momentum; breadth modest but constructive.

Industrials: Grid and thermal mixed; PWR firm, JCI steady, CARR drags; participation uneven.

Materials: Gases weak; APD and LIN both down; defensive tone persists.

Real Estate: DC REITs rebound; EQIX and DLR firm as yields ease.

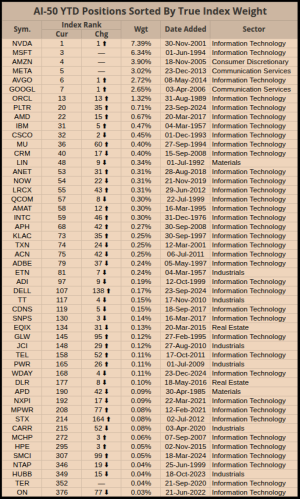

YTD S&P 500’s Tier-Weighted: Rank & Weight Changes

Overview: Top-weight cluster stayed decisive; big climbers broadened leadership while select software and gases lagged.

● Key Takeaway: Heavyweights still set direction; rising climbers add depth to the advance.

● Participation widened across semis and select infra; lag persisted in Materials.

AI-50 — Scenario • Probability • Evidence (conditional)

Horizon: Scenario odds reflect the next 5–10 trading days

• Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

Last edited: