-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Birchtree's Account Talk

- Thread starter Birchtree

- Start date

Birchtree

TSP Talk Royalty

- Reaction score

- 143

My oceanic account has paid the price of the last five weak trading days - so another two days would be purrfect because I have many dividends due tomorrow and lower pricing would be golden - I need to collect as many shares as possible. This pattern will be repeated again in December for even more income. So I'll take what the market provides - it would be nice to see a few more dividend increase announcements during the last quarter.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

"Stock market selling to unwind continues and that's really good news if you're bullish on the market."

http://www.marketoracle.co.uk/Article36745.html

http://www.marketoracle.co.uk/Article36745.html

Birchtree

TSP Talk Royalty

- Reaction score

- 143

Here is what the oceanic did this week: -$22K, -$85K, -$36K, +$51K, -$26K for a devaluation of -$118K. I had high hopes at the beginning of the month for a +$400K September moment - of course it didn't work out that way. Here is what happened on a weekly basis: #1/+$179K, #2/+$200K, #3/-$108K, #4/-$118K for a monthly gain of +$153K - I guess I should be satisfied with the golden dividend prices I got. Now I have the opportunity to look forward to October and I'll just accept what the market wants to give me. Not all is lost - I'm still ahead by +$494K on the year with three months to go. Let the bull stampede. I would also mention that I've taken a profit for tax purposes of +$109K and that money has been reinvested and I don't plan to take any more profits until 2013.

Intrepid_Timer

TSP Talk Royalty

- Reaction score

- 78

"Stock market selling to unwind continues and that's really good news if you're bullish on the market."

http://www.marketoracle.co.uk/Article36745.html

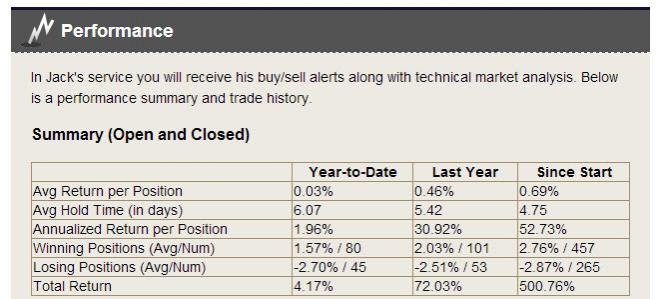

I'd listen to what this guy has to say! Subscribers are paying him $139.95 per month and by looking at his returns, they must be paying for his analysis.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

Would anyone like to see what my oceanic account has done on a monthly basis: Jan/+$283K, Feb/+$128K, Mar/+$30K, Apr/-$44K, May/-$427K, June/+$286K, July/-$27K, Aug/+$112K, Sept/+$153K. As you can see last May was the heavy hit and I prefer not to have one of those again anytime soon - but you never know. I'm more concerned with building an income stream that will more than out live me. Money is like the tides - it flows out and it flows in - the income is fairly stable and increasing as time rolls on. I've had 103 dividend increase announcements so far this year and would hope to see a few more in the fourth quarter and then we can start again in 2013. If we are in the early stages of another mega trend secular bull market money will come fast and furious. The rule is that it takes money to make money and it takes a long time to build that initial base - that's why it takes a working career to get a hefty TSP account. Just keep accumulating shares rain or shine.

Aitrus

TSP Strategist

- Reaction score

- 5

That's where I'm at. I'm counting my daily and weekly ups and downs in the hundreds of dollars. Now I've got a goal to really aspire to!

Goals:

1 - Retire with at least 2 million in TSP - 28 years from now. That would put me at 60 years old, and I would be collecting my ANG retirement, civil service retirement, and TSP payouts. Social Security I'm not counting on to be around then. If it is, then that's gravy on top.

2 - Current allocation is 10% of pay every paycheck - aim to get up to 20% by 2018. This doesn't include the 5% matching.

3 - Average 10% gain in TSP holdings per year, not counting allocations.

Goals:

1 - Retire with at least 2 million in TSP - 28 years from now. That would put me at 60 years old, and I would be collecting my ANG retirement, civil service retirement, and TSP payouts. Social Security I'm not counting on to be around then. If it is, then that's gravy on top.

2 - Current allocation is 10% of pay every paycheck - aim to get up to 20% by 2018. This doesn't include the 5% matching.

3 - Average 10% gain in TSP holdings per year, not counting allocations.

Danny

TSP Strategist

- Reaction score

- 15

Birchtree, is this the running total you have on account at the end of each month or the amount your account increased or decreased each month? If it is the first scenario is true, this Sunday you would have a total of $153k in your acct. If it is the later scenario, you would have $494k...starting October 1st. Hope its the later!

Danny

Danny

Birchtree

TSP Talk Royalty

- Reaction score

- 143

The $494K is the running tally for the last nine months with three more months for gains or give backs - I strongly suspect to make gains. I don't plan to do any more selling unless the back office margin girls give me a call - I'm just going to ride the bull for the rest of the year and see what happens. If I can pull down another +$300K I'd be stinky happy. Now you must remember what I showed you were numbers at the end of each month and the running tally is not the account long market value - just the monthly value changes. The long market value currently is above $4M - I'll be happy when I get to $5M.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

"What is the dry bulk shipping industry BDI index saying?"

http://www.marketoracle.co.uk/Article36761.html

http://www.marketoracle.co.uk/Article36761.html

burrocrat

TSP Talk Royalty

- Reaction score

- 162

you know they're just going to tax it all away from you before you ever can utilize all that value? for xmas i'm going to buy you a camel. then you can practice fitting it through the eye of a needle in your spare time. the inevitable monetary revaluation is gonna hurt you more than it is me.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

Birchtree

TSP Talk Royalty

- Reaction score

- 143

burrocrat,

I have sublime confidence that Romney will win and there won't be another Democrat in high office for the next twelve years if not longer. There are going to be some much better days ahead and I want to remain fully invested because I know what is coming my way.

I have sublime confidence that Romney will win and there won't be another Democrat in high office for the next twelve years if not longer. There are going to be some much better days ahead and I want to remain fully invested because I know what is coming my way.

burrocrat

TSP Talk Royalty

- Reaction score

- 162

the funny part is that it doesn't matter who wins. there's too much money out there. stocks aren't really gaining, just keeping pace while bond (fixed income - retirees) holdings slide backwards. that's the part i don't understand. tarp, qe1, qe2, and now qe3. every liquidity injection props up the market while a lifetime of savings is being destroyed. and nobody seems to care. has it come to this then? we are too dejected to even squeal when they stick it to us anymore? instead we giggle like school children given some paper trinket?

Similar threads

- Replies

- 2

- Views

- 532

- Replies

- 0

- Views

- 119