-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Birchtree's Account Talk

- Thread starter Birchtree

- Start date

Birchtree

TSP Talk Royalty

- Reaction score

- 143

Re: Birchtree's account talk

A few more nibble dollars down the deep well: TRW, AME, ALB, CBI, VHI, JCI, RES. I used to think making $100K a week was real good money - today I'm up +$103K - hope I can hold on to it into the close. This rally has the potential to really explode because of so much myopic loss aversion in the arena.

A few more nibble dollars down the deep well: TRW, AME, ALB, CBI, VHI, JCI, RES. I used to think making $100K a week was real good money - today I'm up +$103K - hope I can hold on to it into the close. This rally has the potential to really explode because of so much myopic loss aversion in the arena.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

Re: Birchtree's account talk

JamesE,

This market can drop a hundred points in a flash or bound forward 100 points to over 300 on the Dow. I'm running with the bulls because there is so much positive type numbers out there - you just have to look for them.

JamesE,

This market can drop a hundred points in a flash or bound forward 100 points to over 300 on the Dow. I'm running with the bulls because there is so much positive type numbers out there - you just have to look for them.

- Reaction score

- 821

BT, Do you think this is end of the quarter window dressing? These 7 percent rally's are becoming commonplace and are being sold regularly. I'm afraid of taking the money and running when I think 1 of these rally's will stick. Thoughts?

Maybe building into a 4th quarter surge. Christmas stuff on the store shelves already.

Last edited:

Bquat

TSP Talk Royalty

- Reaction score

- 715

Maybe building into a 4th quarter surge. Christmas stuff on the store shelves already.

Yea, I guess Howlaween is a flop. Lowes is already moving it to the back shelf and making room for Thanksgiving and Christmas. They're starting the setups now so they can get them arranged befor black friday without seasonal hires.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

I'm waiting on the rocket boosters to kick in when we get over +300 Dow points - fear should be aggressively bought, never sold. "How the market behaves between 1230 and 1260 will go a long way in helping sort out the debate between the bulls and the bears. If the S&P 500 barrels through these levels in impressive fashion, it would obviously be a win for the bulls. If a down reversal does occur, the manner in which the market comes down will be very important. If we see a pull back on weaker volume, then it may represent a good entry point for bullish positions. If the reversal is swift, backed by volume, and negative market breadth, then the bearish case will remain firmly intact."

- Reaction score

- 2,450

I'm waiting on the rocket boosters to kick in when we get over +300 Dow points

We should know by now that just the act of saying something publicly, guarantees the opposite will be true.

http://www.youtube.com/watch?v=vE-cMavkmcY

Birchtree

TSP Talk Royalty

- Reaction score

- 143

"53% of stocks are trading for less than 12 times earnings, the most stocks selling so cheap since late 2008."

http://theguruinvestor.com/2011/09/26/j-p-morgan-strategist-ideal-buying-time-may-be-near/

http://theguruinvestor.com/2011/09/26/j-p-morgan-strategist-ideal-buying-time-may-be-near/

RealMoneyIssues

TSP Legend

- Reaction score

- 101

And they're about to get cheaper..."53% of stocks are trading for less than 12 times earnings, the most stocks selling so cheap since late 2008."

http://theguruinvestor.com/2011/09/26/j-p-morgan-strategist-ideal-buying-time-may-be-near/

jkenjohnson

Market Veteran

- Reaction score

- 24

And they're about to get cheaper...

I hope so.

jkenjohnson

Market Veteran

- Reaction score

- 24

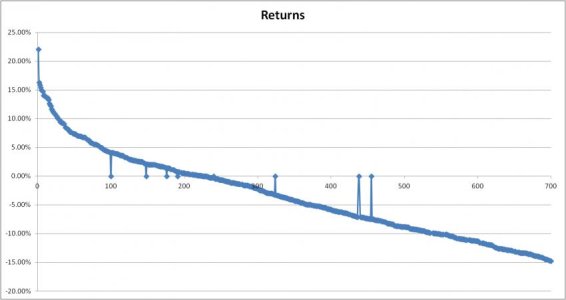

I'm so proud of myself. I was in the top 50 at +8% in July and now I am #369 on the tracker list. Wait a minute, I'm going the wrong way.

- Reaction score

- 821

I'm so proud of myself. I was in the top 50 at +8% in July and now I am #369 on the tracker list. Wait a minute, I'm going the wrong way.

How about #22 and now #576.

jkenjohnson

Market Veteran

- Reaction score

- 24

How about #22 and now #576.

I did not know it kept track below 500 (just kidding). Quite a drop.

RealMoneyIssues

TSP Legend

- Reaction score

- 101

jkenjohnson

Market Veteran

- Reaction score

- 24

I am coming back though. Already gained some ground in my Roth. Now if I can just get my TSP recovery (miracle) underway.

RealMoneyIssues

TSP Legend

- Reaction score

- 101

No kidding, with 3-4 day ups and down (oh, and they are HARD to pinpoint), getting good entry and exits on a noon deadline is, well, A PAIN...I am coming back though. Already gained some ground in my Roth. Now if I can just get my TSP recovery (miracle) underway.

Good luck

And they're about to get cheaper...

P/E is not all that relevant when, as now, E is overstated, revised downwards, and guiding lower.

P/E can fall as low as 8 (and in 2008/9 did) if expectations are not good, and they aren't, but this time it is world wide. Hope you understand this better, and now that you do, you will allocate your TSP funds accordingly. Not really, maybe you'll go 100% I-fund. Most likely - you'll do nothing at all.

This week is a high-wire act based on an unrealistic expectation of an early/soon European solution. Stingy Germans bailing out Greece. Good luck on that one. Sounds hopeless to me - - - but if a whole buncha traders will buy on it, I can be in on the short term, and I was (lowering allocation today).

Out.

Elgallo

TSP Strategist

- Reaction score

- 11

I'm so proud of myself. I was in the top 50 at +8% in July and now I am #369 on the tracker list. Wait a minute, I'm going the wrong way.

http://www.youtube.com/watch?v=KIiUqfxFttM

jkenjohnson

Market Veteran

- Reaction score

- 24

No kidding, with 3-4 day ups and down (oh, and they are HARD to pinpoint), getting good entry and exits on a noon deadline is, well, A PAIN...

Good luck

TZA is up $10/share in my Roth. I thought you were holding some TZA?

Similar threads

- Replies

- 2

- Views

- 530

- Replies

- 0

- Views

- 111