-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Birchtree's Account Talk

- Thread starter Birchtree

- Start date

Bquat

TSP Talk Royalty

- Reaction score

- 715

Like this?Up symmetry is the opposite of the down move we experienced in May - it surely is tracking closely. Check out that bottom and the consequent up moves in both the Dow and SPX.

Handballer

Market Veteran

- Reaction score

- 12

Hi Birch. Wondering how many monitors you use with your computer all the time. I image its like a desk of a broker on the Chicage stock exchange.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

I'm just a simple investor, nothing sophisticated. I use one Toshiba satellite. The secret to my sucess goes to my investment adviser, Mindylou. She does all the research and lines up the selection of wall flowers. And of course age may make a difference - I've seen a lot of investment water flow under my bridge following some equities for many years. I think we just experienced a false breakdown below the SPX 200 day. It never created any fear here. Now when the VIX gets back to 14 will be the time to get nervous, again.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

I asked Mindylou this morning why she never recommends selling - she said I'm a hoarder of equities and should never sell my stuff. She may be right of course. The only time lately I sell equity is when my hands are tied and I'm looking down the barrel of a margin call - that could be a small blessing. I know I make the IRS happy. I don't know if today has the potential to be momentus or not - I'm just going to relax and enjoy doing nothing while my balances shift around. Snort.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

- Reaction score

- 821

The VIX has moved back into negative territory at 18.08 -0.30. QE3 is still on the front burner. We could rally steeply in the next couple of hours.

Right now under 18. What a difference an hour makes. Almost a 7% shift.

Please Mr. Custer could I have a 300 point Dow day? We had one of those two weeks ago so let's have another. I've made the comment this could be a colossal week for gains - sure would like to be right for once.

Custer's scalped body has too many arrows in it to answer you today .....but you still might get your 300 points.....in the other direction. Tomorrow - and especially next week - doesn't look better and could be much worse.

Different paths to the same negative return - not planning to follow you this year

Yup - life in the hedgerows of negatory for us knows no bound:

We can talk smack at each other all we want - but in the end of last year - we both ralphed up negatory 7% last annum; tho in very different paths; you peed away huge early returns from the tsunami call in march, via trader's block which continues. I played the Egypt to begin up 2+%, and crapped them away in the summer bottom; scared to death, I stayed away from the end-of-year rally (which I didn't believe then, and don't now).

So those who make mistakes are bound to repeat them? maybe you - but not me. Once again, your huge return from holding I-fund; gone with the wind. Me? gone conservative; and happy to beat the G-fund.

In fact, if you can guarantee me a 5% return in the G-fund; there will be far fewer complaints about the IFT limit, at least from me.

This year? who knows - it would have been great to beat the G-fund, but it's almost more satisfying beating your -7% with my -6.8%.

Yup - life in the hedgerows of negatory for us knows no bound:

We can talk smack at each other all we want - but in the end of last year - we both ralphed up negatory 7% last annum; tho in very different paths; you peed away huge early returns from the tsunami call in march, via trader's block which continues. I played the Egypt to begin up 2+%, and crapped them away in the summer bottom; scared to death, I stayed away from the end-of-year rally (which I didn't believe then, and don't now).

So those who make mistakes are bound to repeat them? maybe you - but not me. Once again, your huge return from holding I-fund; gone with the wind. Me? gone conservative; and happy to beat the G-fund.

In fact, if you can guarantee me a 5% return in the G-fund; there will be far fewer complaints about the IFT limit, at least from me.

This year? who knows - it would have been great to beat the G-fund, but it's almost more satisfying beating your -7% with my -6.8%.

Handballer

Market Veteran

- Reaction score

- 12

Hi Birch. Wondering how many monitors you use with your computer all the time. I image its like a desk of a broker on the Chicage stock exchange.

Just kidding. Wish I had an advisor like Mindylou. All I have is myself and I'm my worst ememy.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

I've now received 81 dividend increase announcements so far this year - will there be more rolling down the rails. I currently have 36 dividends due to be paid before the month of June ends - that means I'm buying all the time with a DCA strategy into my base. Yesterday was not nice, but I'm tolerant.

can-kicking just won't last forever...

scortched; bortched.....I used to be a believer in the boogey man.....witnessing your precipitous decline after chiding me about my fallen rank; but no more. And if I'm putting the boogey on myself.....then you should benefit and thank me.

But let's be real.....sure....a smidge of the deadcat today is likely....but not a scortcher [I like your spelling, some russian in there, I suppose].....this is summertime. Stimulatory ammo has run out....and all's that's left is the widespread reality check, the fiscal cliff becoming a reality....and we all will just have to deal with it.

