The first trading day after the S&P debt downgrades of several EU countries started off with substantial gains, but those gains largely faded by mid-afternoon leaving the major averages to close with only modest gains.

The only data point released today was the Empire Manufacturing Survey for January, which posted a better than expected 13.5.

Of note today, the S&P 500 managed to climb above the 1300 line for the first time since last July. Obviously, it didn't hold as resistance remains stiff. Still, given the sizable gains from the previous weeks it should be encouraging for the bulls to see such action as it seems to indicate consolidation may be taking place.

Here's today's charts:

NAMO and NYMO remain in sell conditions, but have not retreated much below their 6 day EMA.

NAHL and NYHL are on buys and appear to be climbing modestly.

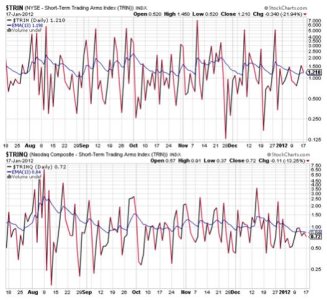

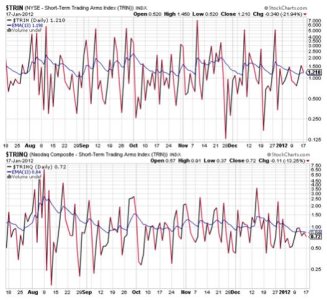

TRIN remains on a sell, while TRINQ remains on a buy. Both are neutral.

BPCOMPQ rose a bit higher today and continues to paint a longer term bullish picture. However, it's also remained above that upper bollinger band for awhile and the longer it does that, the higher the odds are for some selling pressure.

So the signals are mixed and that keeps the system in an official buy status.

I sold a portion of my S fund holdings today, hoping to lock in better gains than I did. While I'm expecting higher prices in the weeks ahead, the short term appears a bit more bearish to me as sentiment may be too bullish in some pockets. I'd rather have waited to get a little close to February before raising some cash, but didn't feel comfortable holding a 100% position going into the latter half of January. I'm looking for choppy trading the rest of this week, but I'm wary of next week's action (post-OPEX).

The only data point released today was the Empire Manufacturing Survey for January, which posted a better than expected 13.5.

Of note today, the S&P 500 managed to climb above the 1300 line for the first time since last July. Obviously, it didn't hold as resistance remains stiff. Still, given the sizable gains from the previous weeks it should be encouraging for the bulls to see such action as it seems to indicate consolidation may be taking place.

Here's today's charts:

NAMO and NYMO remain in sell conditions, but have not retreated much below their 6 day EMA.

NAHL and NYHL are on buys and appear to be climbing modestly.

TRIN remains on a sell, while TRINQ remains on a buy. Both are neutral.

BPCOMPQ rose a bit higher today and continues to paint a longer term bullish picture. However, it's also remained above that upper bollinger band for awhile and the longer it does that, the higher the odds are for some selling pressure.

So the signals are mixed and that keeps the system in an official buy status.

I sold a portion of my S fund holdings today, hoping to lock in better gains than I did. While I'm expecting higher prices in the weeks ahead, the short term appears a bit more bearish to me as sentiment may be too bullish in some pockets. I'd rather have waited to get a little close to February before raising some cash, but didn't feel comfortable holding a 100% position going into the latter half of January. I'm looking for choppy trading the rest of this week, but I'm wary of next week's action (post-OPEX).