That means higher taxes - beginning with the sunsetting of the cap gains tax cut no matter who gets elected. Low interest rates will buoy equities to some extent as long as they last - but in the final analysis - interest rates must rise to provide incentive to banks and holders of notes, and as the safe but fair alternative return to equities they were intended to be.

I know the Fed, and central banks, have kicked the can down the road for what now? 4 years? but can-kicking just won't last forever.

amoeba out.

amoeba,

We are very close on the tracker. I'm at #542 with +1.30%. You are #547 at 1.22%. Tomorrow you are going to get scortched so be careful.

scortched; bortched.....I used to be a believer in the boogey man.....witnessing your precipitous decline after chiding me about my fallen rank; but no more. And if I'm putting the boogey on myself.....then you should benefit and thank me.

But let's be real.....sure....a smidge of the deadcat today is likely....but not a scortcher [I like your spelling, some russian in there, I suppose].....this is summertime. Stimulatory ammo has run out....and all's that's left is the widespread reality check, the fiscal cliff becoming a reality....and we all will just have to deal with it.

That means higher taxes - beginning with the sunsetting of the cap gains tax cut no matter who gets elected. Low interest rates will buoy equities to some extent as long as they last - but in the final analysis - interest rates must rise to provide incentive to banks and holders of notes, and as the safe but fair alternative return to equities they were intended to be.

I know the Fed, and central banks, have kicked the can down the road for what now? 4 years? but can-kicking just won't last forever.

amoeba out.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

Re: can-kicking just won't last forever...

amoeba,

You forgot to mention the impact the crude bear market will have on gasoline prices and the consumer. I'm just going to continue my crusade of wall flower rescue - the more I save the more I'll eventually benefit. Watching the technical levels - in a blink of an eye we could be up 10%.

amoeba,

You forgot to mention the impact the crude bear market will have on gasoline prices and the consumer. I'm just going to continue my crusade of wall flower rescue - the more I save the more I'll eventually benefit. Watching the technical levels - in a blink of an eye we could be up 10%.

ILoveTDs

TSP Analyst

- Reaction score

- 10

Re: can-kicking just won't last forever...

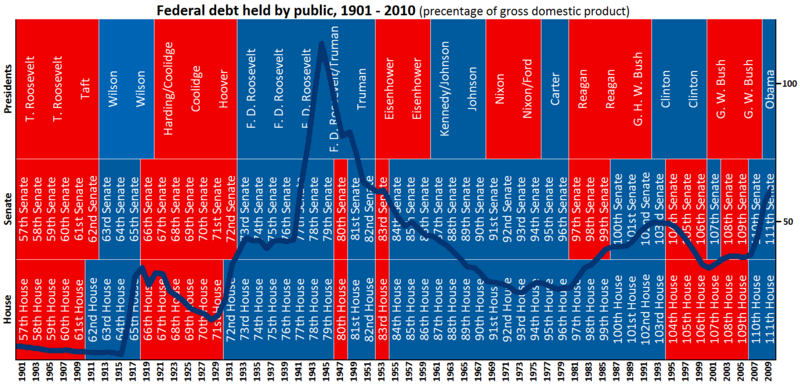

Try the last 100+ years. Our national debt directly correlates with the federal income tax established in 1913. You give the government money they will spend it, look at the EU.

Small government having the purse strings works best. I can talk to my mayor, governor, etc. and if they had the $$ and not the federal gov, they would have more power. Thus vicariously I would have more power over my tax dollars. How it sits now Barbara Boxer could care less on blowing my tax dollars on bull s**t.

Once the EU falls all these countries will all be better off. All Europeans will have more control over their fiscal policy, which will be better off for them

I know the Fed, and central banks, have kicked the can down the road for what now? 4 years? but can-kicking just won't last forever.

amoeba out.

Try the last 100+ years. Our national debt directly correlates with the federal income tax established in 1913. You give the government money they will spend it, look at the EU.

Small government having the purse strings works best. I can talk to my mayor, governor, etc. and if they had the $$ and not the federal gov, they would have more power. Thus vicariously I would have more power over my tax dollars. How it sits now Barbara Boxer could care less on blowing my tax dollars on bull s**t.

Once the EU falls all these countries will all be better off. All Europeans will have more control over their fiscal policy, which will be better off for them

Similar threads

- Replies

- 2

- Views

- 530

- Replies

- 0

- Views

- 111